- Cyprus

- /

- Capital Markets

- /

- CSE:DEM

Demetra Holdings And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rising oil prices and geopolitical tensions, small-cap stocks have faced mixed fortunes, with indices like the S&P MidCap 400 and Russell 2000 showing varied performance. Despite these challenges, investors continue to seek opportunities in lesser-known companies that demonstrate resilience and potential for growth. In this environment, identifying stocks with strong fundamentals and unique market positions can be key to uncovering undiscovered gems like Demetra Holdings.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 12.21% | 17.40% | 21.14% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Demetra Holdings (CSE:DEM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Demetra Holdings Plc is a publicly owned investment manager with a market capitalization of €358 million.

Operations: Demetra Holdings generates revenue primarily from its holdings and financial assets, contributing €7.04 million, followed by real estate development and management at €1.55 million. The company's gross profit margin is not specified in the provided data, but the detailed revenue breakdown highlights a focus on investment-related activities.

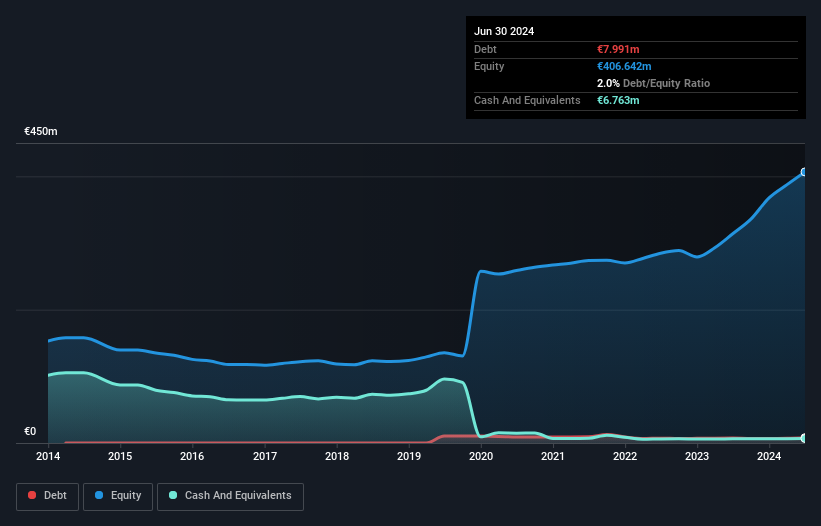

Demetra Holdings, a nimble player in the financial sector, has seen its debt to equity ratio shrink from 7.8% to 2% over five years, showcasing prudent financial management. With earnings growth of 198.6% last year outpacing the industry’s 23.5%, it reflects robust performance despite a net income of €39 million being slightly up from €36.83 million previously. The company’s price-to-earnings ratio at 4x suggests good value compared to the market average of 6.9x, hinting at potential investment appeal amidst mixed revenue results.

- Click to explore a detailed breakdown of our findings in Demetra Holdings' health report.

Review our historical performance report to gain insights into Demetra Holdings''s past performance.

Bank Dhofar SAOG (MSM:BKDB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank Dhofar SAOG is a financial institution offering corporate, retail, and investment banking services in Oman, with a market capitalization of OMR494.40 million.

Operations: The bank generates revenue primarily from corporate banking (OMR49.16 million), retail banking (OMR41.39 million), and Islamic banking (OMR18.81 million), with additional contributions from treasury and investments (OMR10.80 million).

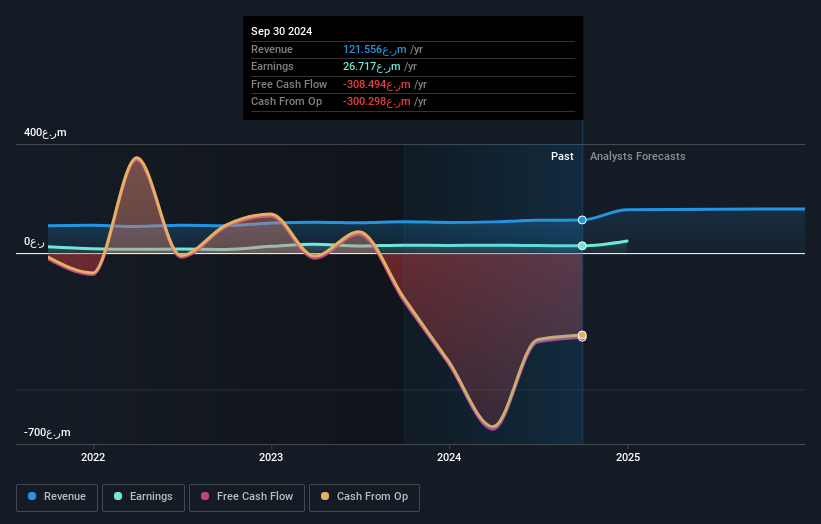

Bank Dhofar SAOG, a notable player in the financial sector, showcases robust growth with earnings rising 21.6% over the past year, outpacing the industry average of 6.2%. The bank's assets total OMR4.8 billion, supported by equity of OMR723.6 million and deposits reaching OMR3.6 billion against loans of OMR3.8 billion. Although it has high bad loans at 5.1%, its funding is primarily low risk with customer deposits comprising 86% of liabilities, suggesting a stable foundation amidst challenges.

- Click here to discover the nuances of Bank Dhofar SAOG with our detailed analytical health report.

Assess Bank Dhofar SAOG's past performance with our detailed historical performance reports.

Thai Coconut (SET:COCOCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Thai Coconut Public Company Limited focuses on the production and distribution of coconut products in Thailand, with a market cap of THB18.38 billion.

Operations: Thai Coconut Public Company Limited generates its revenue primarily from coconut water products and coconut milk products, with the former contributing THB2.81 billion and the latter THB2.22 billion.

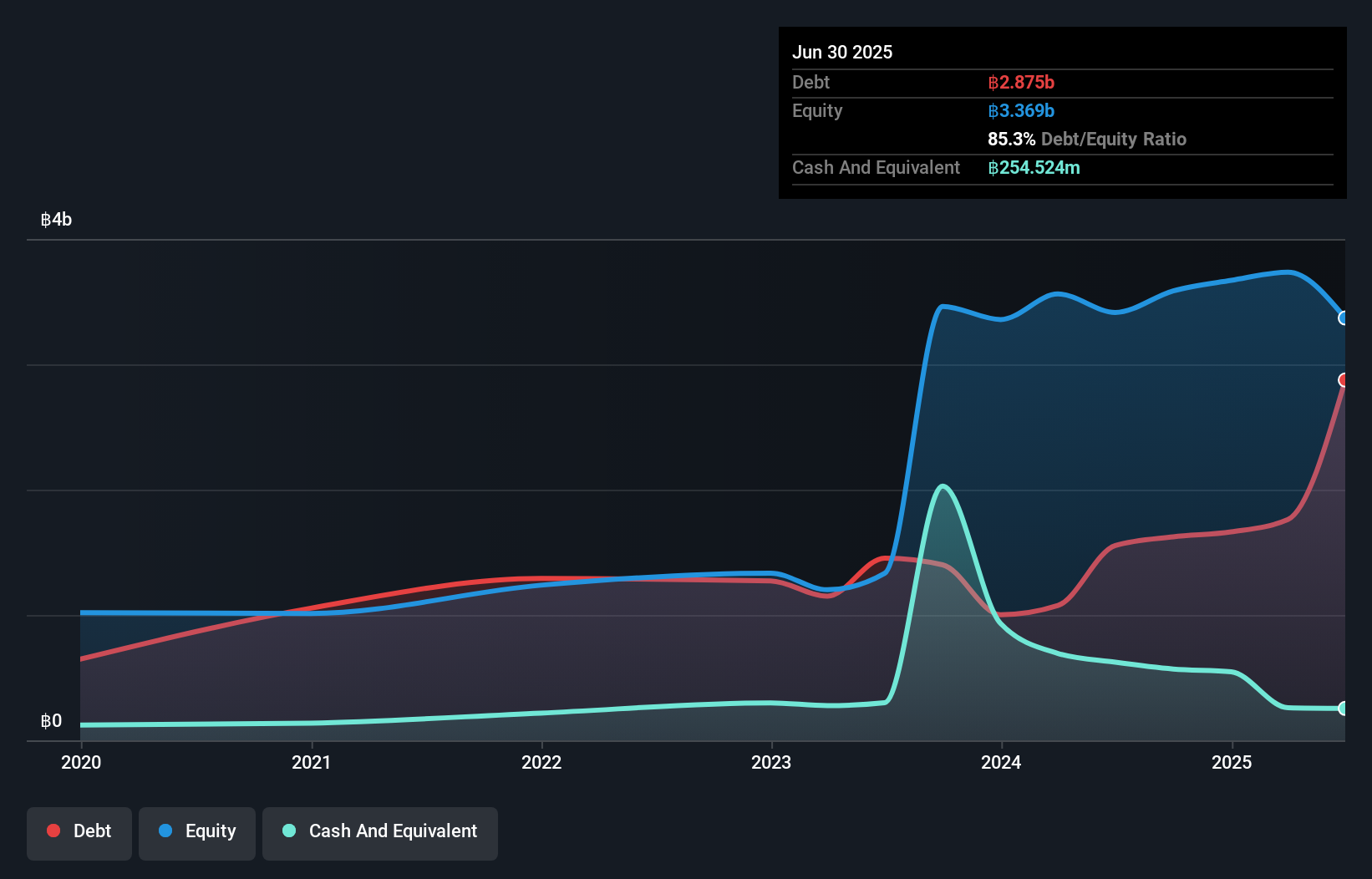

Thai Coconut has shown robust growth, with earnings rising 89% last year, surpassing the food industry's 33%. The company trades at a notable discount of 35% below its estimated fair value. Recent financials highlight revenue for Q2 at THB 1.59 billion and net income at THB 227 million, both up from the previous year. A strategic investment of THB 280 million aims to boost production capacity from 360,000 to 398,000 tons annually.

- Take a closer look at Thai Coconut's potential here in our health report.

Gain insights into Thai Coconut's past trends and performance with our Past report.

Seize The Opportunity

- Gain an insight into the universe of 4773 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CSE:DEM

Excellent balance sheet with proven track record.