- New Zealand

- /

- Logistics

- /

- NZSE:MFT

Shareholders May Not Be So Generous With Mainfreight Limited's (NZSE:MFT) CEO Compensation And Here's Why

Under the guidance of CEO Don Braid, Mainfreight Limited (NZSE:MFT) has performed reasonably well recently. As shareholders go into the upcoming AGM on 29 July 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Mainfreight

How Does Total Compensation For Don Braid Compare With Other Companies In The Industry?

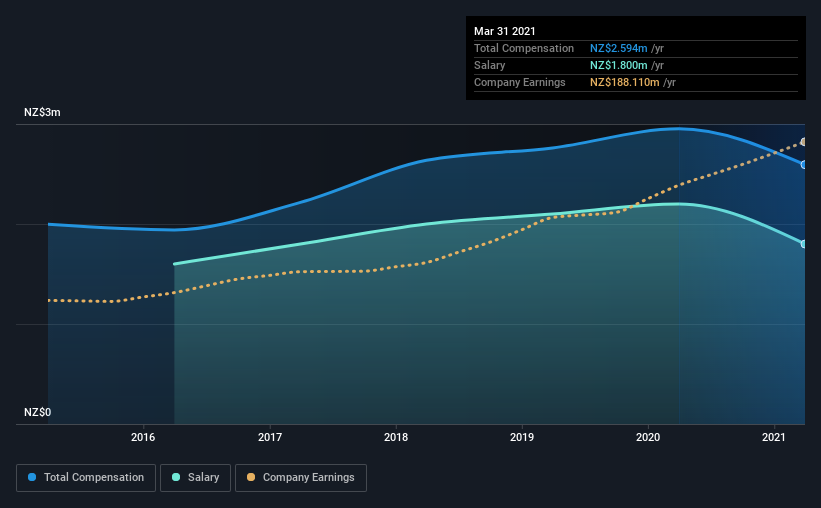

Our data indicates that Mainfreight Limited has a market capitalization of NZ$7.8b, and total annual CEO compensation was reported as NZ$2.6m for the year to March 2021. That's a notable decrease of 12% on last year. Notably, the salary which is NZ$1.80m, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between NZ$5.7b and NZ$17b had a median total CEO compensation of NZ$1.7m. This suggests that Don Braid is paid more than the median for the industry. Furthermore, Don Braid directly owns NZ$222m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | NZ$1.8m | NZ$2.2m | 69% |

| Other | NZ$794k | NZ$752k | 31% |

| Total Compensation | NZ$2.6m | NZ$3.0m | 100% |

On an industry level, roughly 90% of total compensation represents salary and 10% is other remuneration. In Mainfreight's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Mainfreight Limited's Growth

Over the past three years, Mainfreight Limited has seen its earnings per share (EPS) grow by 20% per year. It achieved revenue growth of 15% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Mainfreight Limited Been A Good Investment?

We think that the total shareholder return of 190%, over three years, would leave most Mainfreight Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Mainfreight that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:MFT

Mainfreight

Provides supply chain logistics services in New Zealand, Australia, the Americas, Europe, and Asia.

Excellent balance sheet average dividend payer.