- New Zealand

- /

- Telecom Services and Carriers

- /

- NZSE:SPK

Can Spark (NZSE:SPK) Refocusing on Core Assets Reshape Its Long-Term Growth Prospects?

Reviewed by Sasha Jovanovic

- At its 2025 Annual Meeting held earlier this month, Spark New Zealand announced a renewed focus on its core connectivity business and revealed the SPK-30 five-year strategy, following the divestment of non-core assets and a partnership for its data centers with Pacific Equity Partners.

- Despite recent declines in revenue and profit, Spark New Zealand maintained its dividend and is turning to partnerships and AI to drive future growth.

- We’ll explore how Spark's sale of non-core assets and ambition to leverage AI shape the company’s evolving investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Spark New Zealand's Investment Narrative?

The big picture for Spark New Zealand shareholders right now is about believing in the company’s ability to sharpen its focus, following the major decision to divest non-core assets and double down on its connectivity and digital offerings. The recent announcement of SPK-30, a five-year plan centered on leveraging partnerships and AI, signals a commitment to turning operational focus into more sustainable returns. This reshaping of the business model could prove to be a short-term catalyst, potentially addressing long-standing concerns over slow revenue and earnings growth, as well as dividend sustainability. On the flip side, risks remain if the narrowing of focus fails to reignite growth, especially given Spark’s recent underperformance and lower profit margins. The latest board changes and shifting priorities mean investors are weighing a different set of near-term opportunities and risks than they were even a few months ago. How much this actually changes the company’s medium-term growth trajectory, though, is still up for debate as recent price moves don’t yet suggest a clear market verdict.

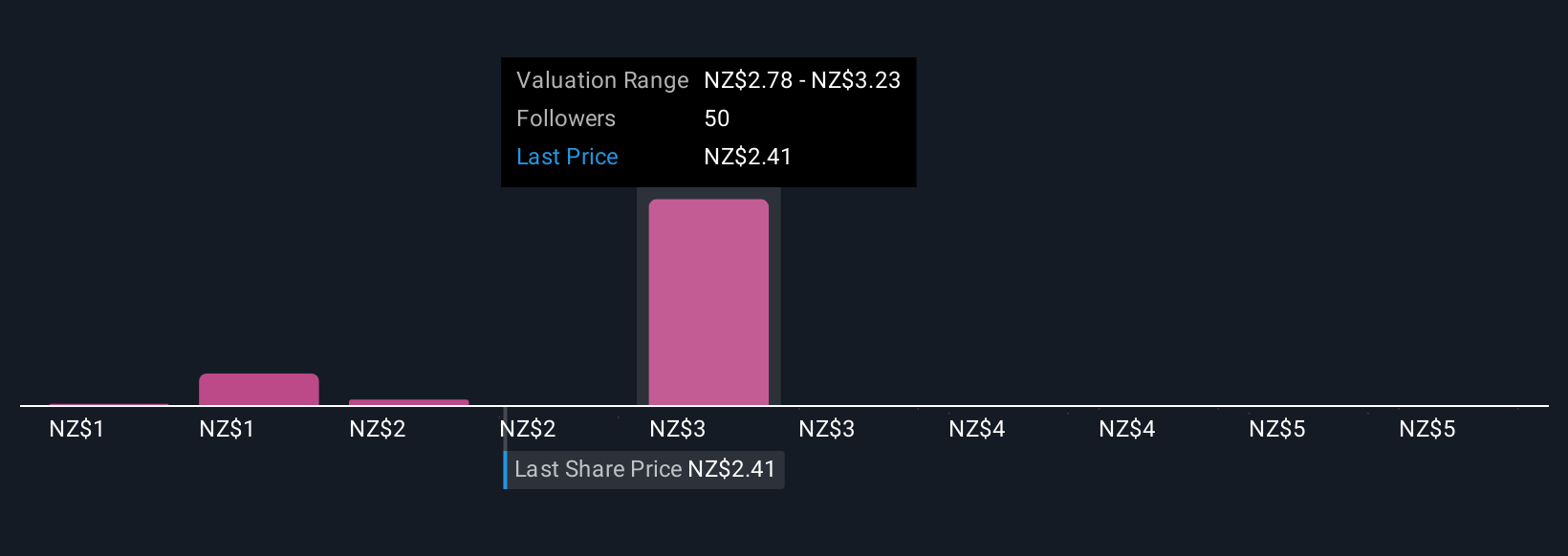

But, there’s still the issue of whether Spark’s high debt and modest growth potential can support its ambitious plans. Despite retreating, Spark New Zealand's shares might still be trading 19% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 28 other fair value estimates on Spark New Zealand - why the stock might be worth over 2x more than the current price!

Build Your Own Spark New Zealand Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spark New Zealand research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Spark New Zealand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spark New Zealand's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SPK

Spark New Zealand

Provides telecommunications and digital services in New Zealand.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives