- New Zealand

- /

- Food

- /

- NZSE:ATM

The a2 Milk (NZSE:ATM) Share Price Is Up 1401% And Shareholders Are Euphoric

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. For example, the The a2 Milk Company Limited (NZSE:ATM) share price is up a whopping 1401% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 31% over the last quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for a2 Milk

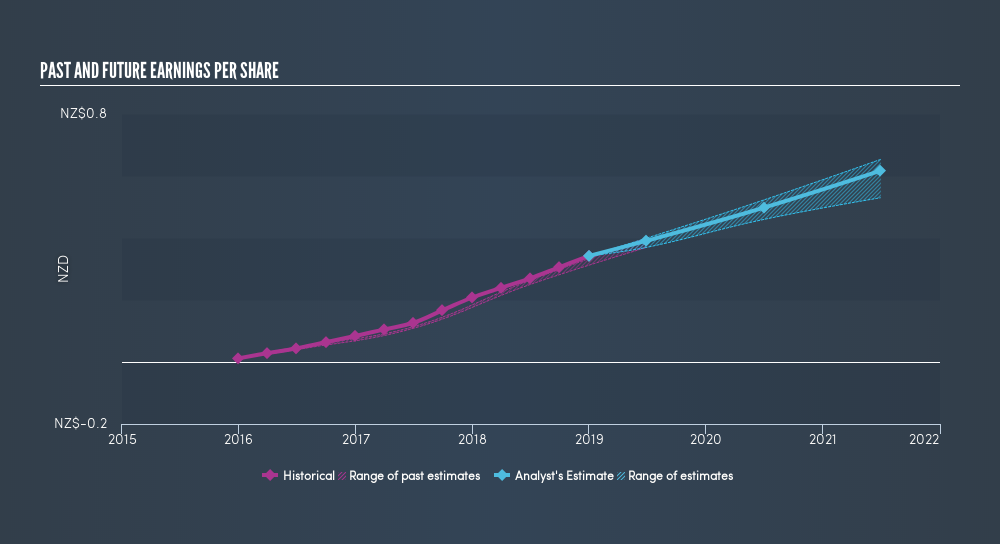

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, a2 Milk achieved compound earnings per share (EPS) growth of 118% per year. The EPS growth is more impressive than the yearly share price gain of 72% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that a2 Milk has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at a2 Milk's financial health with this freereport on its balance sheet.

A Different Perspective

a2 Milk shareholders are up 0.6% for the year. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 72% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. If you would like to research a2 Milk in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NZSE:ATM

a2 Milk

Sells A2 protein type branded milk and related products in Australia, New Zealand, China, rest of Asia, and the United States.

Excellent balance sheet with proven track record.