- Norway

- /

- Marine and Shipping

- /

- OB:HAUTO

Is Slowing Net Income Growth Despite Higher Sales Changing the Investment Case for Höegh Autoliners (OB:HAUTO)?

Reviewed by Sasha Jovanovic

- On October 30, 2025, Höegh Autoliners ASA reported third quarter results, with year-over-year sales growth to US$370.47 million, but a decline in net income to US$131.17 million.

- While revenues rose over both the quarter and nine months, persistent drops in net income and earnings per share signal ongoing cost or margin pressures for the company.

- With costs weighing on profits despite higher sales, we examine what these results mean for Höegh Autoliners’ investment outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Höegh Autoliners Investment Narrative Recap

To be a Höegh Autoliners shareholder, you need to believe that sustained volume growth, strong contract coverage, and ongoing fleet modernization will outweigh near-term margin pressures. The latest results, showing higher revenue but declining profitability, do not materially alter the short-term catalyst of cost relief from new, more efficient vessels, but they do make rapidly rising costs an even greater risk to watch.

Of recent announcements, the upcoming cash dividend of NOK 1.5729 per share stands out, signaling the company’s confidence in its capital reserves despite shrinking profits. This is particularly relevant for investors seeking income, but continued cost stress may influence the sustainability of future dividends if margin pressures persist.

However, investors should also be aware that despite a robust contract backlog, the company continues to face persistent cost inflation and higher port fees, which could ...

Read the full narrative on Höegh Autoliners (it's free!)

Höegh Autoliners is projected to have $1.2 billion in revenue and $246.8 million in earnings by 2028. This outlook reflects a 4.1% annual revenue decline and a $361.8 million decrease in earnings from the current $608.6 million.

Uncover how Höegh Autoliners' forecasts yield a NOK89.98 fair value, in line with its current price.

Exploring Other Perspectives

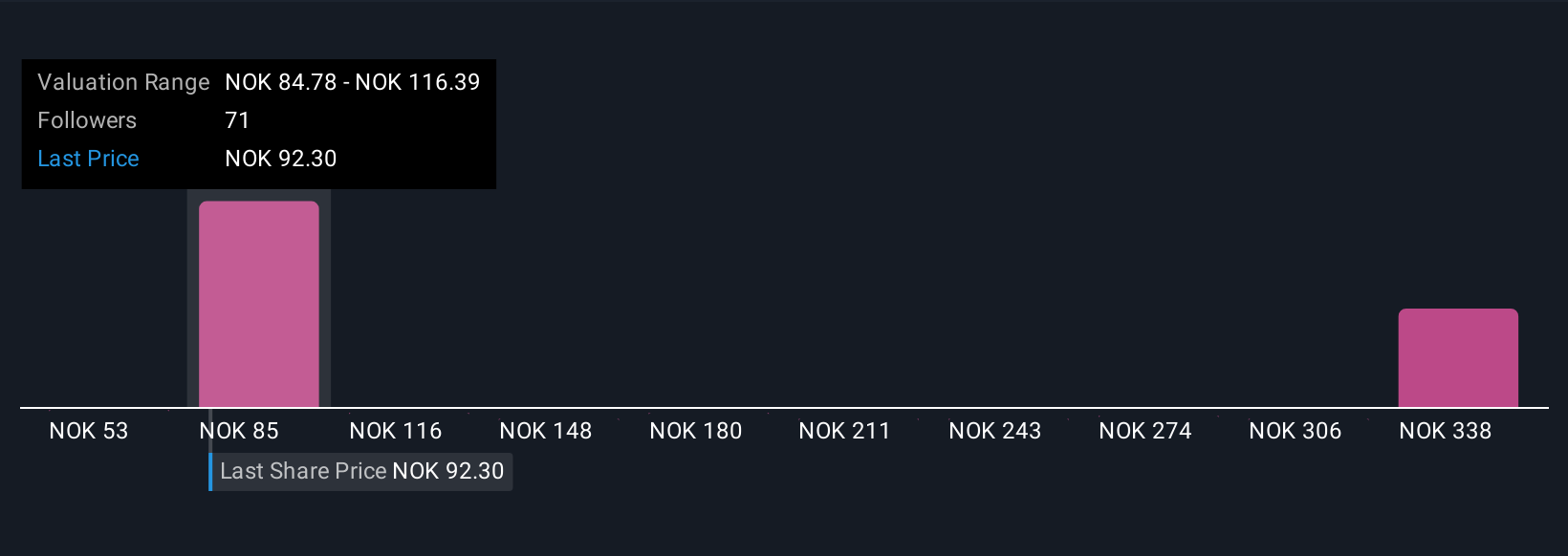

Thirteen fair value estimates from the Simply Wall St Community range widely from NOK 53.17 to NOK 243.34 per share. While many see significant upside, rising shipping costs and volume risks could narrow future performance, so exploring different viewpoints is essential.

Explore 13 other fair value estimates on Höegh Autoliners - why the stock might be worth 41% less than the current price!

Build Your Own Höegh Autoliners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Höegh Autoliners research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Höegh Autoliners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Höegh Autoliners' overall financial health at a glance.

No Opportunity In Höegh Autoliners?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Höegh Autoliners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HAUTO

Höegh Autoliners

Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets in Norway.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives