- Norway

- /

- Marine and Shipping

- /

- OB:HAUTO

Evaluating Höegh Autoliners After Shares Surge 556% and Logistics Demand Remains Strong

Reviewed by Simply Wall St

If you are standing at the crossroads with Höegh Autoliners, wondering whether now is the right time to buy, hold, or even double down, you are not alone. The car carrier specialist has been a talking point for investors lately, and for good reason. While the last month has been a bit soft with the stock down 2.2%, and even over the past week the price has slipped by 1.5%, these short-term moves come after an eye-popping 556.8% climb over the past three years and a 21.7% gain in the last twelve months. Those are numbers that definitely grab your attention.

Underlying these sways in the share price are bigger market trends impacting global logistics and shipping, which remain front and center for the industry. Investors seem to be weighing both optimism about sustained demand for car shipment capacity and some caution as broader transport routes normalize. That mix of confidence and caution is visible in the stock’s recent performance; some see potential, while others are locking in gains or waiting for clarity.

Of course, great returns attract more eyes on valuation. Looking at six widely used methods for assessing value, Höegh Autoliners checks the undervalued box in five out of six, giving it a standout valuation score of 5. That alone is enough to make value-driven investors lean in a little closer.

So, how exactly is that valuation score built? Let’s break down the key methods for assessing whether Höegh Autoliners is trading at a bargain, or if there is a better way to think about its true worth. The answer may surprise you before we are done.

Höegh Autoliners delivered 21.7% returns over the last year. See how this stacks up to the rest of the Shipping industry.Approach 1: Höegh Autoliners Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation works by estimating the future cash the business will generate and discounting those amounts back to today’s value. This model is particularly relevant for a company like Höegh Autoliners, as cash flow patterns and growth projections can be mapped out over a long horizon.

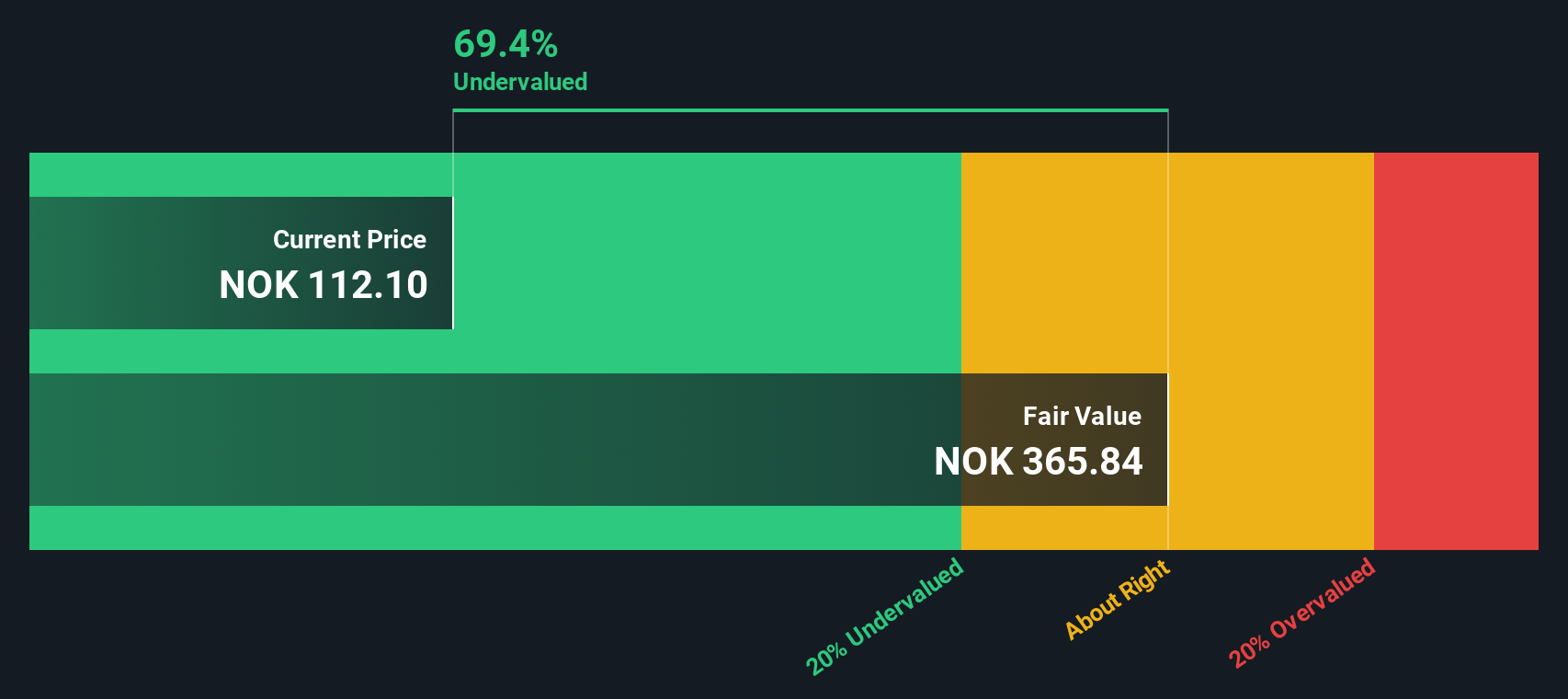

Currently, Höegh Autoliners’ free cash flow stands at $386.53 million, providing a solid foundation for future value. Analyst estimates extend to 2027, predicting Free Cash Flow of $359.5 million for that year. Simply Wall St extends projections even further, with FCF expected to gradually decrease to $367.44 million by 2035. These estimates reflect cautious assumptions about premium rates normalizing and a consistently profitable business model.

After discounting all of those future cash flows to present value, the DCF model estimates an intrinsic fair value for the company of $349.72 per share. This indicates that the stock is trading at a 68.5% discount to its estimated value based on projected cash generation.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Höegh Autoliners.

Approach 2: Höegh Autoliners Price vs Earnings

For profitable companies like Höegh Autoliners, the Price-to-Earnings (PE) ratio is a widely used and effective valuation metric. It lets investors quickly see how much they are paying for a unit of earnings, which is particularly relevant when profits are steady or growing, as is the case here.

The "right" PE ratio for a stock is shaped by expectations for future growth and the level of risk associated with its business. Higher growth and lower risk tend to justify higher PE multiples, while companies facing headwinds or uncertainty are usually assigned lower multiples.

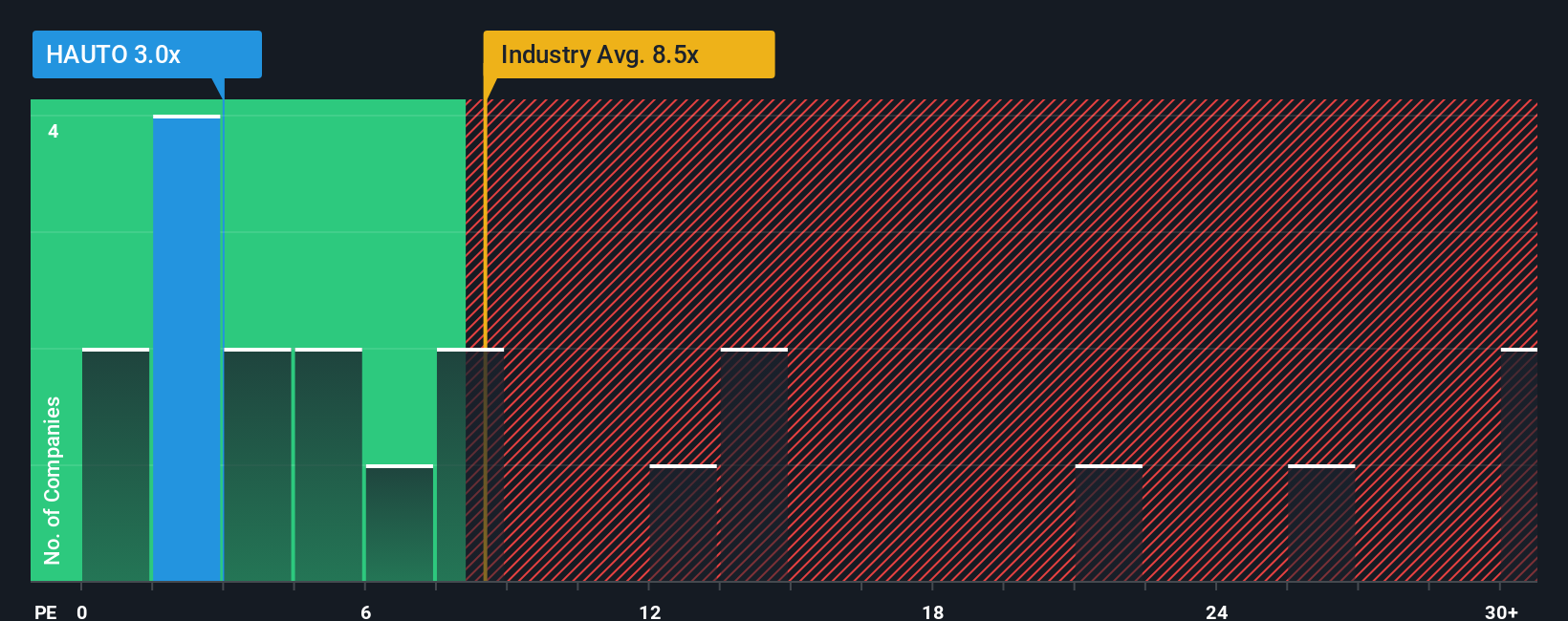

Currently, Höegh Autoliners trades at a PE of just 3.5x. For context, the average for its Shipping industry peers is a much higher 10.09x, and the specific peer group sits at 4.21x. At first glance, the stock appears to be valued conservatively by the market despite its strong track record and profitability.

Simply Wall St also calculates what it calls a “Fair Ratio.” This metric estimates what the PE multiple should be for Höegh Autoliners, taking into account not just earnings growth or profit margins in isolation, but also industry trends, risk levels, the company’s size, and more. This makes it a more reliable benchmark than a simple comparison to peers or the industry average. For Höegh Autoliners, the Fair Ratio is 3.68x.

With the current PE at 3.5x and a Fair Ratio of 3.68x, Höegh Autoliners is trading very close to its calculated fair value by this measure. That suggests that, at today’s price, the stock is neither deeply discounted nor stretched beyond reason based on earnings.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Höegh Autoliners Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story about a company's future, backed by your assumptions for its fair value, revenue growth, profitability, and risks. It is a way of turning raw numbers into a viewpoint you can update as new insights emerge.

Narratives connect a company's story with your financial forecast and, ultimately, a fair value, helping you make clearer, conviction-driven decisions. They are easy to create and use, available right on Simply Wall St's Community page, and used by millions of investors to weigh up their own take versus the consensus.

What makes Narratives special is their dynamic nature; whenever critical news, new earnings releases, or industry shifts happen, they update your assumptions so your perspective and your fair value remain relevant. By comparing your Narrative's fair value to today's share price, you can quickly decide if it might be time to buy, hold, or sell.

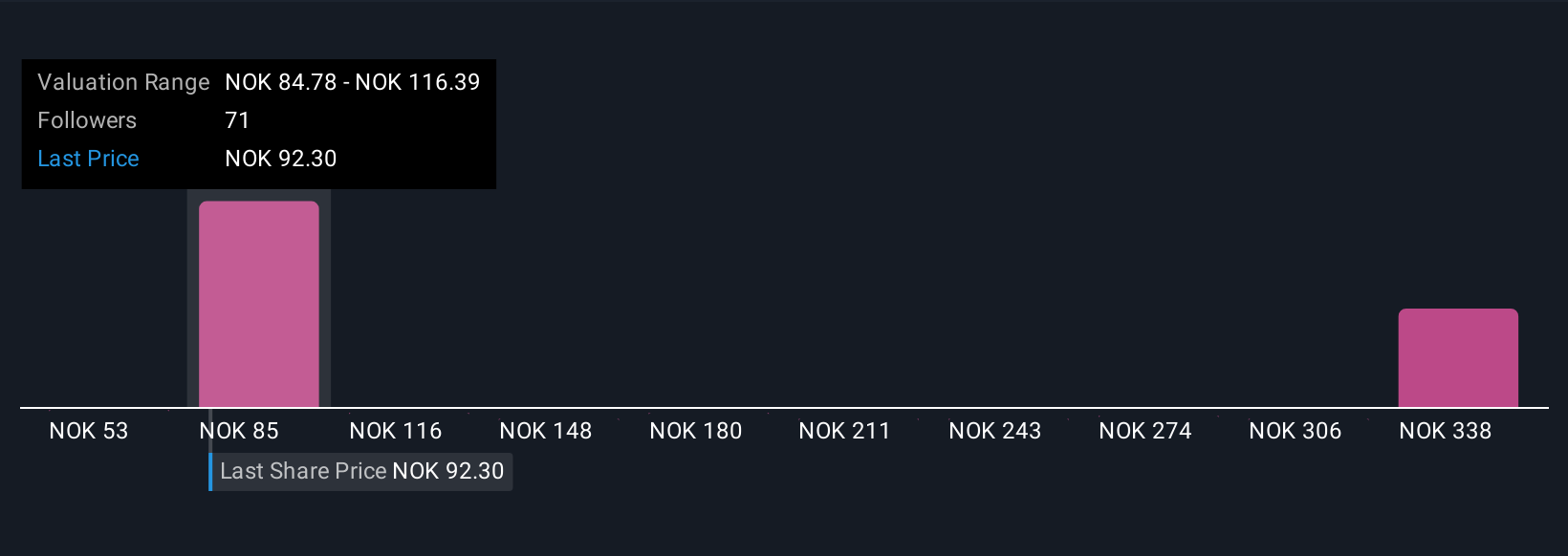

For example, one investor might believe tariffs and overcapacity will drive Höegh Autoliners down to NOK85, while another sees sustainability efforts and resilient demand supporting NOK108. Narratives let you weigh these perspectives so your investment decision is always rooted in your best reasoning.

Do you think there's more to the story for Höegh Autoliners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Höegh Autoliners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HAUTO

Höegh Autoliners

Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets in Norway.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives