Undiscovered European Gems with Strong Fundamentals July 2025

Reviewed by Simply Wall St

Amid recent fluctuations in global markets, the pan-European STOXX Europe 600 Index showed resilience, ending 1.15% higher as hopes for new trade deals buoyed investor sentiment. However, looming U.S. tariffs on European goods have tempered gains and added uncertainty to the market landscape. In this context, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth opportunities in Europe's dynamic economic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Aplicaciones y Tratamiento de Sistemas (BME:ATSI)

Simply Wall St Value Rating: ★★★★☆☆

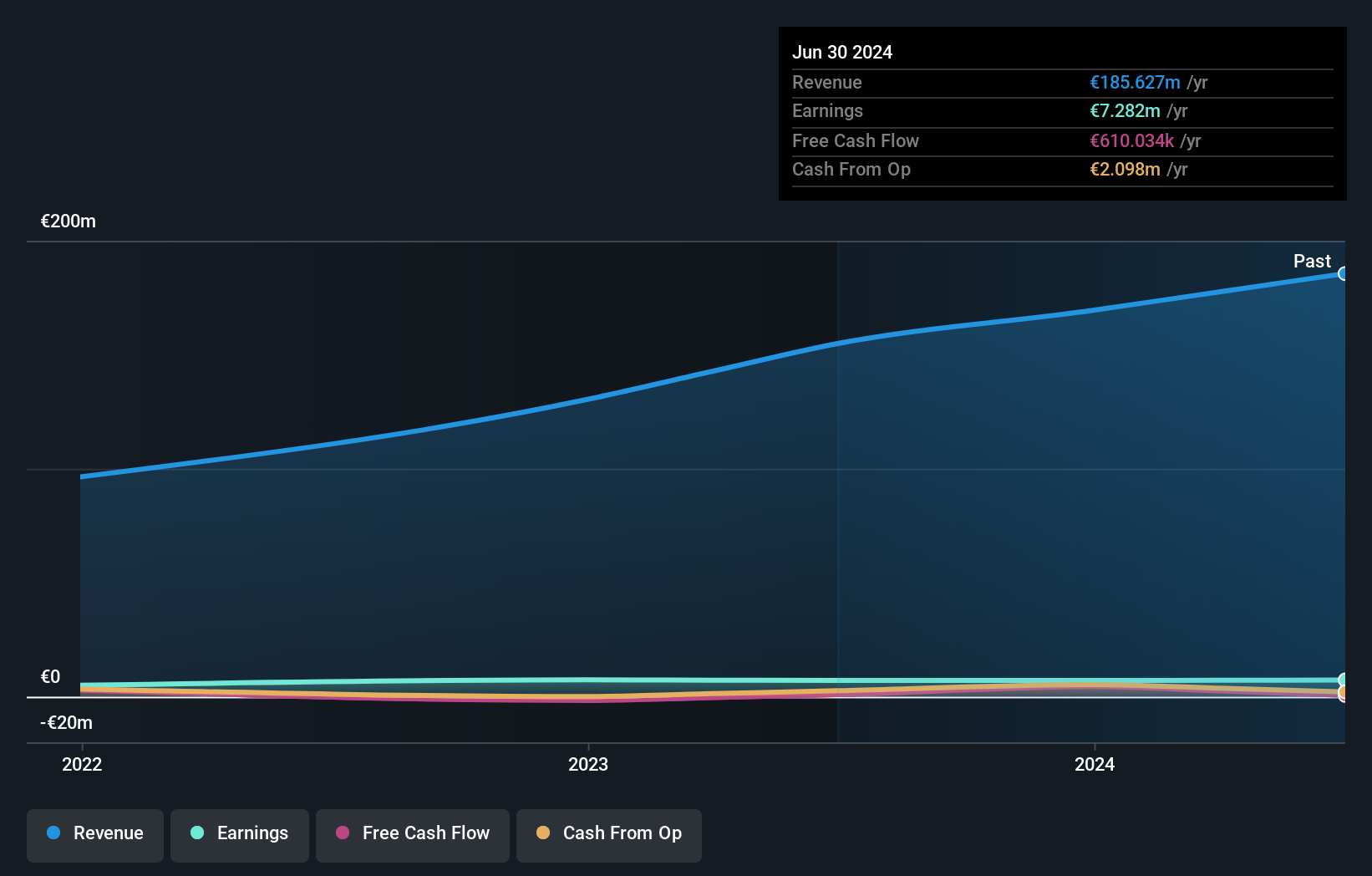

Overview: Aplicaciones y Tratamiento de Sistemas, S.A. is a company involved in computer services with a market capitalization of €216.53 million.

Operations: ATSI generates revenue primarily from its computer services segment, amounting to €185.63 million.

ATSI, a relatively small player in the IT sector, showcases high-quality earnings and a satisfactory net debt to equity ratio of 14.3%. Over the past year, its earnings grew by 2.1%, outpacing the broader IT industry’s -0.6% performance. The company’s interest payments are well covered with an EBIT coverage of 13.9x, indicating robust financial health in managing debt obligations. Despite having outdated financial reports over six months old, ATSI's strategic focus on quality earnings and effective debt management positions it favorably within its niche market segment for potential future growth opportunities.

Norbit (OB:NORBT)

Simply Wall St Value Rating: ★★★★★☆

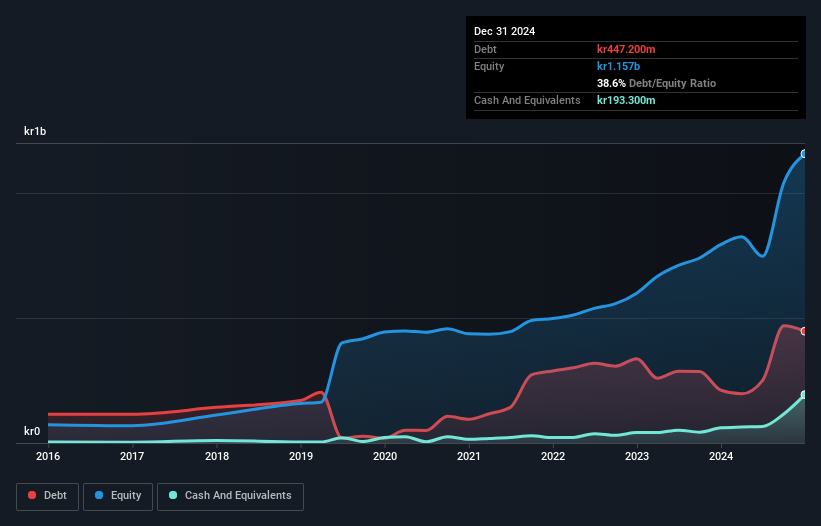

Overview: Norbit ASA is a technology solutions provider serving various industries, with a market capitalization of NOK13.69 billion.

Operations: Norbit ASA generates revenue primarily from its Oceans, Connectivity, and Product Innovation and Realization (PIR) segments, with Oceans contributing NOK855.20 million and PIR adding NOK558.50 million. The company has a market capitalization of NOK13.69 billion.

Norbit, a promising player in the electronics industry, has demonstrated robust growth with earnings surging by 85.1% over the past year, outpacing its industry peers. The company's debt to equity ratio has risen from 11.4% to 34.9% over five years, yet it remains satisfactory with net debt at 15.5%. Recent strategic moves like acquiring Innomar and developing the GNSS On-Board Unit are expected to drive revenue up by an anticipated 20.6% annually over three years while lifting profit margins from 13.9% to 18.6%. However, integration challenges and regulatory uncertainties pose potential hurdles ahead for Norbit's expansion plans.

Solstad Offshore (OB:SOFF)

Simply Wall St Value Rating: ★★★★☆☆

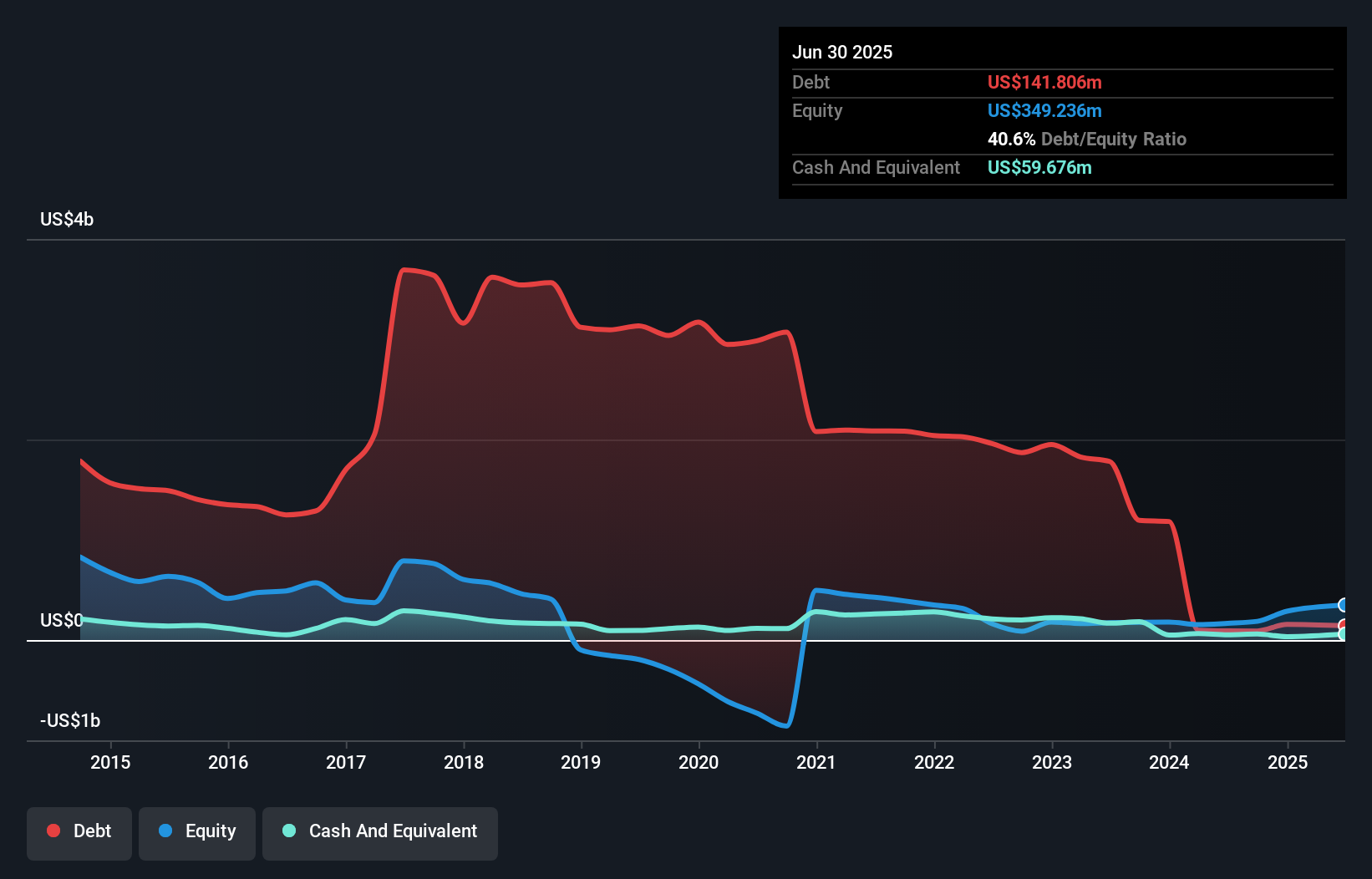

Overview: Solstad Offshore ASA owns and operates offshore service vessels, with a market capitalization of NOK4.06 billion.

Operations: The company's revenue is primarily generated from its fleet of offshore service vessels. A significant portion of costs is attributed to vessel operations and maintenance. The net profit margin has shown variability, reflecting changes in operational efficiency and market conditions over time.

Solstad Offshore, a nimble player in the energy services sector, recently reported a significant jump in net income to US$37.78 million for Q2 2025, up from US$2.54 million the previous year, reflecting its newfound profitability. The company is trading at nearly half its estimated fair value and has secured lucrative contracts with Petrobras worth approximately US$210 million over four years. Despite these positives, Solstad's interest payments are not well covered by EBIT (1.6x), though its net debt to equity ratio of 23.5% remains satisfactory. A one-off gain of $47M also bolstered recent earnings results.

- Click here to discover the nuances of Solstad Offshore with our detailed analytical health report.

Gain insights into Solstad Offshore's past trends and performance with our Past report.

Summing It All Up

- Dive into all 319 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ATSI

Aplicaciones y Tratamiento de Sistemas

Aplicaciones y Tratamiento de Sistemas, S.A.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives