Is Harvest Volume Growth and Volatile Profits Reshaping the Investment Story for SalMar (OB:SALM)?

Reviewed by Sasha Jovanovic

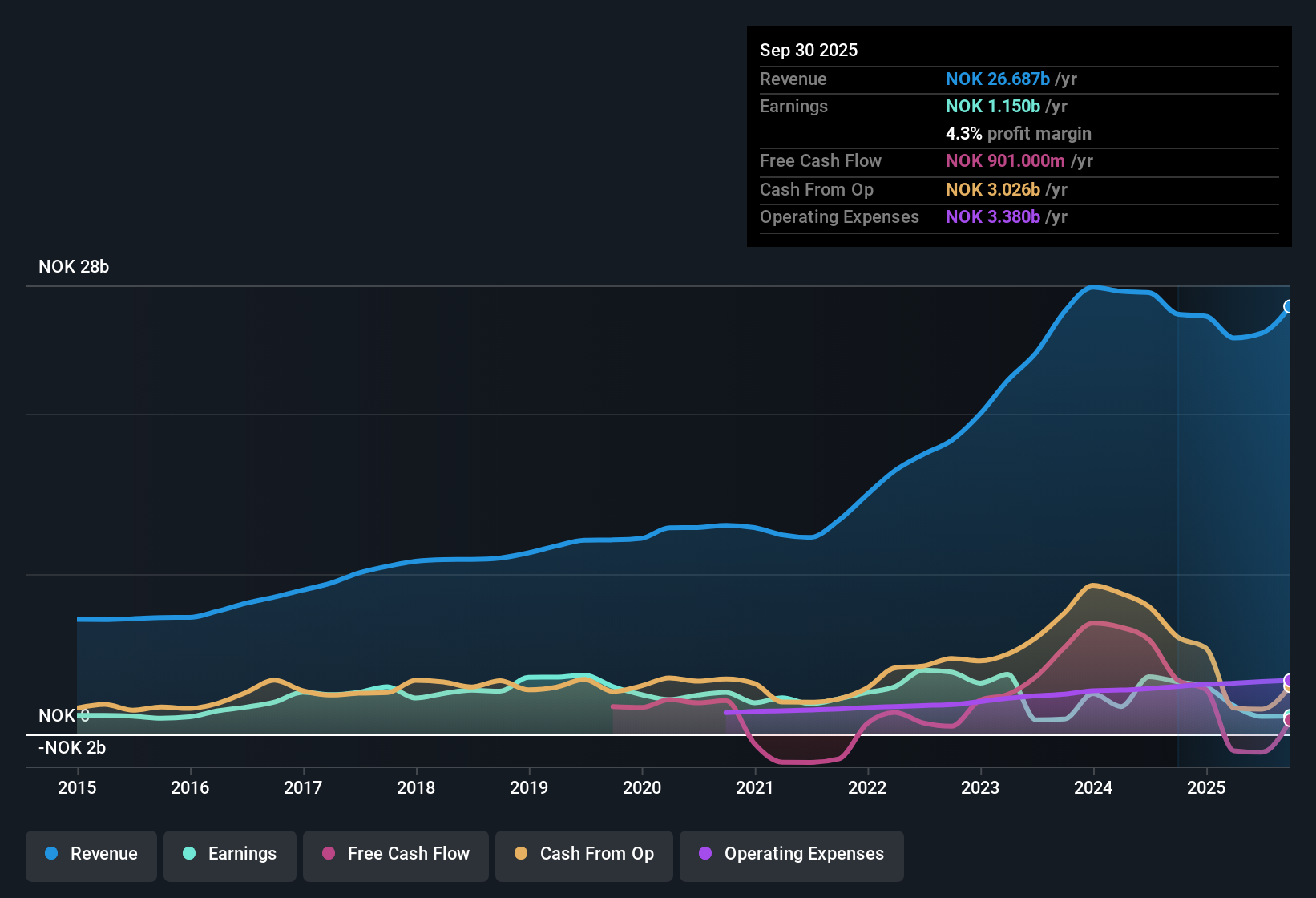

- SalMar ASA recently reported its third-quarter 2025 results, with sales rising to NOK 7,752 million and net income at NOK 305 million, alongside updated production guidance indicating harvest volume growth for 2025 and 2026.

- While quarterly profits increased compared to the previous year, the nine-month net income showed a sharp drop, highlighting variability in earnings despite the expanded production outlook.

- We'll now examine how SalMar's newly raised harvest volume expectations may shape its future investment narrative and sector outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SalMar Investment Narrative Recap

To be a SalMar shareholder, you need to believe that its push for higher harvest volumes and operational efficiencies will offset recent margin pressures and earnings variability. The latest news, stronger quarterly profits but weaker year-to-date net income, doesn’t materially change the biggest short-term catalyst: meeting aggressive production targets, nor does it fully resolve the current risk from volatile biological and environmental conditions that continue to impact costs and fish quality.

The company’s recent guidance projecting a 19% increase in total harvest volume for 2025 and further growth into 2026 is the most relevant announcement here. If achieved, these targets could support future revenue growth, but the real test will be whether SalMar can deliver these volumes without cost overruns or biological setbacks, a critical concern for investors watching operational trends and sector risks.

However, even with increased harvest expectations, investors should be mindful of unpredictable biological production events that can quickly shift margin trends…

Read the full narrative on SalMar (it's free!)

SalMar's narrative projects NOK35.7 billion revenue and NOK8.1 billion earnings by 2028. This requires 12.6% yearly revenue growth and a NOK7.0 billion earnings increase from the current NOK1.1 billion.

Uncover how SalMar's forecasts yield a NOK592.50 fair value, in line with its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community range from NOK 420 to NOK 1,652.93 per share. With this range in mind, keep a close eye on ongoing operational risks that could affect SalMar’s ability to turn higher volumes into sustained profit, these varied viewpoints highlight the importance of exploring multiple perspectives on the stock.

Explore 5 other fair value estimates on SalMar - why the stock might be worth over 2x more than the current price!

Build Your Own SalMar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SalMar research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SalMar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SalMar's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SALM

SalMar

An aquaculture company, produces and sells farmed salmon in Norway, Asia, Europe, North America, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives