Assessing SalMar's (OB:SALM) Valuation Following Strong Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for SalMar.

After a rapid 23% share price return over the past 90 days, SalMar is showing clear signs of building momentum. Even when you zoom out, the company’s one-year total shareholder return sits at an impressive 11%, reflecting sustained performance alongside the recent surge.

If this kind of upward trend has you watching the market, it could be the perfect time to discover fast growing stocks with high insider ownership.

With shares surging and fundamentals looking robust, the question for investors now is whether SalMar remains undervalued relative to its prospects or if the market has already priced in all that future growth.

Most Popular Narrative: 3.1% Undervalued

SalMar's widely followed fair value narrative pegs its shares just above the last close price, suggesting market pricing and narrative projections are nearly aligned. This keeps investors focused on a thin margin for upside, driven by ambitious future targets.

The analysts have a consensus price target of NOK527.143 for SalMar based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK650.0, and the most bearish reporting a price target of just NOK420.0.

Curious what financial leaps or operational achievements could push SalMar out of this narrow valuation band? The real intrigue is in the radical growth and margin assumptions baked into this narrative. Are they truly within reach or a leap of faith? The answers, and the projections behind them, might surprise you.

Result: Fair Value of $592.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharp rise in operational costs or persistent environmental issues could quickly challenge these optimistic projections and shift the outlook for SalMar.

Find out about the key risks to this SalMar narrative.

Another View: Eye on Earnings Ratios

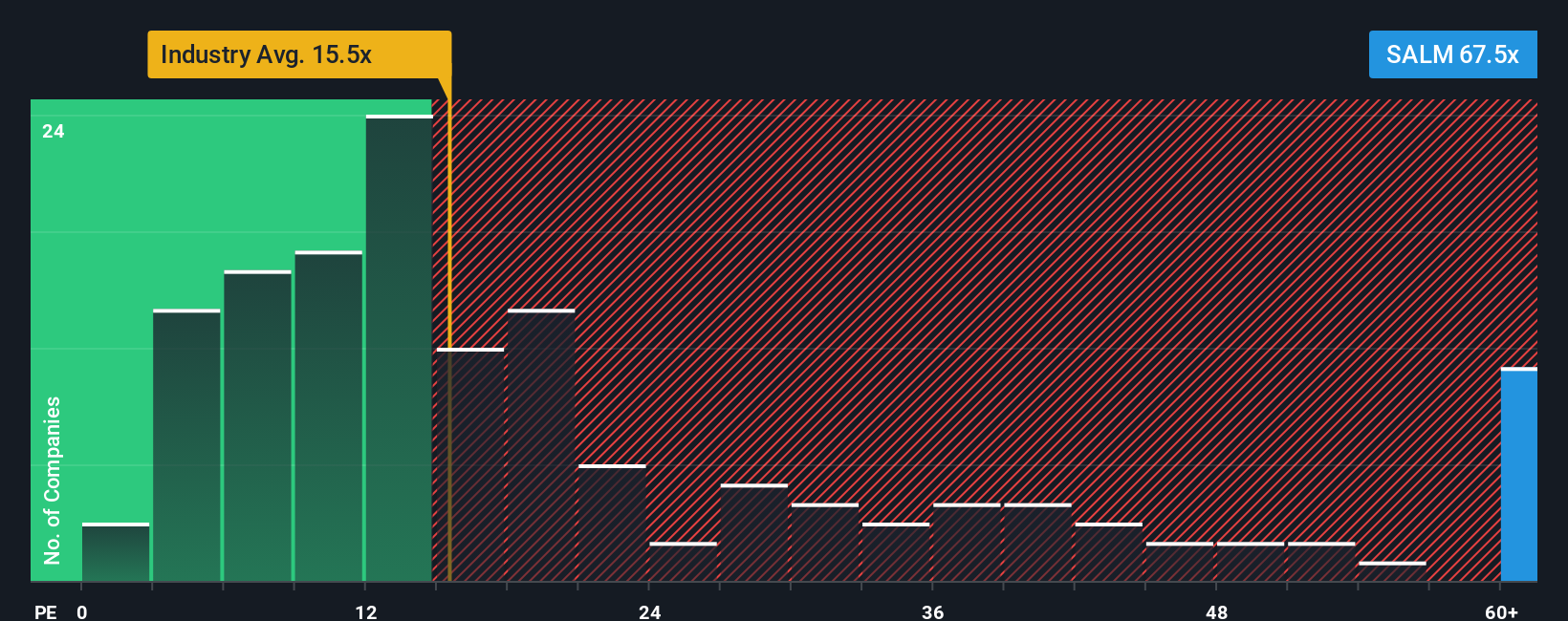

While fair value models paint SalMar as undervalued, a quick look at its price-to-earnings ratio tells a different story. SalMar trades at 67.5 times earnings, well above its peers' average of 27x and the industry standard of 15.5x. Even compared to our fair ratio of 57.4x, it remains pricey. What does such a high valuation mean for investors—an opportunity or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SalMar Narrative

If the prevailing views are not quite your own or you’d rather dig into the numbers yourself, try crafting your own SalMar narrative in just minutes: Do it your way.

A great starting point for your SalMar research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors constantly scan the horizon for the next breakout opportunity. Don't let your best moves pass you by. Expand your watchlist and uncover tomorrow's winners with powerful market screeners built for real results:

- Accelerate your portfolio with these 24 AI penny stocks, powering innovations across industries from automation to smart healthcare.

- Fuel your search for value by targeting these 870 undervalued stocks based on cash flows that show strong fundamentals and real growth potential.

- Boost your passive income by selecting these 16 dividend stocks with yields > 3% with market-beating yields and robust payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SALM

SalMar

An aquaculture company, produces and sells farmed salmon in Norway, Asia, Europe, North America, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives