- Norway

- /

- Energy Services

- /

- OB:TGS

TGS (OB:TGS): Evaluating Valuation After Landmark Chevron Agreement Expands Contract Pipeline and Tech Collaboration

Reviewed by Simply Wall St

TGS (OB:TGS) has just entered a three-year agreement with Chevron covering marine streamer and OBN acquisition services, featuring a minimum eighteen-month firm commitment. This collaboration is set to enhance TGS’s future contract pipeline and boost its technology profile with a major industry partner.

See our latest analysis for TGS.

TGS shares jumped 5.01% in a single day following the Chevron agreement, making for a 26.01% 1-month share price return and recapturing momentum after an earlier slide. Despite this recent surge, the year-to-date share price is still down, while the one-year total shareholder return is just ahead at 4.11%. This suggests that short-term excitement is meeting longer-term caution.

If the Chevron deal has you curious about what else is gaining ground, this could be a perfect time to broaden your search and discover fast growing stocks with high insider ownership

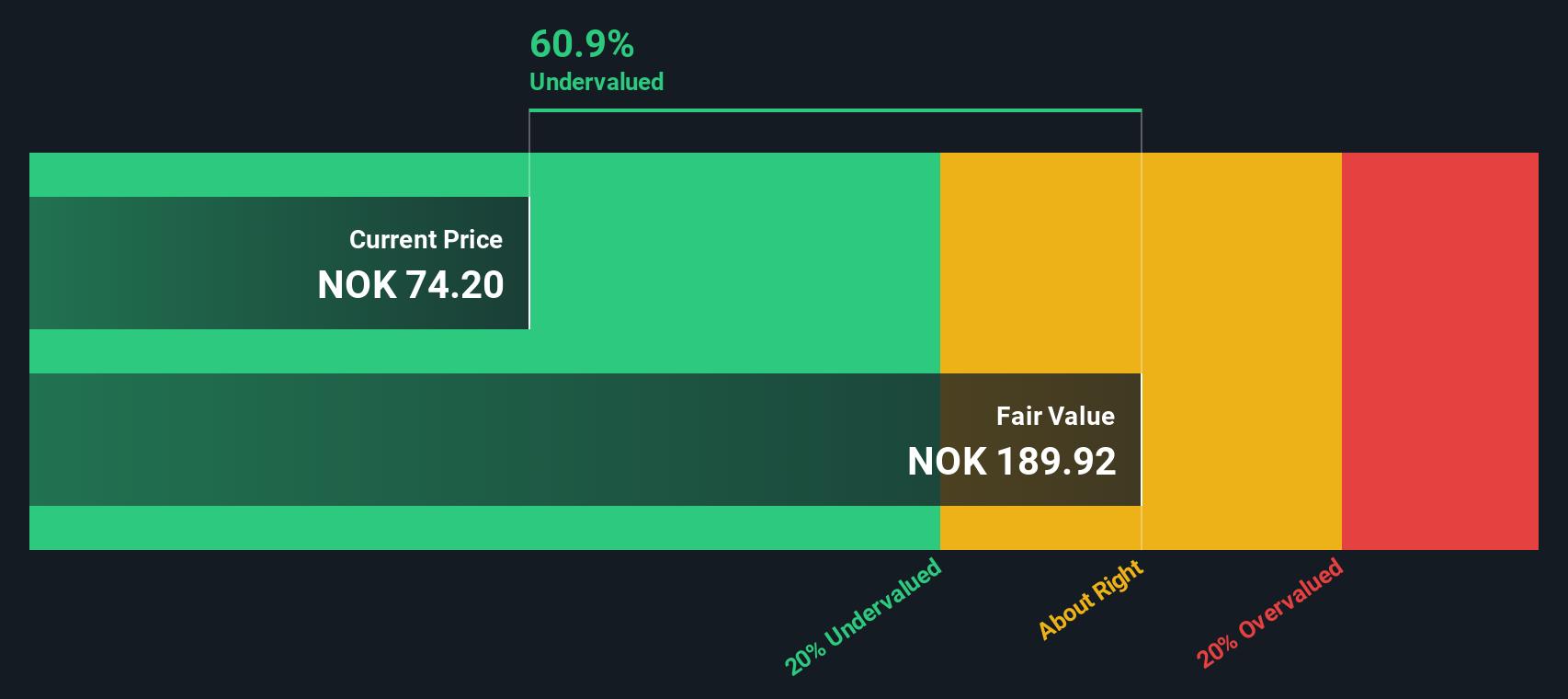

But after such a sharp move and TGS’s recent ups and downs, is the market offering a rare undervaluation? Or are investors right to think future growth is already priced in?

Most Popular Narrative: 10% Overvalued

While TGS shares recently jumped and market sentiment has turned brighter, the most-watched narrative places its fair value below the latest close price, suggesting the market may be running ahead of fundamentals. Here is a key point shaping that perspective.

Heavy dependence on volatile oil sector conditions and large clients, coupled with asset-heavy strategies, heightens earnings instability and exposes TGS to operational and competitive risks.

Want to uncover what’s fueling this valuation? The full narrative breaks down bold profit margin bets and future earnings estimates that could make or break TGS’s story. There is a surprising twist behind the headline figure. Click to see what drives analysts’ thinking and what they expect next.

Result: Fair Value of $87.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent oil sector volatility and dependence on major clients could disrupt TGS’s recovery if exploration spending or contract renewals are insufficient.

Find out about the key risks to this TGS narrative.

Another View: Deep Discount on Long-Term Value?

While market-based measures suggest TGS is overvalued, the SWS DCF model paints a very different picture. This approach estimates the company's fair value at NOK 423.5, which is well above the current price. Such a wide gap implies the market could be significantly underestimating TGS’s long-term cash flow potential. Which story will win out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TGS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TGS Narrative

If you want to go beyond the consensus or would rather trust your own analysis, you can quickly build your own story in just a few minutes. Do it your way

A great starting point for your TGS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Opportunities?

Smart investors don't stand still. Get ahead of the crowd and target high-potential stocks with screeners tailored to spot tomorrow’s big movers before the headlines hit.

- Capture unique innovations and stay ahead in tech by checking out these 27 quantum computing stocks, which is transforming the landscape with game-changing breakthroughs.

- Boost your income stream by tapping into these 15 dividend stocks with yields > 3%, offering generous yields that could enhance your returns.

- Capitalize on rapid AI-driven growth with these 25 AI penny stocks, making waves in the hottest sector of the decade.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TGS

TGS

Provides geoscience data services to the oil and gas industry in Norway and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives