- Norway

- /

- Energy Services

- /

- OB:SUBC

Subsea 7 (OB:SUBC): Assessing Valuation After Recent Investor Attention

Reviewed by Simply Wall St

Most Popular Narrative: 32% Undervalued

According to MrMoneyMan, the narrative around Subsea 7 signals a substantial undervaluation, with prospects for meaningful upside based on carefully weighted growth assumptions and strategic events expected in the near future.

Even though investors may wait for the Q1 report before making big moves, we believe positions in Subsea 7 should be taken before mid-June, because the valuation is highly attractive. The dividend will be very significant (again 1.1 billion dollars over the next 18 months, more than 25 percent of the market cap). Even if the coming months may not bring many major catalysts, we suspect the stock will see a turning point from June, with 1) announcement of the formal agreement and first communication of the business plan, 2) the Q2 report with potentially strong orders (Buzios, Sakarya) and potential upside for guidance (Subsea 7 may tweak it upwards), and 3) the first news flow from September from competition authorities.

Curious why Subsea 7 could be trading so far below its estimated worth? There's a critical combination of bold dividend commitments, looming contract news, and anticipated strategy shifts embedded in this fair value call. Want to see which financial levers the narrative pulls to justify such a deep discount? Find out what factors might drive the next surge in value.

Result: Fair Value of 290.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower than expected contract wins or disappointing quarterly results could challenge the optimism and weigh on Subsea 7’s next upward move.

Find out about the key risks to this Subsea 7 narrative.Another View: What Do Earnings Ratios Say?

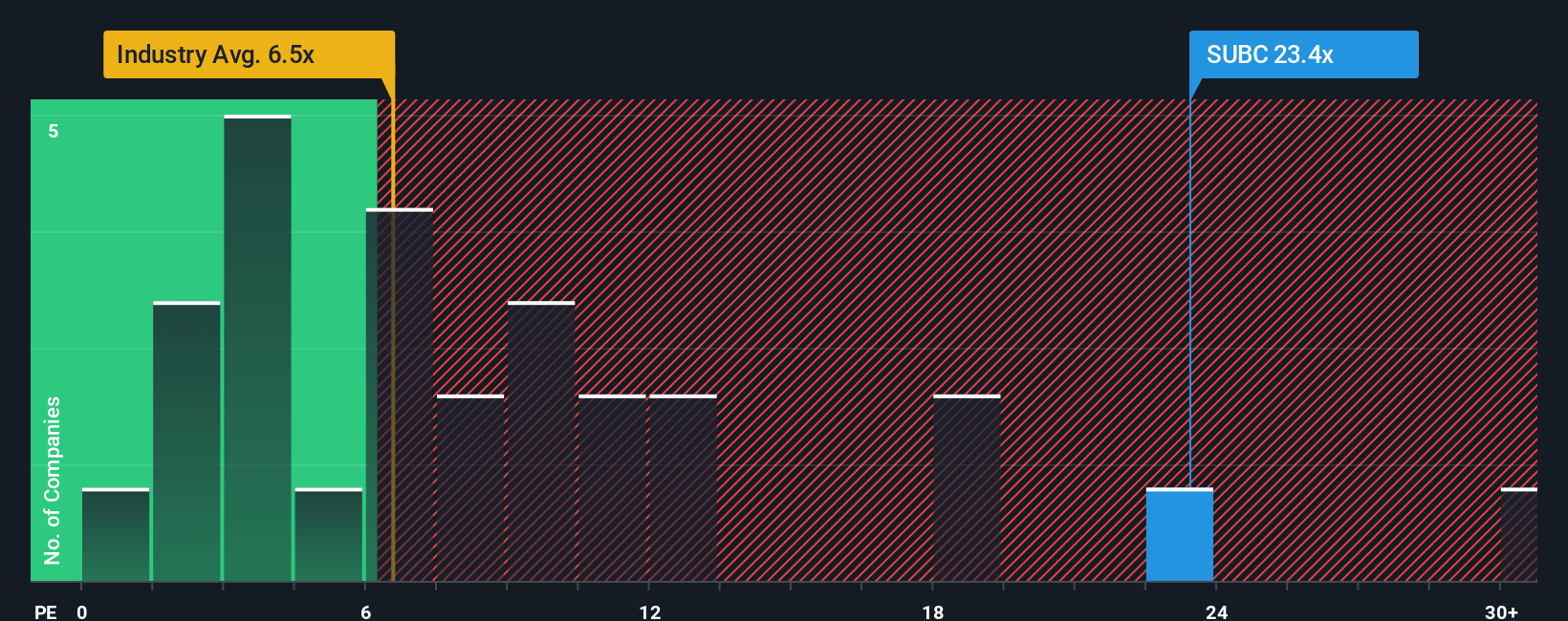

While the recent fair value estimate points to Subsea 7 trading at a meaningful discount, a look through earnings ratios tells a different story. In this analysis, the stock appears somewhat expensive compared to the industry average. Which angle should investors trust most for their next move?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Subsea 7 to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Subsea 7 Narrative

If our analysis does not match your perspective or you want to dive into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Subsea 7 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities slip past you. Use the Simply Wall Street Screener to find stocks that match bold growth, value, and innovation trends before others catch on.

- Unlock the next wave of potential with penny stocks showing robust financials by following the trail of penny stocks with strong financials.

- Access stocks pushing boundaries in artificial intelligence by starting your search with AI penny stocks.

- Spot businesses overlooked by the market and trading below their worth using our window into undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OB:SUBC

Subsea 7

Subsea 7 S.A. delivers offshore projects and services for the energy industry worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives