- Norway

- /

- Oil and Gas

- /

- OB:ALNG

Revenues Not Telling The Story For Awilco LNG ASA (OB:ALNG) After Shares Rise 25%

Awilco LNG ASA (OB:ALNG) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 63% share price drop in the last twelve months.

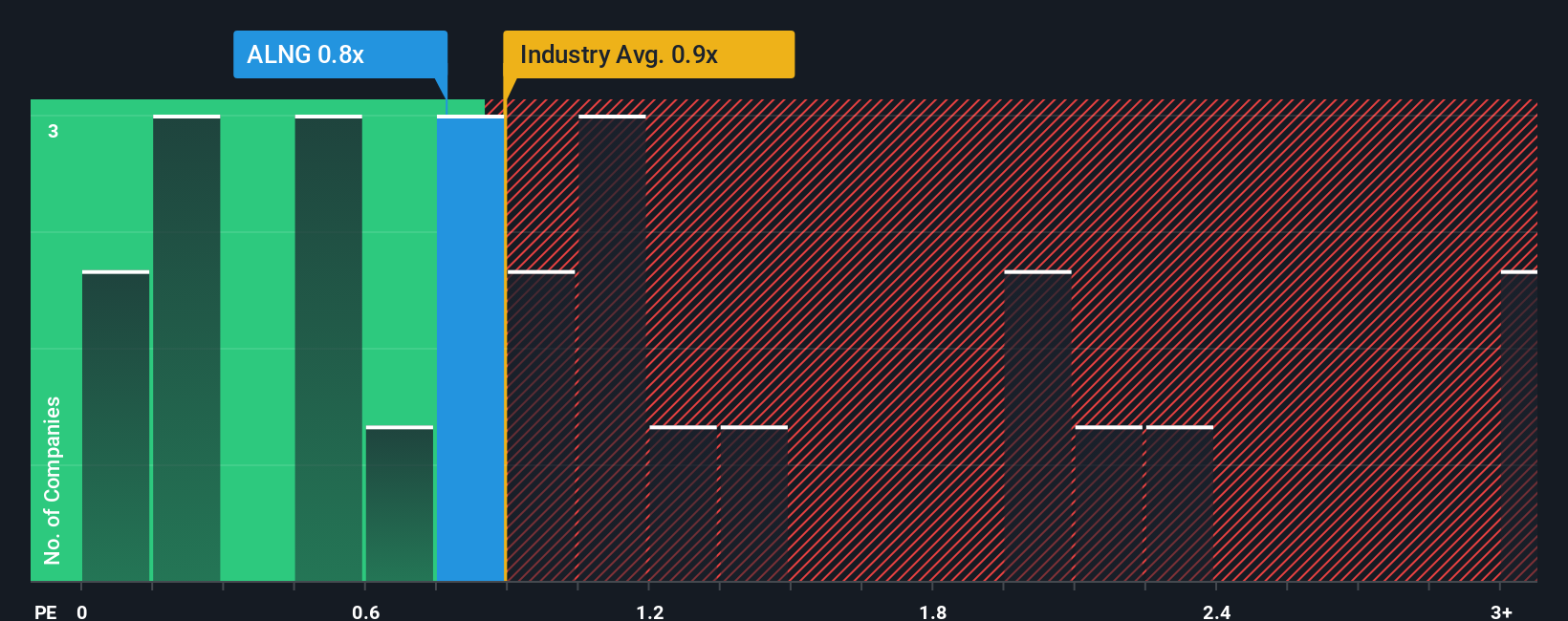

Although its price has surged higher, it's still not a stretch to say that Awilco LNG's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Oil and Gas industry in Norway, where the median P/S ratio is around 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Awilco LNG

What Does Awilco LNG's P/S Mean For Shareholders?

Awilco LNG hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Awilco LNG.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Awilco LNG's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 32%. This means it has also seen a slide in revenue over the longer-term as revenue is down 1.1% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 23% as estimated by the only analyst watching the company. Meanwhile, the broader industry is forecast to moderate by 5.7%, which indicates the company should perform poorly indeed.

With this in mind, we find it intriguing that Awilco LNG's P/S is similar to its industry peers. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What Does Awilco LNG's P/S Mean For Investors?

Awilco LNG's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Awilco LNG currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Awilco LNG (1 is concerning) you should be aware of.

If these risks are making you reconsider your opinion on Awilco LNG, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ALNG

Awilco LNG

Owns and operates liquefied natural gas (LNG) vessels in Norway.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives