Despite an already strong run, Awilco LNG ASA (OB:ALNG) shares have been powering on, with a gain of 25% in the last thirty days. But the last month did very little to improve the 54% share price decline over the last year.

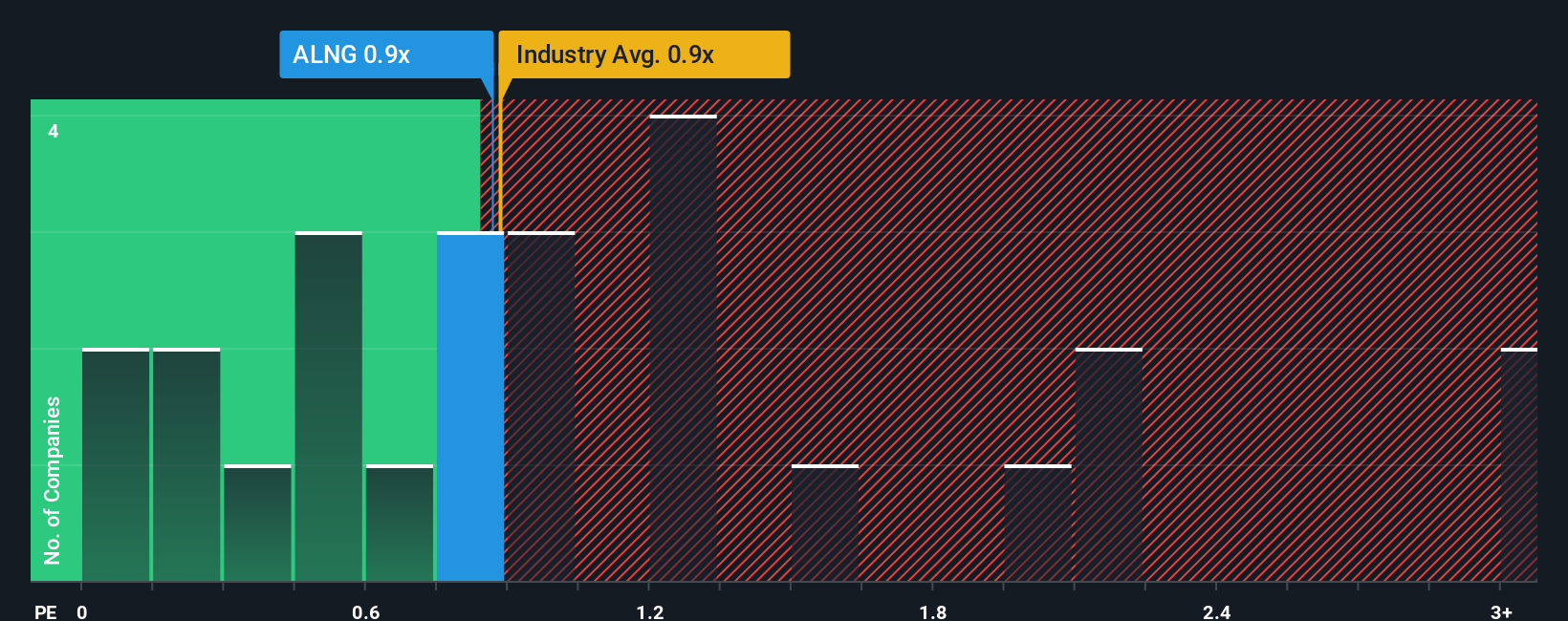

Although its price has surged higher, there still wouldn't be many who think Awilco LNG's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when it essentially matches the median P/S in Norway's Oil and Gas industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Awilco LNG

How Awilco LNG Has Been Performing

Recent times haven't been great for Awilco LNG as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Awilco LNG will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Awilco LNG's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. As a result, revenue from three years ago have also fallen 1.1% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 23% as estimated by the sole analyst watching the company. The industry is also set to see revenue decline 7.9% but the stock is shaping up to perform materially worse.

With this information, it's perhaps strange that Awilco LNG is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What Does Awilco LNG's P/S Mean For Investors?

Awilco LNG appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Awilco LNG's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

Having said that, be aware Awilco LNG is showing 5 warning signs in our investment analysis, and 1 of those is a bit concerning.

If you're unsure about the strength of Awilco LNG's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ALNG

Awilco LNG

Owns and operates liquefied natural gas (LNG) vessels in Norway.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives