- Norway

- /

- Energy Services

- /

- OB:AKSO

Should Aker Solutions' (OB:AKSO) Forecasted Revenue Drop After 2025 Prompt Investor Action?

Reviewed by Sasha Jovanovic

- On October 31, 2025, Aker Solutions issued earnings guidance, expecting 2025 revenues to surpass NOK 60 billion and anticipating approximately NOK 45 billion in revenue for 2026.

- The significant difference between 2025 and 2026 revenue projections reflects shifts in the company's project pipeline and anticipated business demand.

- We'll assess how the shift from higher expected 2025 revenues to lower 2026 estimates could reshape Aker Solutions' investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Aker Solutions Investment Narrative Recap

To invest in Aker Solutions, you need to believe in its ability to execute large-scale projects across both traditional energy and renewables, and successfully transition toward sectors like offshore wind and carbon capture. The jump in 2025 revenue guidance, followed by a significant drop expected in 2026, does not materially change the company’s biggest near-term catalyst, project execution, or its major risk: ongoing challenges in legacy renewables projects affecting margins and costs.

Among recent announcements, the major contract awarded for the Northern Lights Phase 2 project by Equinor stands out, directly reflecting the type of high-value projects currently driving Aker Solutions' order book and short-term revenue expectations. Delivering on such contracts remains a key factor supporting the company's near-term momentum, especially against the backdrop of evolving project pipelines and revenue forecasts.

But in contrast, investors should still be aware that unresolved issues in legacy renewables projects may...

Read the full narrative on Aker Solutions (it's free!)

Aker Solutions is projected to reach NOK35.0 billion in revenue and NOK1.6 billion in earnings by 2028. This scenario assumes a 15.2% annual revenue decline and an earnings decrease of NOK0.6 billion from the current NOK2.2 billion.

Uncover how Aker Solutions' forecasts yield a NOK33.88 fair value, a 21% upside to its current price.

Exploring Other Perspectives

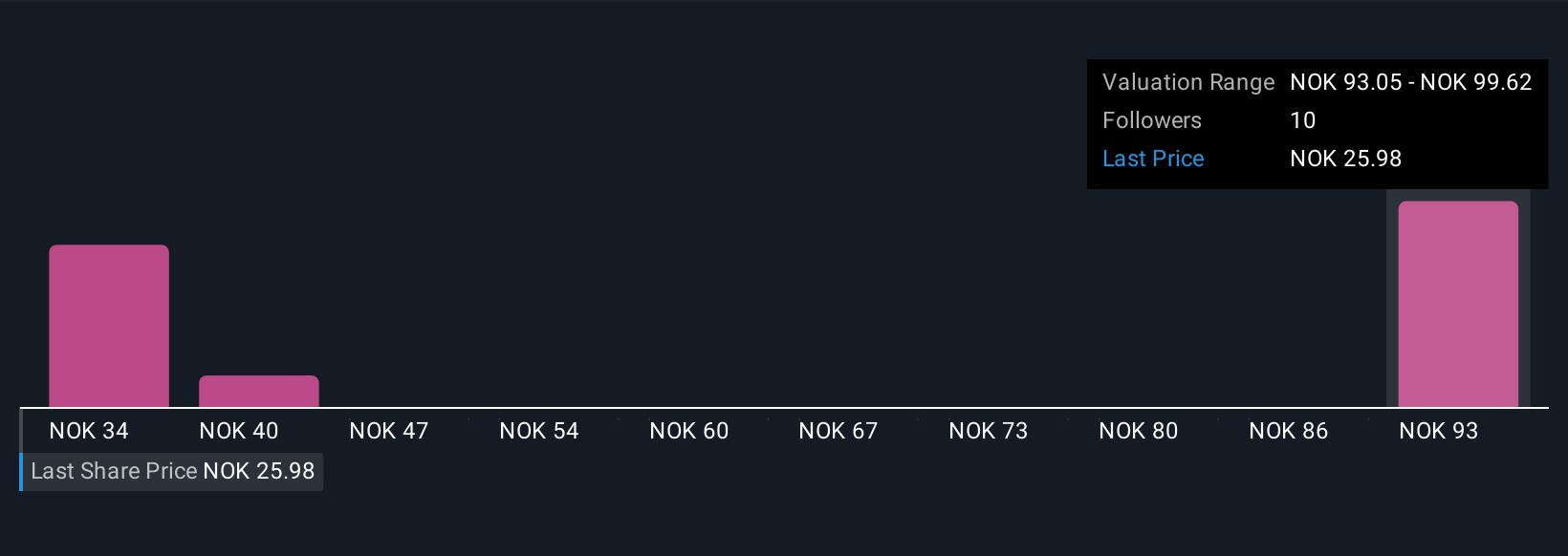

Simply Wall St Community members have published four fair value estimates for Aker Solutions ranging from NOK 33.88 to NOK 64.62. With earnings and revenue expected to decline in the coming years, your outlook on future project wins and margin recovery could mean very different outcomes, explore the full spectrum of views from other investors.

Explore 4 other fair value estimates on Aker Solutions - why the stock might be worth over 2x more than the current price!

Build Your Own Aker Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aker Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aker Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aker Solutions' overall financial health at a glance.

No Opportunity In Aker Solutions?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKSO

Aker Solutions

Provides solutions, products, systems, and services to the oil and gas industry in Norway, the United States, Brazil, the United Kingdom, Malaysia, Angola, Brunei, Canada, India, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives