- Norway

- /

- Energy Services

- /

- OB:AKAST

Akastor (OB:AKAST) Losses Narrow 57.7% Annually Despite Expected 1.9% Revenue Decline

Reviewed by Simply Wall St

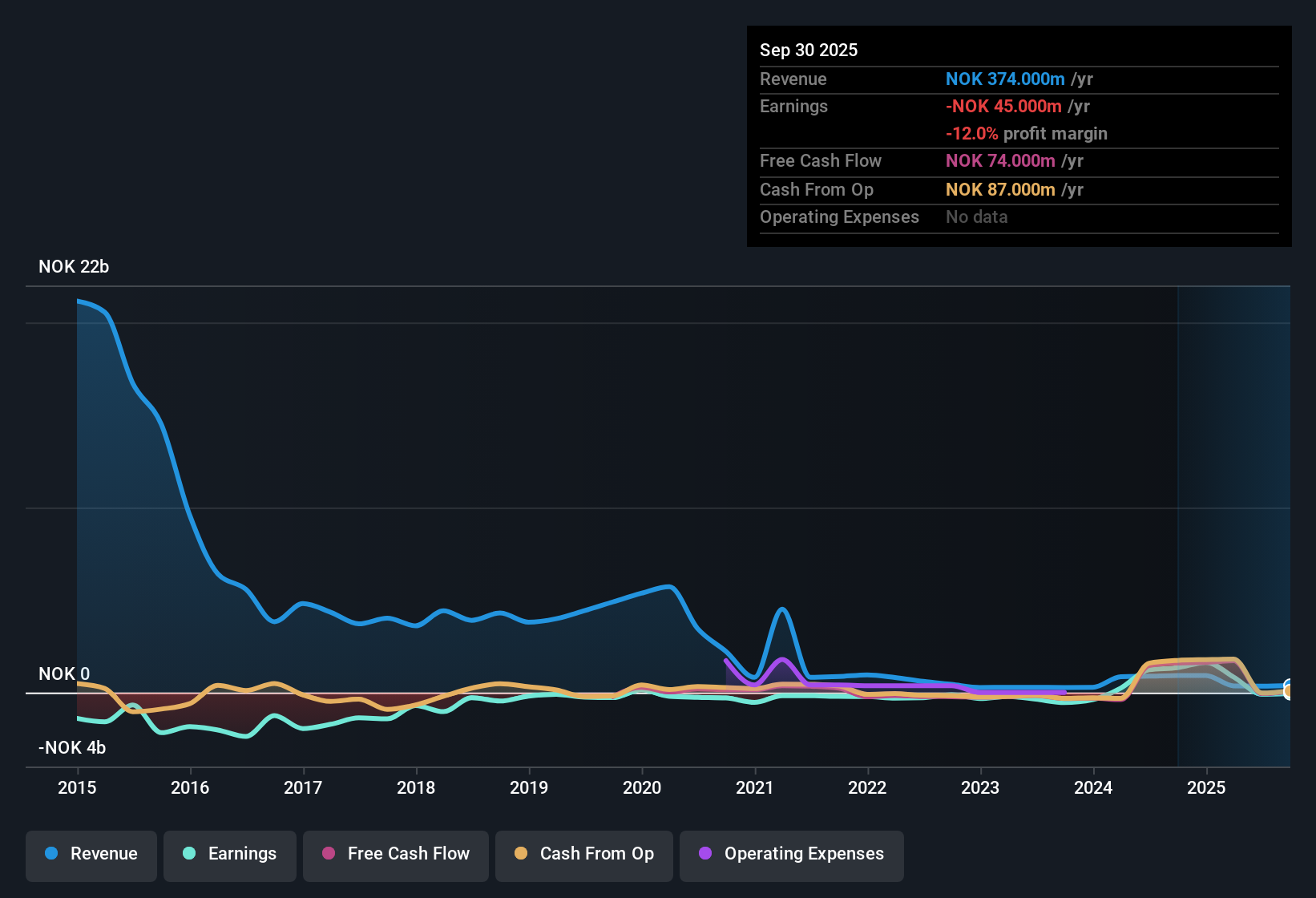

Akastor (OB:AKAST) remains unprofitable, with revenues expected to decline by 1.9% per year over the next three years. Despite there being no signs of margin improvement or high-quality earnings recently, the company has managed to reduce its losses at an annual rate of 57.7% over the past five years. However, with its shares trading at 8.8x price-to-sales, which is well above the Norwegian energy services industry average of 0.8x, and a current share price of NOK11.12 sitting considerably higher than its estimated fair value of NOK1.3, investors are likely weighing these realities against the ongoing outlook for further profit turnaround.

See our full analysis for Akastor.The next section examines how these headline figures compare to the market’s widely followed narratives. Some expectations may be confirmed, while others may face a reality check.

See what the community is saying about Akastor

Loss Reduction Pace Significantly Outpaces Revenue Decline

- Akastor’s annual loss reduction rate has averaged 57.7% per year for the past five years. Analysts now forecast that annual revenue will decrease by 1.9% over the next three years. This contrast highlights management’s recent focus on cost controls rather than top-line growth.

- According to the analysts' consensus view, strategic operational changes such as asset divestments and new AKOFS Offshore contracts are expected to enhance financial stability and may partly offset the projected revenue decline.

- Analysts point to the significant reduction in recent losses as evidence that Akastor is able to contain costs and manage operational inefficiencies even amid top-line pressure.

- However, risks such as global supply chain disruptions and macroeconomic instability are seen by analysts as ongoing threats that could challenge further efficiency gains.

- Consensus narrative suggests Akastor’s focus on margin improvements and strategic partnerships could support further progress even if headline revenues keep trending downward.

Analyst Price Target Assumes Aggressive Turnaround

- The consensus analyst price target of NOK19.00 is about 71% above the current share price of NOK11.12. This implies that the market would need to see Akastor shift to earnings of NOK28.2 million by 2028 despite current unprofitability and shrinking revenue projections.

- Analysts' consensus view highlights that achieving this target would require profit margins that ramp from negative levels toward the 12.2% industry average, plus a willingness among investors to accept a PE of 255.4x, which is far above the GB Energy Services market’s 8.6x typical valuation.

- This aggressive price target stands in contrast to the current lack of evidence for margin turnaround, as management has yet to show signs of a consistent pivot to high-quality earnings.

- If global trade disruptions or delayed contract wins hit revenue or cash flows, these ambitious projections could quickly come under pressure.

Valuation Multiple Far Exceeds Industry Peers

- Akastor trades at a price-to-sales multiple of 8.8x, compared to just 0.8x for the Norwegian energy services industry and 0.9x for its closest peers. This reflects a major valuation premium despite ongoing losses.

- Consensus narrative frames this premium as a sign that investors are pricing in substantial operational improvements and future shareholder distributions, but this view could be challenged if projected catalysts like AKOFS Offshore contract wins or margin gains fail to materialize.

- Analysts note that the company’s current share price of NOK11.12 remains well above its DCF fair value of NOK1.30, reinforcing concerns about downside risk from overvaluation.

- Even with planned asset sales and strategic payouts, valuation risk looms large if future profitability and cash flow stability fall short of expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Akastor on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not convinced by the figures above? Take a moment to frame your own take and shape the story from a perspective that matters to you. Do it your way

See What Else Is Out There

Akastor’s high valuation and lack of margin improvements leave investors exposed to overvaluation risk if operational gains or contract wins fail to materialize.

If you want potential bargains instead, use these 833 undervalued stocks based on cash flows to discover stocks trading below their fair value with healthier valuation fundamentals now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKAST

Akastor

Operates as an oilfield services investment company in Norway and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives