- China

- /

- Professional Services

- /

- SZSE:300938

Undiscovered Gems And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced significant challenges, with smaller-cap indexes generally experiencing broader losses amid cautious Federal Reserve commentary and political uncertainty in the U.S. Despite these headwinds, economic indicators such as strong consumer spending and job growth provide a backdrop that could support future opportunities for small-cap companies. In this environment, identifying promising stocks involves looking for those with solid fundamentals and resilience to navigate economic fluctuations, which can offer potential value even when broader market conditions are less favorable.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Baoding Technology | 64.72% | 34.64% | 46.42% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Avance Gas Holding (OB:AGAS)

Simply Wall St Value Rating: ★★★★★★

Overview: Avance Gas Holding Ltd, along with its subsidiaries, operates in the global transportation of liquefied petroleum gas (LPG) and has a market capitalization of NOK 5.90 billion.

Operations: Avance Gas generates revenue primarily from the transportation of liquefied petroleum gas (LPG), with reported revenues of $357.63 million. The company's financial performance is reflected in its net profit margin, which stands at 24%.

Avance Gas, a notable player in the oil and gas sector, has seen its debt to equity ratio decrease significantly from 138% to 68.8% over five years, indicating improved financial health. The company trades at a favorable price-to-earnings ratio of 1.8x compared to the Norwegian market's 11.2x, suggesting good value for investors. Despite earnings growth of 115% last year outpacing the industry's -3.7%, future earnings are expected to decline by an average of 88.5% annually over three years. Recent asset deliveries have bolstered its position with BW LPG shares and substantial cash proceeds enhancing liquidity further.

- Take a closer look at Avance Gas Holding's potential here in our health report.

Understand Avance Gas Holding's track record by examining our Past report.

EMTEK (Shenzhen) (SZSE:300938)

Simply Wall St Value Rating: ★★★★★☆

Overview: EMTEK (Shenzhen) Co., Ltd. operates as a third-party testing institution in China with a market cap of CN¥3.95 billion.

Operations: EMTEK generates revenue primarily from its research services, amounting to CN¥719.98 million.

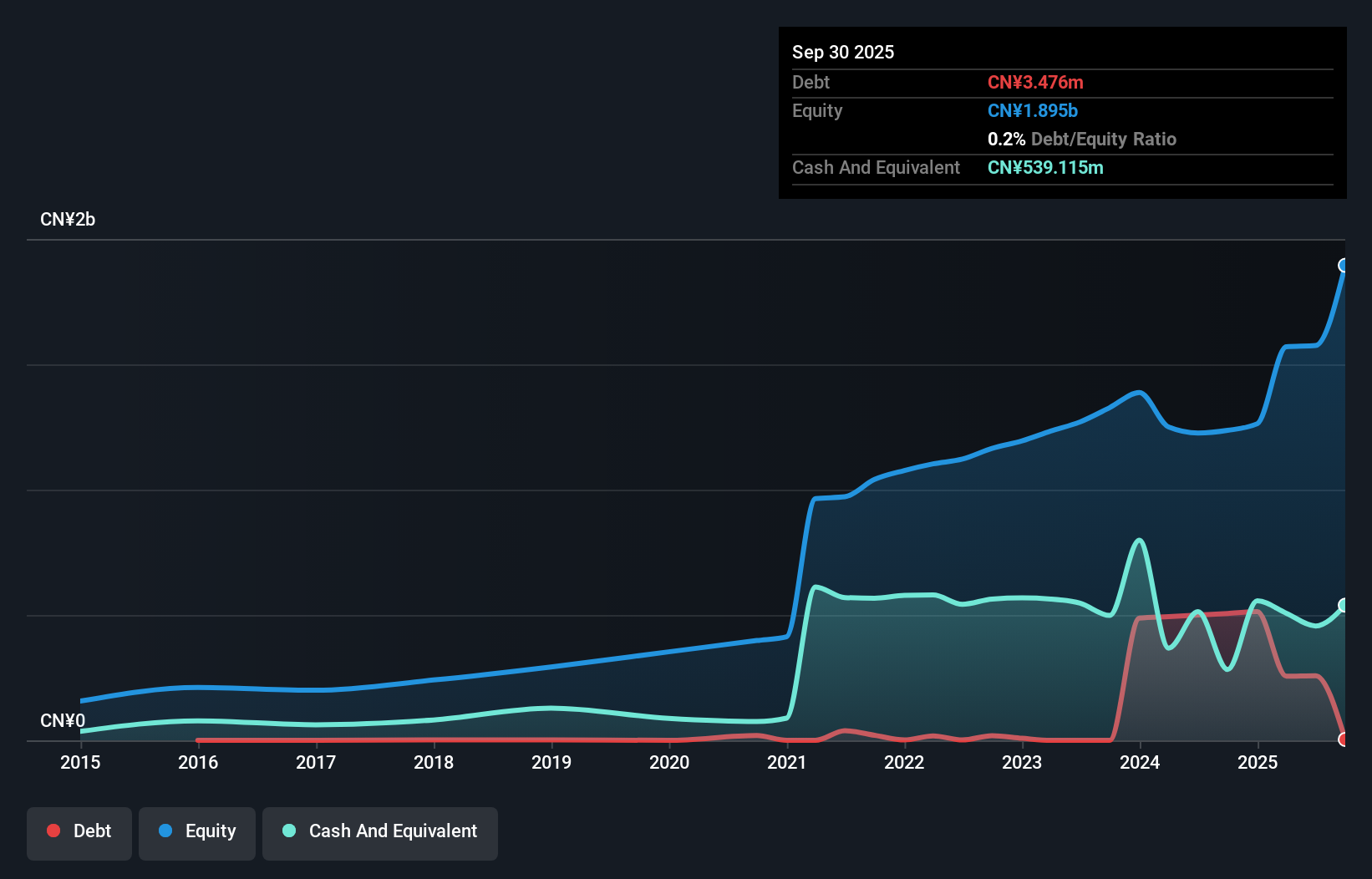

EMTEK, a promising player in the professional services industry, has shown robust earnings growth of 10.7% over the past year, outpacing the industry's -2.8%. It boasts a satisfactory net debt to equity ratio of 18.1%, indicating sound financial health despite an increase from 0.1% to 40.9% over five years. The company's price-to-earnings ratio stands at 22.8x, offering better value compared to the CN market's average of 35.5x. Recent reports highlight sales reaching CNY 551 million for nine months ending September 2024, with net income rising to CNY 143 million from CNY 133 million last year, reflecting solid performance and potential for future growth.

Sun (TSE:6736)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sun Corporation operates in mobile data solutions, entertainment, and information technology sectors in Japan with a market capitalization of ¥217.07 billion.

Operations: Sun Corporation generates revenue primarily from its Entertainment Related Business, which accounts for ¥6.94 billion, followed by the New IT Related Business at ¥3.27 billion. The Global Data Intelligence Business contributes ¥1.09 billion to the total revenue stream.

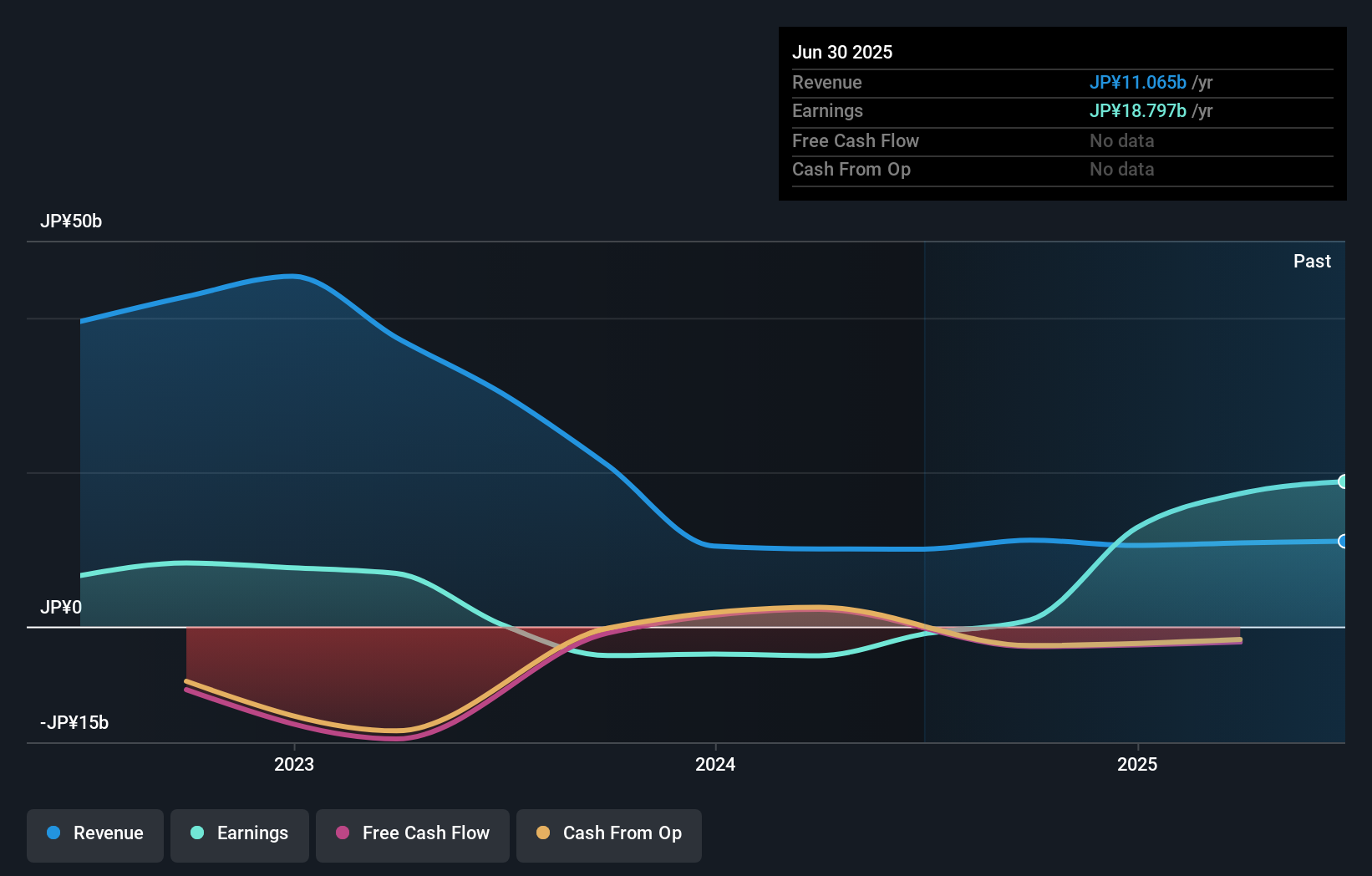

Sun Corporation, a small-cap player, has shown notable financial improvements recently. The firm's debt to equity ratio impressively decreased from 21.6% to 9.5% over five years, indicating robust financial management. With high-quality earnings and profitability achieved this year, Sun stands out in its sector despite a volatile share price over the past three months. Although not free cash flow positive yet, it earns more interest than it pays on debts, ensuring sound coverage of interest payments. Recent executive changes and consistent dividend payouts further highlight its commitment to shareholder value and strategic growth initiatives.

- Dive into the specifics of Sun here with our thorough health report.

Explore historical data to track Sun's performance over time in our Past section.

Seize The Opportunity

- Gain an insight into the universe of 4620 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade EMTEK (Shenzhen), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EMTEK (Shenzhen) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300938

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives