- Norway

- /

- Construction

- /

- OB:NORCO

How Investors Are Reacting To Norconsult (OB:NORCO) Surging Q3 Profit and Revenue Growth

Reviewed by Sasha Jovanovic

- Norconsult ASA recently reported third-quarter 2025 earnings, with sales of NOK 2,467 million and net income of NOK 132 million, both higher than the same period last year.

- This sharp improvement in profitability and earnings per share highlights the company's financial momentum relative to recent performance periods.

- With Norconsult posting a meaningful increase in quarterly net income, we’ll now explore how this shapes its updated investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Norconsult Investment Narrative Recap

To be a Norconsult shareholder, you need to believe in sustained public infrastructure investment and rising demand for engineering and climate-resilient design in the Nordics. The recent sharp improvement in net income and profit margins in the third quarter supports near-term confidence in these themes, though margin compression remains the biggest short-term risk due to ongoing wage inflation and talent shortages, these headwinds are still evident and could offset recent financial gains if cost pressures escalate further.

One particularly relevant update was Norconsult’s selection by HENT to provide consultancy services for the NRK media house in Oslo, a NOK 100 million project that adds to the firm's robust order backlog and showcases its positioning in ongoing infrastructure and media developments. This project win highlights the company's ability to secure large, multi-year contracts, an important catalyst underpinning both revenue visibility and its investment case.

By contrast, investors should be aware that despite recent earnings strength, rising salary costs could quickly erode margins if...

Read the full narrative on Norconsult (it's free!)

Norconsult's outlook projects NOK11.7 billion in revenue and NOK987.6 million in earnings by 2028. This is based on a 2.6% annual revenue growth rate and an increase in earnings of NOK363.6 million from the current NOK624.0 million.

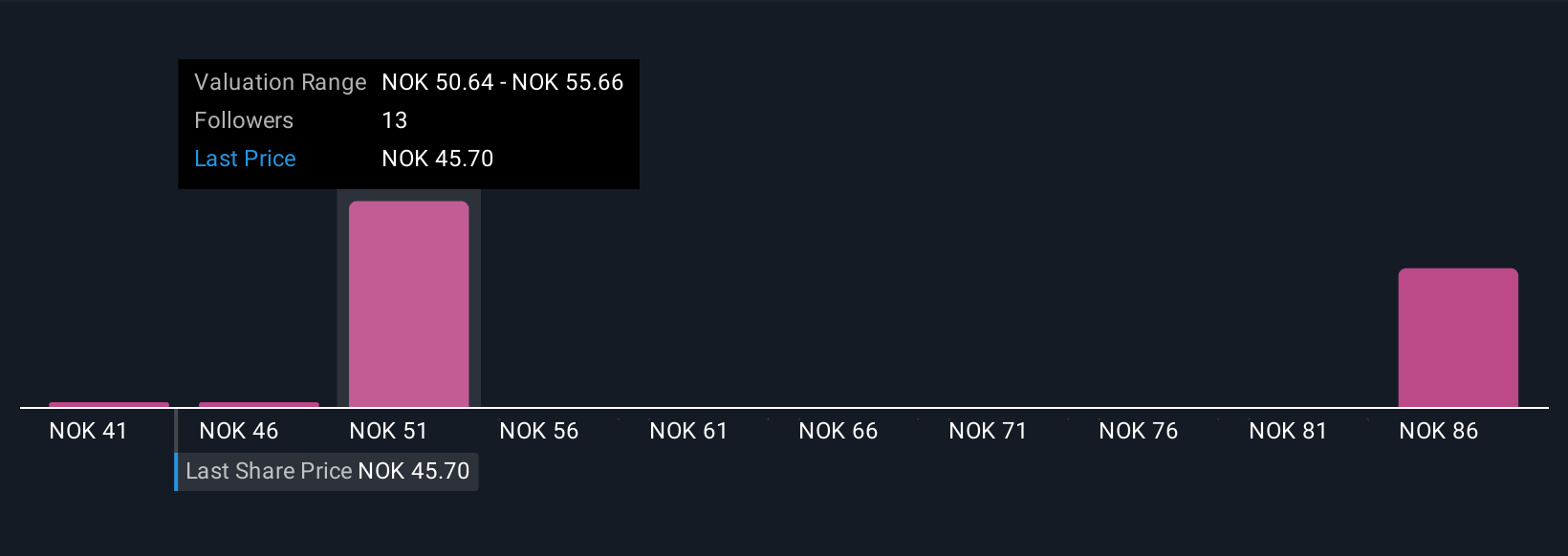

Uncover how Norconsult's forecasts yield a NOK51.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range widely from NOK 40.61 to NOK 90.67 per share. While recent financial results highlight strong margin gains, margin compression risk from wage inflation is still a major concern for future profitability, see how other investors are thinking about Norconsult’s potential.

Explore 5 other fair value estimates on Norconsult - why the stock might be worth 12% less than the current price!

Build Your Own Norconsult Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norconsult research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Norconsult research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norconsult's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norconsult might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORCO

Norconsult

Provides consultancy services with focus on community planning, engineering design, and architecture in the Nordics and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives