Undiscovered European Gems with Strong Potential for November 2025

Reviewed by Simply Wall St

As European markets face a pullback with the pan-European STOXX Europe 600 Index ending 1.24% lower, concerns about overvaluation in AI-related stocks have weighed heavily on investor sentiment. In this climate of cautious optimism and potential rate adjustments by central banks like the Bank of England, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Aerostar (BVB:ARS)

Simply Wall St Value Rating: ★★★★★★

Overview: Aerostar S.A. specializes in the manufacture, integration, upgrade, and maintenance of aviation and ground defense systems for the civil aviation industry both in Romania and internationally, with a market cap of RON1.41 billion.

Operations: Aerostar S.A. generates revenue through its activities in the aviation and ground defense sectors, focusing on manufacturing, integration, upgrades, and maintenance services for civil aviation.

Aerostar, a nimble player in the Aerospace & Defense sector, showcases robust financial health with no debt over the past five years and high-quality earnings. Its price-to-earnings ratio of 13.1x suggests it is attractively valued compared to the broader Romanian market at 15.7x. Despite an impressive annual earnings growth rate of 15.8%, it slightly trails behind the industry average of 21.6%. Recent results highlight a net income increase to RON 70.82 million for nine months ending September 2025, up from RON 58.81 million last year, indicating solid operational performance amidst competitive pressures.

Morrow Bank (OB:MOBA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Morrow Bank ASA specializes in providing unsecured financing to private individuals across Norway, Finland, Sweden, the Netherlands, and Germany with a market capitalization of NOK3.11 billion.

Operations: Morrow Bank generates revenue primarily through interest income from unsecured loans offered to individuals in several European countries. The bank's net profit margin is 15%, reflecting its efficiency in managing expenses relative to its income.

Morrow Bank, with NOK19.1 billion in assets and NOK2.6 billion in equity, is making waves with its strategic focus on digital expansion and a scalable platform. Its total deposits stand at NOK15.9 billion against loans of NOK14.3 billion, reflecting a solid balance sheet despite high bad loans at 18.2%. The bank's earnings grew by 58% last year, far outpacing the industry average of 9.7%, highlighting its robust performance amidst challenges like unsecured consumer lending risks in the Nordic region. With a price-to-earnings ratio of 12.6x below the Norwegian market average, it presents an intriguing opportunity for investors mindful of inherent risks and growth potential.

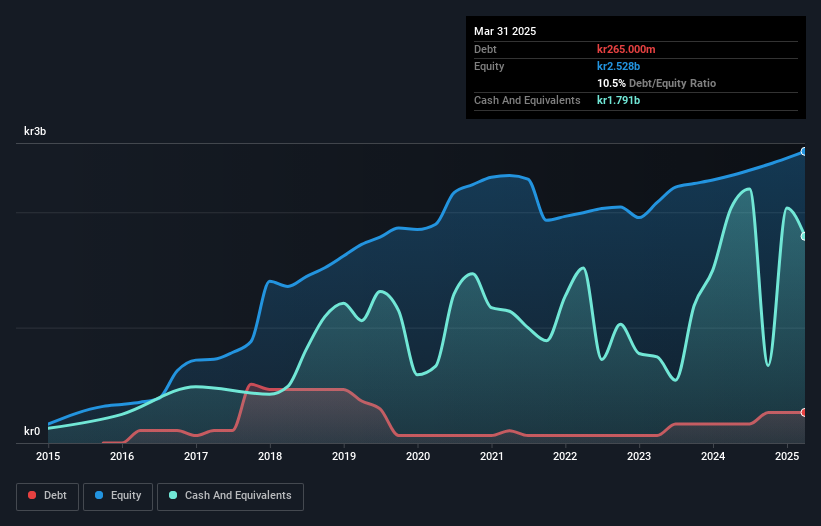

VRG (WSE:VRG)

Simply Wall St Value Rating: ★★★★★★

Overview: VRG S.A. is a company that designs, manufactures, and distributes jewelry and clothing for both women and men across Poland, Hungary, the Eurozone, and the United States with a market capitalization of approximately PLN1.08 billion.

Operations: VRG generates revenue primarily from its jewelry segment, which accounts for PLN 802.03 million, and its clothing segment, contributing PLN 625.17 million.

VRG has shown robust financial health with its debt to equity ratio decreasing from 15.2% to 11.7% over five years, and interest payments well covered by EBIT at a multiple of 6.6 times. The company's earnings grew by 13.2% last year, outpacing the luxury industry's growth of 2.8%. Trading at an attractive valuation, VRG is priced 8.3% below its estimated fair value, suggesting potential upside for investors seeking value opportunities in smaller European stocks. Recent results indicate solid performance with sales rising to PLN 377 million in Q2 and net income reaching PLN 28 million compared to the previous year.

- Get an in-depth perspective on VRG's performance by reading our health report here.

Explore historical data to track VRG's performance over time in our Past section.

Taking Advantage

- Navigate through the entire inventory of 326 European Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VRG

VRG

Designs, manufactures, and distributes jewelry and clothing for women and men in Poland, Hungary, the Eurozone, and the United States.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives