- Netherlands

- /

- Logistics

- /

- ENXTAM:PNL

Insiders Are Backing These 3 High Growth Companies

Reviewed by Simply Wall St

In a week marked by mixed economic signals and cautious corporate earnings, global markets have shown volatility, with major indices like the Nasdaq Composite and S&P MidCap 400 experiencing highs followed by sharp declines. Amidst this backdrop of uncertainty and fluctuating market conditions, companies with high insider ownership can often signal confidence in their growth potential, as insiders are typically well-informed about the company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

Let's take a closer look at a couple of our picks from the screened companies.

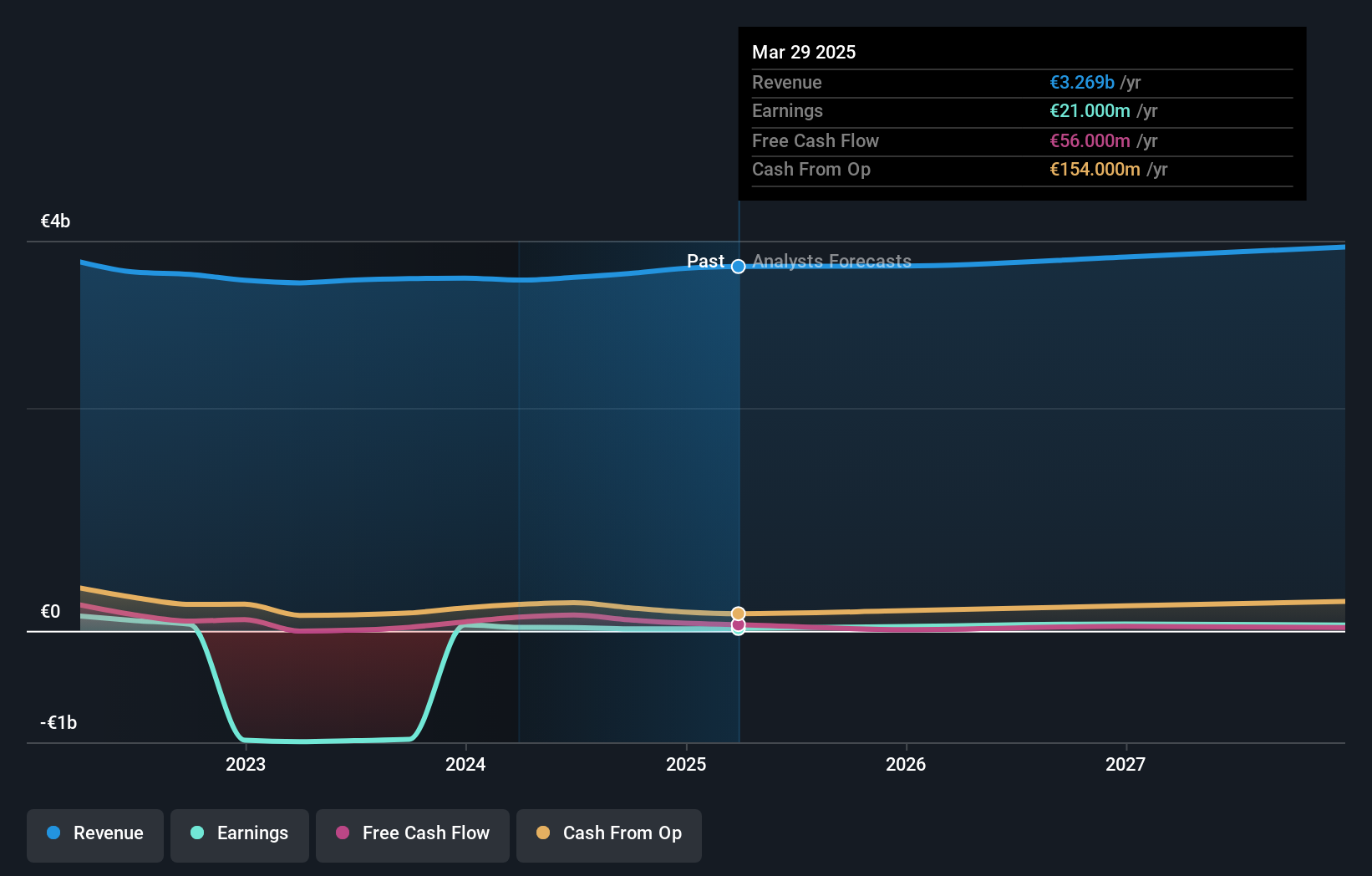

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally with a market cap of €551.32 million.

Operations: The company's revenue is primarily generated from its Parcels segment, which accounts for €2.28 billion, and Mail in the Netherlands, contributing €1.35 billion.

Insider Ownership: 35.6%

PostNL's earnings are forecast to grow significantly at 38.6% per year, outpacing the Dutch market's 15.7%. Despite trading at a significant discount to its estimated fair value, revenue growth is expected to lag behind the market. The company recently became profitable but faces challenges with high debt levels and an unsustainable dividend yield of 5.46%. Recent earnings show modest sales growth but a net loss for the first half of 2024.

- Dive into the specifics of PostNL here with our thorough growth forecast report.

- The analysis detailed in our PostNL valuation report hints at an deflated share price compared to its estimated value.

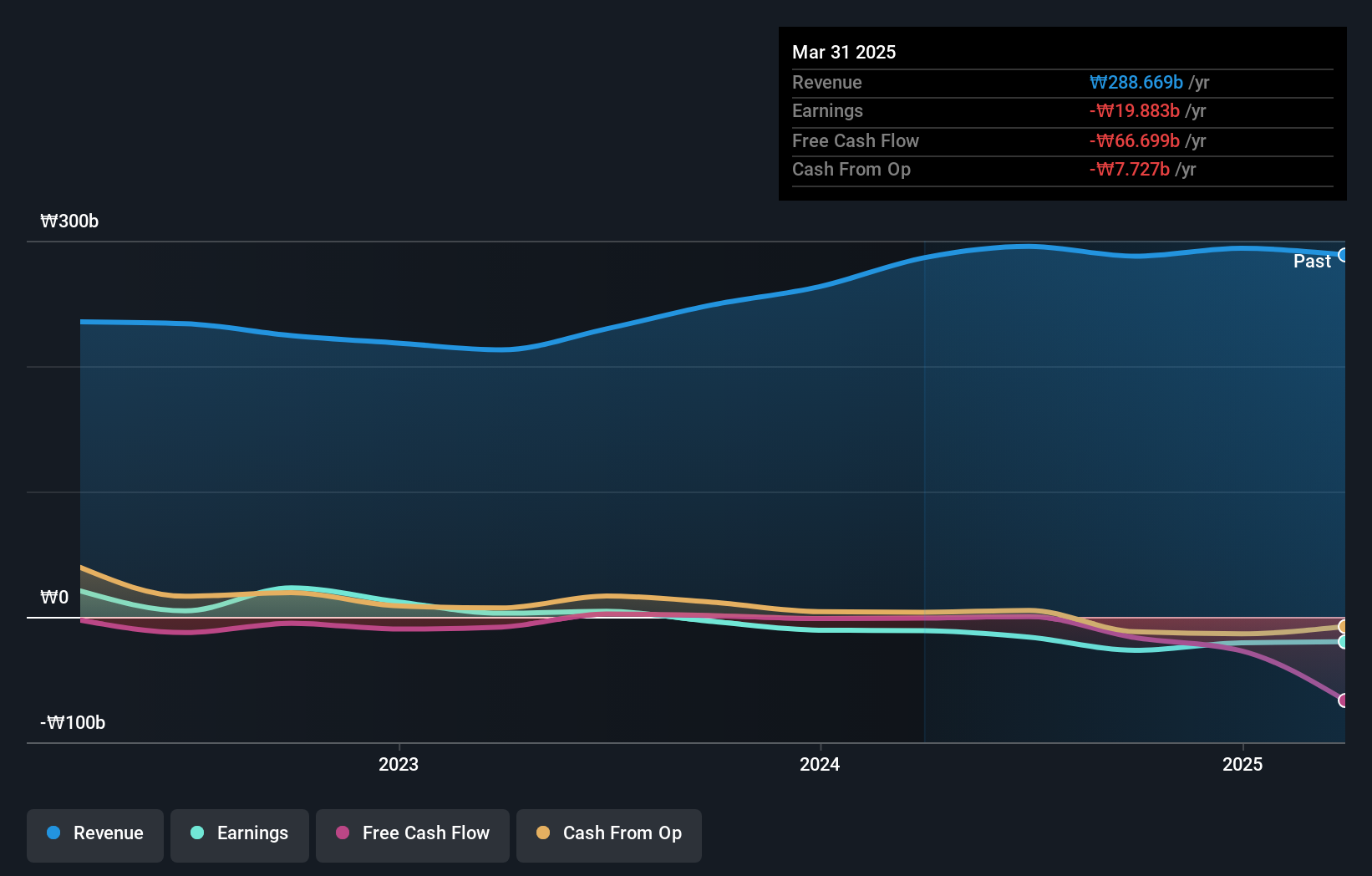

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bioneer Corporation is a biotechnology company operating in South Korea and internationally, with a market cap of ₩596.22 billion.

Operations: Bioneer generates revenue through its biotechnology operations across South Korea and various international markets, including the Americas, Europe, Asia, and Africa.

Insider Ownership: 15.8%

Bioneer is trading at 72.1% below its estimated fair value, with earnings projected to grow 97.58% annually, surpassing market expectations and becoming profitable within three years. Revenue growth is anticipated at 23.5%, outpacing the South Korean market's average of 10%. Despite strong growth forecasts, recent earnings reveal a net loss for Q2 and the first half of 2024, highlighting potential financial challenges amidst high insider ownership stability over the past three months.

- Unlock comprehensive insights into our analysis of Bioneer stock in this growth report.

- Our expertly prepared valuation report Bioneer implies its share price may be lower than expected.

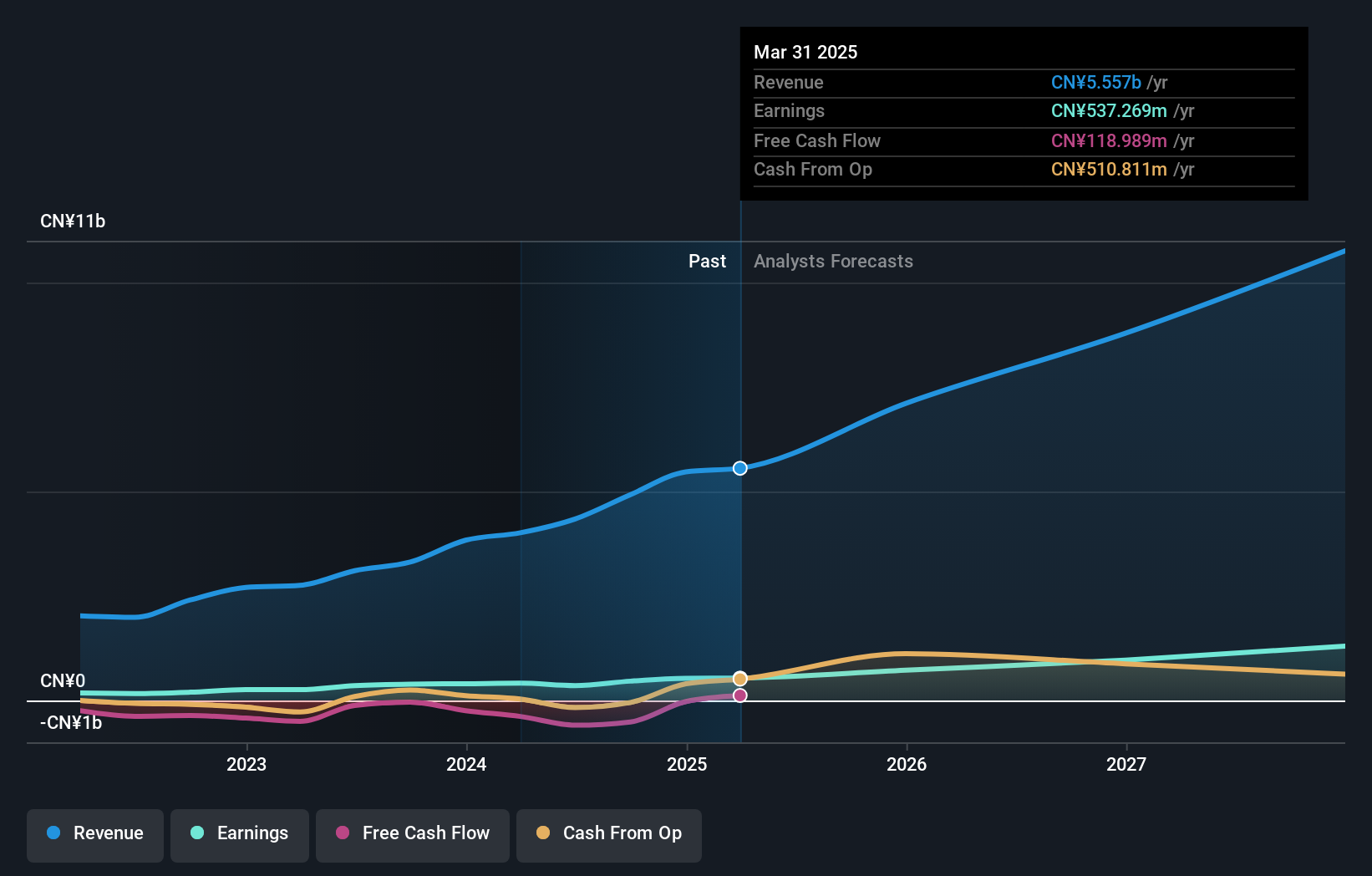

Shanghai GenTech (SHSE:688596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai GenTech Co., Ltd. offers process critical system solutions for hi-tech and advanced manufacturing industries in China, with a market cap of CN¥10.46 billion.

Operations: Shanghai GenTech Co., Ltd. generates revenue by providing essential system solutions to customers within China's hi-tech and advanced manufacturing sectors.

Insider Ownership: 13.5%

Shanghai GenTech's recent earnings report shows robust growth, with sales reaching CNY 3.50 billion for the nine months ended September 30, 2024, up from CNY 2.41 billion a year earlier. Despite this growth and a favorable price-to-earnings ratio of 22.6x compared to the CN market, the company faces challenges such as low return on equity forecasts and past shareholder dilution. Earnings are expected to grow significantly at over 31% annually, outpacing market averages.

- Delve into the full analysis future growth report here for a deeper understanding of Shanghai GenTech.

- Our comprehensive valuation report raises the possibility that Shanghai GenTech is priced lower than what may be justified by its financials.

Seize The Opportunity

- Gain an insight into the universe of 1541 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PNL

PostNL

Provides postal and logistics services to businesses and consumers in the Netherlands, rest of Europe, and internationally.

Reasonable growth potential with adequate balance sheet.