- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:EAS2P

Should Shareholders Have Second Thoughts About A Pay Rise For Ease2pay N.V.'s (AMS:EAS2P) CEO This Year?

Key Insights

- Ease2pay will host its Annual General Meeting on 21st of June

- Salary of €88.0k is part of CEO Gijs van Lookeren Campagne's total remuneration

- Total compensation is 70% below industry average

- Ease2pay's three-year loss to shareholders was 82% while its EPS was down 67% over the past three years

The disappointing performance at Ease2pay N.V. (AMS:EAS2P) will make some shareholders rather disheartened. The next AGM coming up on 21st of June will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for Ease2pay

Comparing Ease2pay N.V.'s CEO Compensation With The Industry

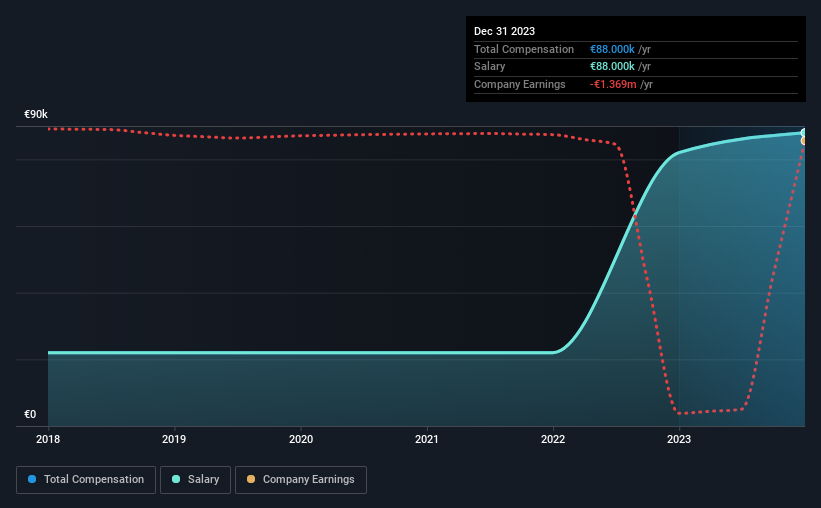

At the time of writing, our data shows that Ease2pay N.V. has a market capitalization of €13m, and reported total annual CEO compensation of €88k for the year to December 2023. That's just a smallish increase of 7.3% on last year. Notably, the salary of €88k is the entirety of the CEO compensation.

On comparing similar-sized companies in the the Netherlands IT industry with market capitalizations below €187m, we found that the median total CEO compensation was €293k. Accordingly, Ease2pay pays its CEO under the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €88k | €82k | 100% |

| Other | - | - | - |

| Total Compensation | €88k | €82k | 100% |

Speaking on an industry level, nearly 71% of total compensation represents salary, while the remainder of 29% is other remuneration. At the company level, Ease2pay pays Gijs van Lookeren Campagne solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Ease2pay N.V.'s Growth Numbers

Ease2pay N.V. has reduced its earnings per share by 67% a year over the last three years. In the last year, its revenue is down 20%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Ease2pay N.V. Been A Good Investment?

With a total shareholder return of -82% over three years, Ease2pay N.V. shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Ease2pay pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Ease2pay (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Ease2pay might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:EAS2P

Ease2pay

Provides payment services through its self-service platform in the Netherlands.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives