- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

Is ASML Still a Good Value After Strong 42.7% Rally and Q2 2025 Earnings?

Reviewed by Bailey Pemberton

- Ever wondered if ASML Holding is actually a good deal right now? You're not alone, especially with all the buzz around its place in the global semiconductor market.

- The stock has had a wild ride lately, dipping 4.3% over the last week but still boasting a 42.7% rally in the past year and a long-term 159.1% gain over five years.

- Recent headlines have focused on ASML's crucial role in chipmaking and how global supply chain shifts are putting more attention on its unique technology. A surge in demand for advanced chips, coupled with government moves to secure the semiconductor supply, has brought ASML into the spotlight and may be fueling investor optimism.

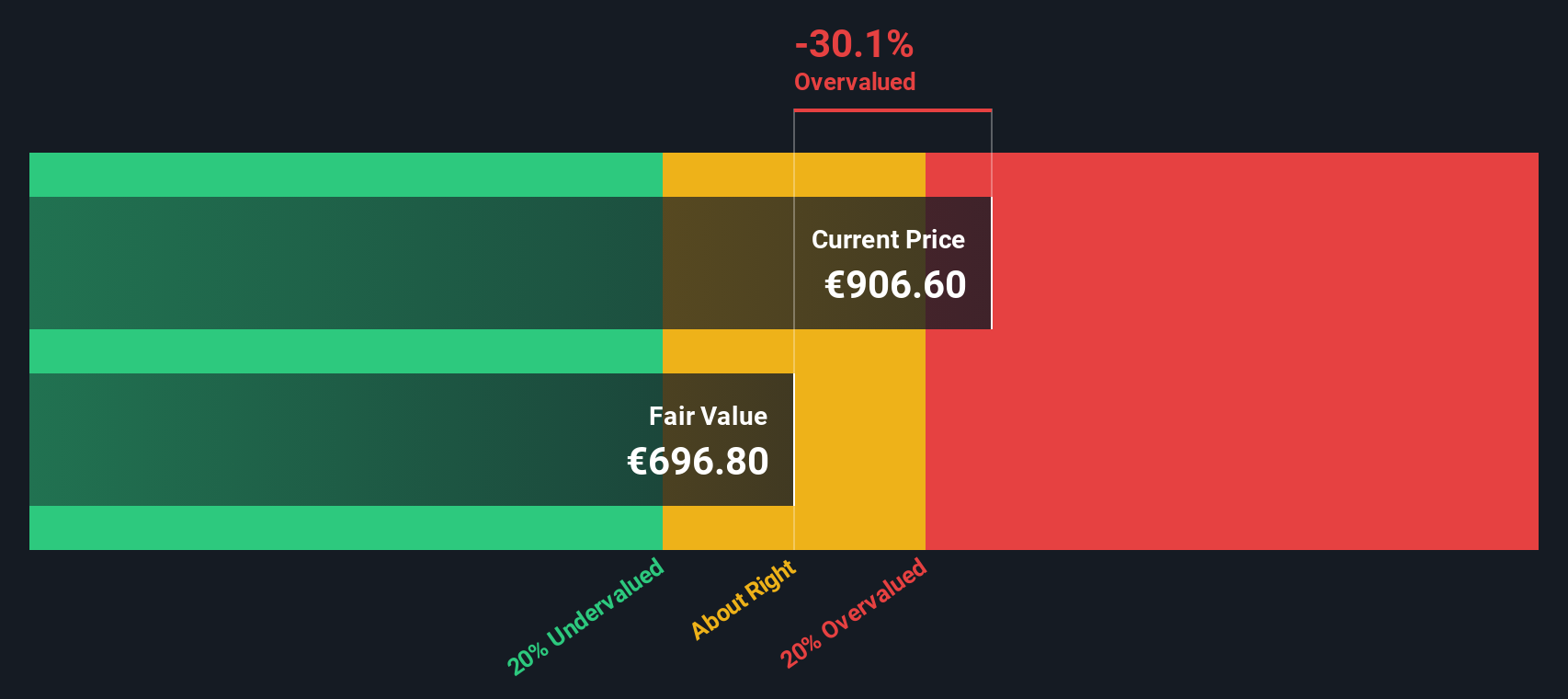

- On our valuation scale, ASML Holding scores 2 out of 6 for being undervalued. This means there is plenty to dig into with the major valuation models, and a deeper approach is waiting for you at the end of this article.

ASML Holding scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today’s value. This helps investors determine whether a stock is trading above or below its fair value based on expected future performance.

For ASML Holding, the DCF calculation uses the recent Free Cash Flow of approximately €8.56 billion. Over the next few years, analysts expect this figure to grow sharply. By 2029, projections suggest Free Cash Flow could reach around €17.1 billion. The model relies on specific analyst forecasts for the next five years. For years beyond, Simply Wall St extrapolates the trend to estimate continued growth.

According to these projections and discounting methods, ASML Holding’s intrinsic value is estimated at €686.09 per share. However, this is about 29.2% below the company’s current share price, implying that ASML stock is overvalued according to this DCF model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 29.2%. Discover 865 undervalued stocks or create your own screener to find better value opportunities.

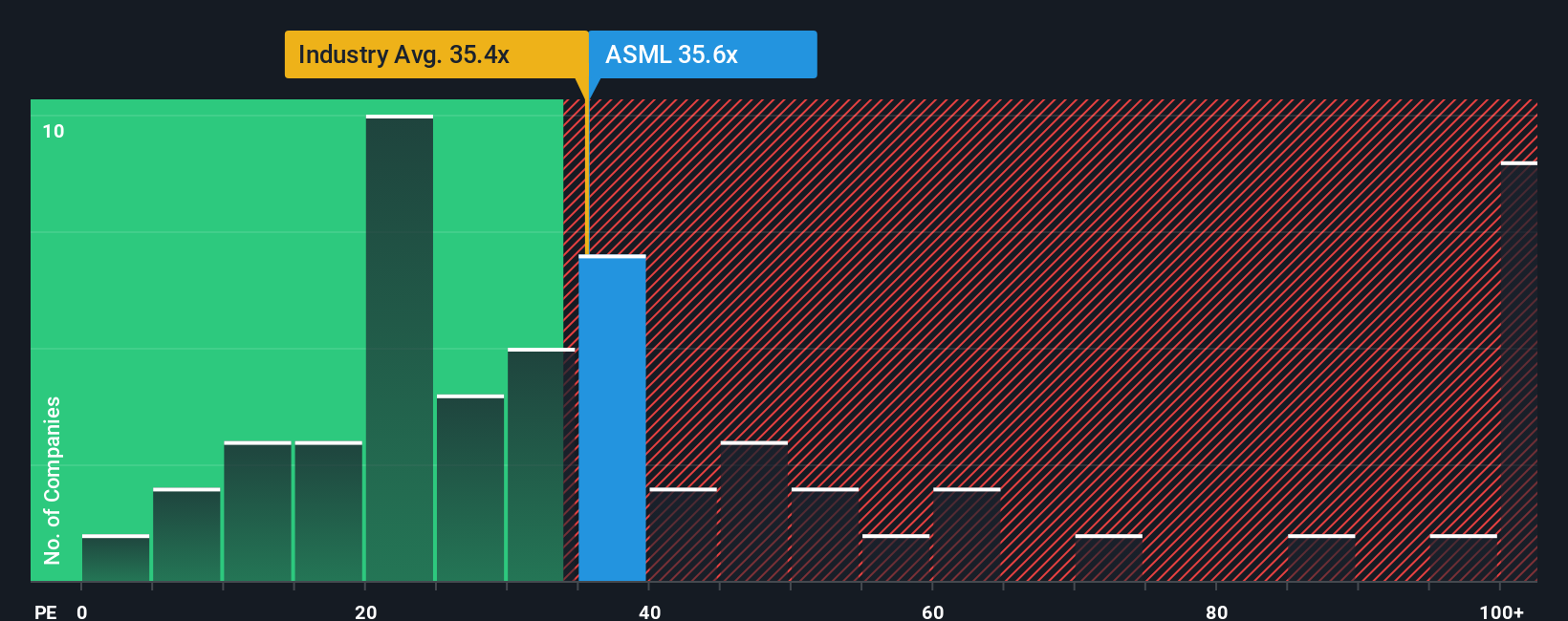

Approach 2: ASML Holding Price vs Earnings

One of the most widely used ways to value profitable companies is by looking at their Price-to-Earnings (PE) ratio. The PE ratio is helpful because it shows how much investors are willing to pay today for each euro of ASML's earnings, which is especially relevant for mature, profitable businesses. However, what counts as a fair or normal PE ratio can differ greatly depending on expectations for a company's future growth and the uncertainty, or risk, involved in the sector.

ASML currently trades on a PE of 36.29x, which is below the average of its close peers at 41.84x and just under the broader semiconductor industry average of 37.77x. While these numbers suggest ASML is attractively priced compared to many rivals, it is important to go a step further for a more tailored view.

Simply Wall St uses a proprietary “Fair Ratio,” which takes into account not just peer and industry comparisons, but also factors like ASML’s earnings growth outlook, profit margins, overall risk, market size, and sector dynamics. For ASML, the Fair Ratio is calculated at 51.47x. This means that, considering its strong fundamentals and growth drivers, the company could reasonably trade at a much higher multiple than it does today. Unlike basic comparisons, the Fair Ratio provides a more complete picture by adjusting for what makes ASML unique.

Since ASML’s current PE is well below its Fair Ratio, the stock appears meaningfully undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

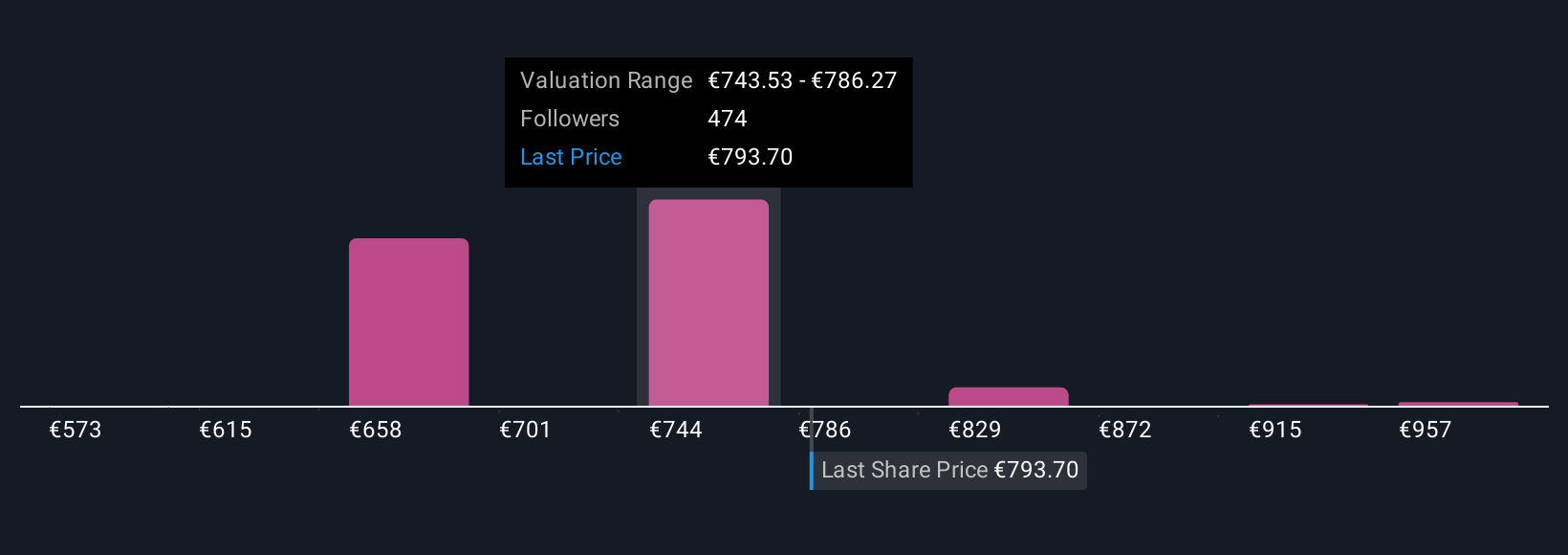

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you build your own story about a company, connecting your view of its long-term prospects to specific financial forecasts and an estimated fair value. Instead of just crunching numbers, Narratives let you express your perspective, such as what you believe ASML’s revenue growth or profit margins could be, while making these assumptions explicit and testable.

On Simply Wall St’s platform, millions of investors use Narratives on each company’s Community page to bring clarity to their decisions. Narratives help you decide when to buy or sell by comparing your calculated Fair Value to the current Price, and these projections automatically update as soon as new information such as earnings or news is released, so your view stays current.

With Narratives, you might see one investor forecasting a fair value for ASML Holding above €1,000, based on strong AI growth and expanding market dominance, while another expects a fair value closer to €500, citing macroeconomic risks and geopolitical headwinds. This illustrates how much your beliefs and research can shape your own investment edge.

For ASML Holding, we’ll make it really easy for you with previews of two leading ASML Holding Narratives:

Fair Value: €1,000

Undervalued by approximately 11.33%

Revenue Growth Rate: 17.26%

- ASML maintains a technological monopoly as the world’s only supplier of EUV lithography machines, keeping it essential to advanced chipmaking for major customers like TSMC and Intel.

- Q2 2025 results were strong with €7.7 billion in sales and robust recurring revenue from services. However, management’s cautious guidance led to a short-term stock drop.

- Despite near-term uncertainty, secular tailwinds such as AI chip demand and global semiconductor independence support the long-term growth story. This makes current weakness an opportunity for long-term investors.

Fair Value: €864.91

Overvalued by approximately 2.52%

Revenue Growth Rate: 9.65%

- ASML’s dominant position and technological edge place it at the core of the semiconductor supply chain, but also make it a target for geopolitical and competitive challenges, especially from China.

- Export restrictions, China’s push for self-sufficiency, and regulatory risks could erode ASML’s monopoly power and impact future growth and sales dependency on China.

- While strong financials, R&D investment, and demand in the U.S. and Europe support continued growth, current pricing is rich and long-term risks remain, especially if market conditions or China’s strategy shift.

Do you think there's more to the story for ASML Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives