Is Prosus Still a Smart Bet After Its 53.9% Gain and Tech Portfolio Shakeup?

Reviewed by Bailey Pemberton

- Ever wondered if Prosus could be your next smart investment? Let’s pull back the curtain on its true value and see if the current price stacks up to reality.

- After a standout year with gains of 53.9%, Prosus’ shares have seen some recent volatility, dipping 1.6% in the past week and 5.5% over the past month. However, they remain up an impressive 52.7% year-to-date.

- Behind these moves, market watchers are eyeing news like Prosus’s continued tech investments and portfolio reshuffling, as well as high-profile asset sales that hint at a shifting strategy. These events have shaped sentiment and may have a lasting effect on both risk and growth potential.

- When it comes to valuation, Prosus currently earns a score of 3 out of 6. This suggests there’s more to the fair value story than meets the eye. Stick with us as we break down the traditional valuation angles, and share a fresher perspective you might not expect at the end of the article.

Approach 1: Prosus Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to their value today. The core idea is that what Prosus will earn in the years to come, in today’s dollars, drives its true worth.

For Prosus, the latest reported Free Cash Flow (FCF) is $1.76 billion. Analysts forecast FCF growth to continue, reaching $3.15 billion by 2028. Beyond 2028, future estimates are extrapolated. This means long-term projections are less precise but help fill in the big picture for up to 10 years.

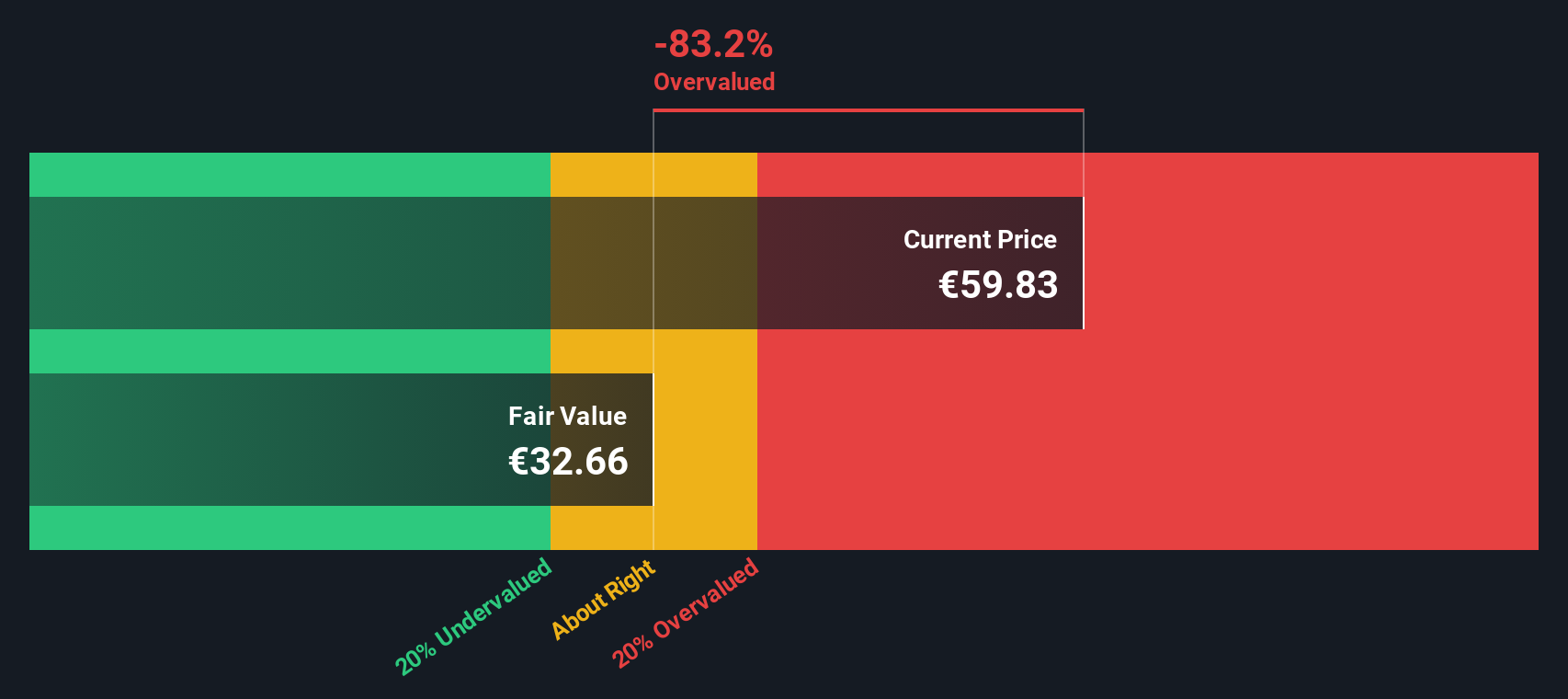

Based on this cash flow growth and expectation, the DCF model estimates Prosus’s intrinsic value at $31.87 per share. With the current market price implying an 85% premium to this value, the stock appears significantly overvalued according to this analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Prosus may be overvalued by 85.0%. Discover 870 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Prosus Price vs Earnings

For companies that are profitable, the Price-to-Earnings (PE) ratio is a well-established way to assess how the market values every euro of earnings. The PE ratio works well because it links the stock price directly to the company’s bottom line, which is especially useful for established firms like Prosus that generate positive earnings.

Typically, higher growth or lower risk justifies a higher PE ratio, since future earnings are expected to increase or are seen as more dependable. In contrast, stocks in riskier or slower-growing categories often trade at lower PEs, reflecting tempered expectations or greater uncertainty.

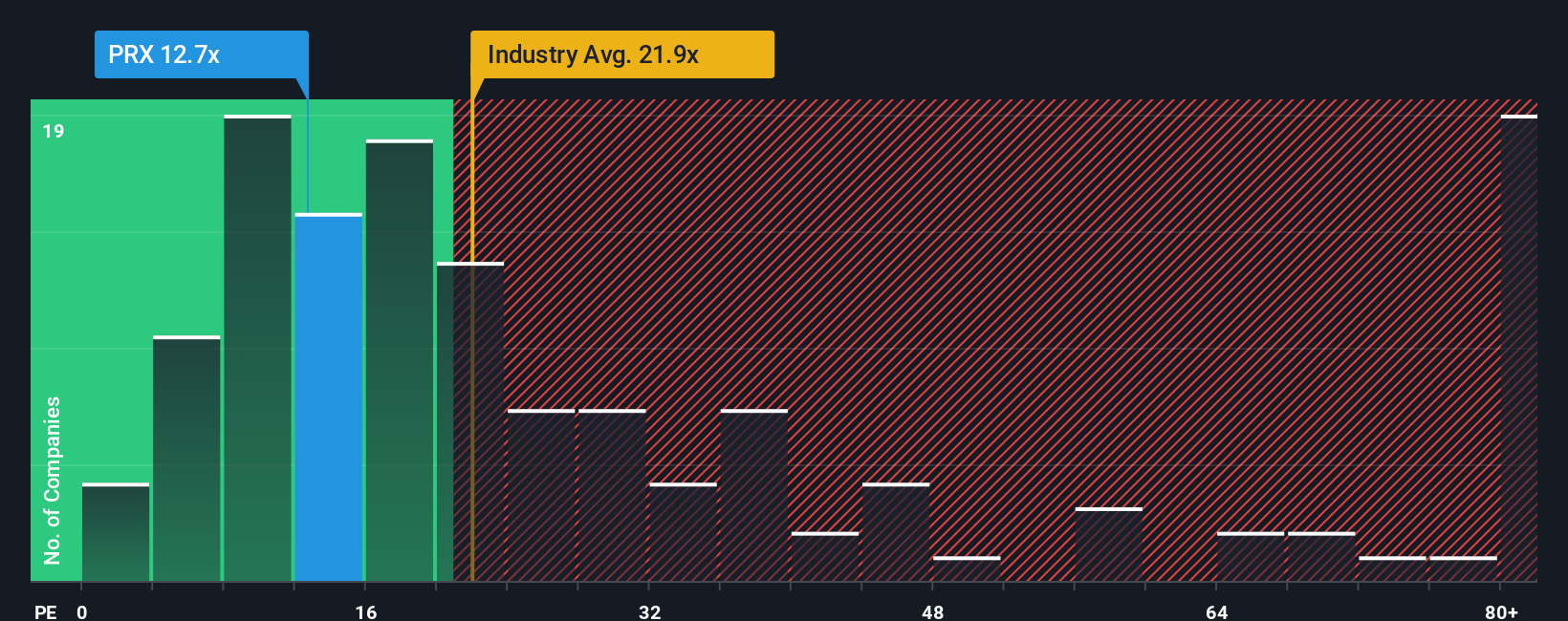

Right now, Prosus trades at a PE ratio of 12.1x. This is a hefty discount to both its peer group average of 44.3x and the broader Multiline Retail industry average of 19.9x. At first glance, this signals that the stock might be undervalued relative to its sector.

Rather than just comparing Prosus to these broad benchmarks, Simply Wall St’s “Fair Ratio” offers a more nuanced gauge. This metric factors in the company’s unique mix of earnings growth, risks, profit margins, industry characteristics and size to pinpoint what would be a reasonable multiple for Prosus today. This approach is designed to move past the noise of industry and peer comparisons to arrive at a more tailored valuation signal.

Prosus’s Fair Ratio is calculated at 16.3x, slightly above its current PE of 12.1x. With the two figures quite close, this suggests the current price is about right when all relevant factors are weighed.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Prosus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple, accessible tool that let investors tell the story behind Prosus’s numbers by bringing together your personal perspective on the company, financial forecasts, and your own idea of fair value all in one place. This approach links the “why” behind a company’s future (the story), to the “how much” (the forecast), and then to a concrete fair value that you can easily compare with today’s share price.

On Simply Wall St’s Community page, millions of investors use Narratives to decide when to buy or sell by tracking how their fair value view stacks up against the market and adjusting instantly as new news or results come in. For example, some investors might build an optimistic Narrative for Prosus, expecting rapid revenue growth and future tech wins, giving a fair value as high as €70. Others, taking a more cautious view on risks and margins, might set their fair value around €45. Narratives empower you to invest with a clear rationale, not just the numbers, and update your view whenever events change the story.

Do you think there's more to the story for Prosus? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PRX

Prosus

Engages in the e-commerce and internet businesses in Asia, Europe, Latin America, North America, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives