- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:AMG

A Fresh Look at AMG Critical Materials (ENXTAM:AMG) Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

AMG Critical Materials (ENXTAM:AMG) recently reported annual net income growth of 38%. The stock delivered a 66% total return for shareholders over the past year. Investors have been watching these shifts closely and are assessing potential value opportunities.

See our latest analysis for AMG Critical Materials.

AMG Critical Materials’ share price has pulled back 18% over the past month after strong year-to-date momentum pushed the stock up more than 74%. Despite the recent volatility, the 1-year total shareholder return remains stellar at 67%, which suggests that investor optimism about long-term prospects is holding firm even through short-term swings.

If you’re wondering what other opportunities could capture this kind of momentum, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares sitting nearly 31% below consensus analyst price targets and trading at a steep discount to some measures of intrinsic value, the key question is whether AMG Critical Materials is now a bargain or if the market has already factored in all future growth prospects.

Most Popular Narrative: 19.3% Undervalued

The most closely watched narrative puts AMG Critical Materials’ fair value well above the recent close, suggesting the shares have room to run if consensus assumptions play out. These market watchers are eyeing catalysts that could shift the valuation picture even further.

The commissioning and demand coverage (contracted utilization) of the Bitterfeld lithium refining facility, as well as new feedstock agreements in Europe, are set to solidify AMG's position as a key regional supplier. This is likely to lead to greater revenue stability and the potential for premium pricing, supporting both top-line growth and margin enhancement.

Which real-world numbers drive this optimistic outlook? The narrative is built on aggressive growth in profitability, margin expansion, and falling share count. What are the estimates behind this bullish scenario? Only a deep dive reveals the bold bets fueling that fair value estimate.

Result: Fair Value of $30.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected volatility in lithium and vanadium prices, or setbacks in new facility ramp-ups, could challenge the bullish outlook for AMG Critical Materials.

Find out about the key risks to this AMG Critical Materials narrative.

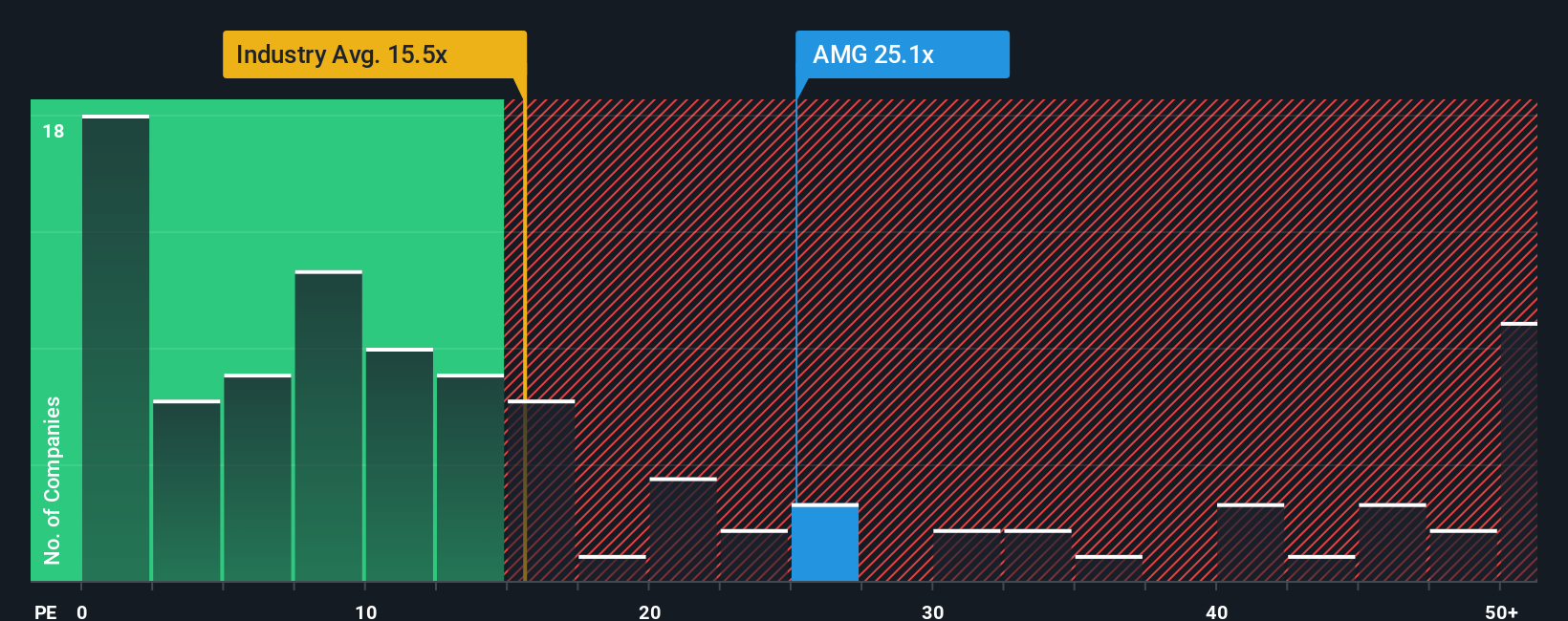

Another View: Signals from the Market Ratios

Looking at valuation through the lens of the price-to-earnings ratio, AMG Critical Materials appears expensive compared to both its industry (25.2x versus 15.3x) and peers (15.1x). Its current ratio is also above the fair ratio of 18.1x, which signals investors might be paying up for recent momentum. This premium may reflect lasting potential or could hint at valuation risk ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AMG Critical Materials Narrative

If you see the story differently or want to dig deeper into the numbers, you can craft your own insights and perspective in just a few minutes. Start with Do it your way

A great starting point for your AMG Critical Materials research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t settle for a single stock pick when so many standout opportunities are available. Use these hand-picked tools to easily spot what others might miss:

- Supercharge your passive income by checking out these 16 dividend stocks with yields > 3%, which boasts yields above 3% for reliable returns on your capital.

- Ride the next wave of digital innovation by tapping into these 24 AI penny stocks, created to highlight companies revolutionizing industries with artificial intelligence.

- Find tomorrow’s winners before the crowd by zeroing in on these 870 undervalued stocks based on cash flows, which looks attractive based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AMG

AMG Critical Materials

Develops, produces, and sells energy storage materials.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives