- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken (ENXTAM:HEIA) Valuation in Focus After Announcing Major EverGreen 2030 Headquarters Restructuring

Reviewed by Kshitija Bhandaru

Heineken (ENXTAM:HEIA) has announced a major restructuring of its Amsterdam headquarters as part of the new EverGreen 2030 strategy. This move will impact approximately 400 jobs and aims to create a nimbler, more innovative organization.

See our latest analysis for Heineken.

The restructuring news has put Heineken in the spotlight at a time when momentum around the stock has been mixed. Shares have rebounded nearly 6% over the past month, reflecting growing optimism after recent strategic moves such as a major share buyback. However, the one-year total shareholder return remains down by almost 9%. In the short run, investors appear to be cautiously welcoming the company’s transformation plans, but long-term returns still lag as the market waits for clear evidence that these changes are driving sustained value.

If Heineken’s new direction has you watching for what else could shake up the market, it may be a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With Heineken trading below many analyst price targets and still showing muted long-term returns, the real question is whether there is undiscovered value here or if the market already reflects all of its future potential.

Most Popular Narrative: 20.3% Undervalued

Heineken's current share price trails its fair value estimate by a significant margin, suggesting investors are skeptical about bold growth projections embedded in the narrative. With the last close at €69.42 versus a fair value of €87.08, the disconnect highlights the contrast between market caution and analyst optimism.

“Continued portfolio premiumization, including robust performance of global brands like Heineken, Amstel, and innovative extensions such as Heineken Silver and 0.0, enables higher average selling prices and improved profitability, pointing to sustainable margin and earnings growth.”

Want to know what mix of premium brands and changing consumer habits justifies this ambitious outlook? The valuation is driven by expectations of stronger profits and improved margins, but the secret sauce behind those projections might surprise you. See which future earnings milestones underlie this target. Discover the numbers shaping Heineken’s next chapter.

Result: Fair Value of €87.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency volatility and stagnant sales in mature European markets could stall Heineken’s projected growth and challenge the bullish long-term narrative.

Find out about the key risks to this Heineken narrative.

Another View: Multiples Add Caution

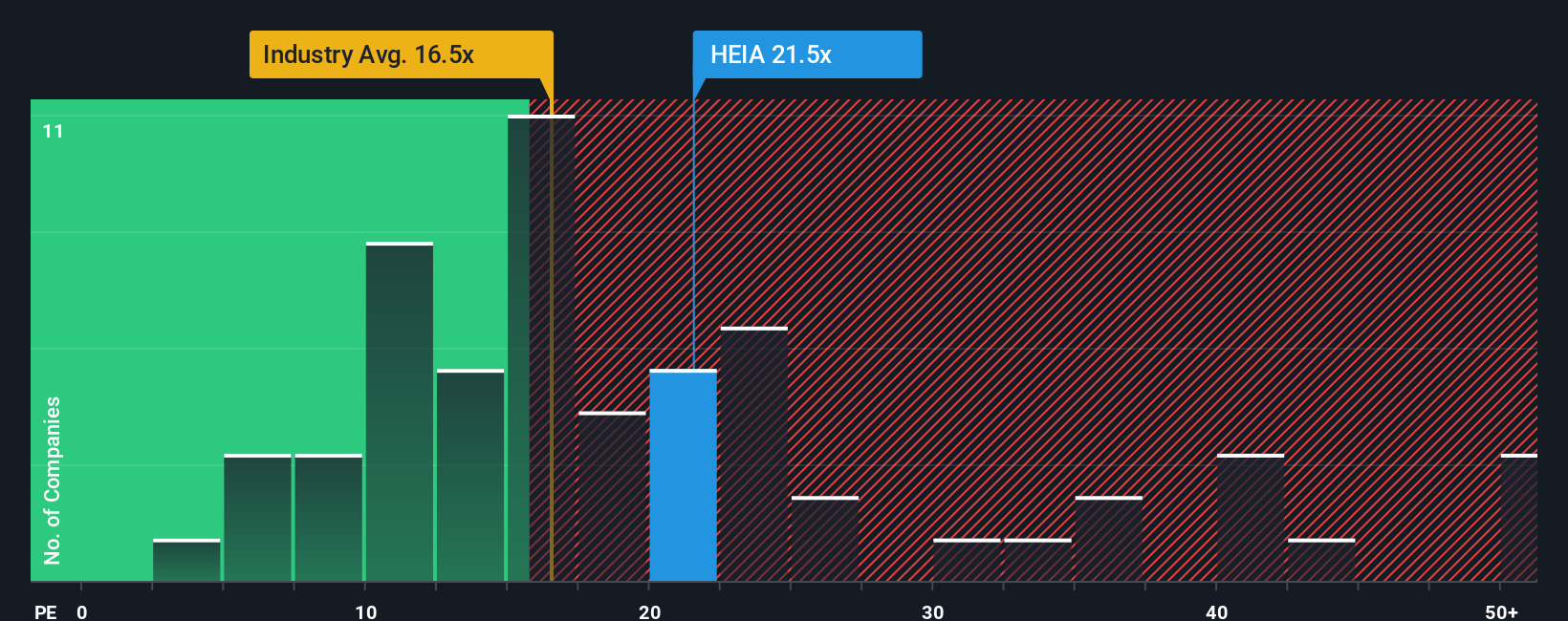

While the fair value estimate suggests Heineken is undervalued, a quick glance at its price-to-earnings ratio tells a different story. Heineken trades at 21.2 times earnings, higher than both its European peers (16.2x) and the sector’s fair ratio of 21x. This gap signals that the market is already pricing in plenty of optimism, and any disappointment could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heineken Narrative

If you see the story differently or want to back your own research with fresh data, building your own narrative takes just a few minutes. Do it your way

A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar on for new opportunities. Gain your edge with unique screens below and secure your place among tomorrow’s standout winners.

- Spot high-yield opportunities and boost your portfolio’s income potential with these 20 dividend stocks with yields > 3% for reliable picks offering dividends above 3%.

- Catch the AI-driven transformation early by seizing your chance at growth among these 24 AI penny stocks revolutionizing entire industries with artificial intelligence.

- Expand into the next wave of technological disruption by tracking advances through these 26 quantum computing stocks at the forefront of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record average dividend payer.

Market Insights

Community Narratives