Stock Analysis

- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Adyen (AMS:ADYEN) shareholders have earned a 12% CAGR over the last five years

Adyen N.V. (AMS:ADYEN) shareholders might be concerned after seeing the share price drop 25% in the last month. On the bright side the share price is up over the last half decade. Unfortunately its return of 76% is below the market return of 97%. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 40% in the last three years.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Adyen

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

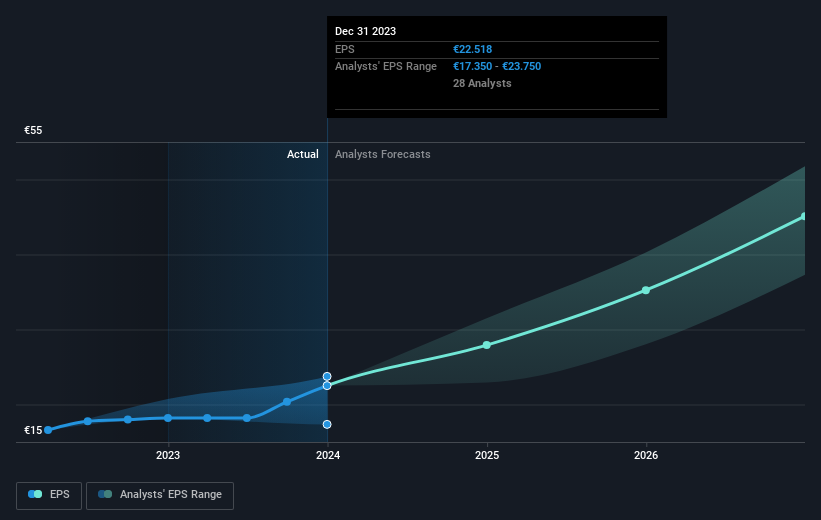

Over half a decade, Adyen managed to grow its earnings per share at 38% a year. This EPS growth is higher than the 12% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. Of course, with a P/E ratio of 51.32, the market remains optimistic.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Adyen's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Adyen had a tough year, with a total loss of 19%, against a market gain of about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 12% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Adyen better, we need to consider many other factors. For instance, we've identified 1 warning sign for Adyen that you should be aware of.

But note: Adyen may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Adyen is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, Latin America.

Flawless balance sheet with solid track record.