- Netherlands

- /

- Professional Services

- /

- ENXTAM:WKL

Did Wolters Kluwer's AI-Powered SaaS Launch Just Shift Its (ENXTAM:WKL) Investment Narrative?

Reviewed by Sasha Jovanovic

- In October 2025, Wolters Kluwer Health announced the launch of UpToDate Expert AI and UpToDate Pro Plus at HLTH 2025, spotlighting responsible AI-driven clinical decision support, while Wolters Kluwer also introduced Enablon Process Hazard Analysis, a cloud-native SaaS application for operational risk management in industries such as oil & gas and manufacturing.

- These recent product innovations highlight Wolters Kluwer’s ongoing commitment to AI and cloud solutions, reflecting the company’s focus on enhancing value through advanced, workflow-driven technology in both healthcare and industrial risk management.

- Next, we'll assess how Wolters Kluwer's expansion of AI-powered SaaS offerings may impact its long-term earnings outlook and market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Wolters Kluwer Investment Narrative Recap

To be a shareholder in Wolters Kluwer, you need to believe in the continued growth of recurring revenues driven by the adoption of AI-powered SaaS solutions and the ongoing shift away from legacy print and on-premise offerings. The latest launches reinforce Wolters Kluwer’s position in AI and cloud, but they are unlikely to shift short-term catalysts or outweigh the biggest risk: continued drag from declining print and slow customer migration to digital platforms.

The recent introduction of the Enablon Process Hazard Analysis application is especially relevant, as it extends Wolters Kluwer’s SaaS footprint into industrial risk and compliance. This move directly addresses a key catalyst, expansion of recurring, workflow-based revenues, while also highlighting the importance of successful customer adoption for near-term growth.

Yet, despite the promise of these innovations, investors should not overlook the persistent risks posed by legacy revenue streams and the uncertain pace of SaaS migration...

Read the full narrative on Wolters Kluwer (it's free!)

Wolters Kluwer is projected to reach €7.1 billion in revenue and €1.4 billion in earnings by 2028, reflecting an annual revenue growth rate of 5.2% and an earnings increase of about €0.3 billion from the current €1.1 billion.

Uncover how Wolters Kluwer's forecasts yield a €147.50 fair value, a 31% upside to its current price.

Exploring Other Perspectives

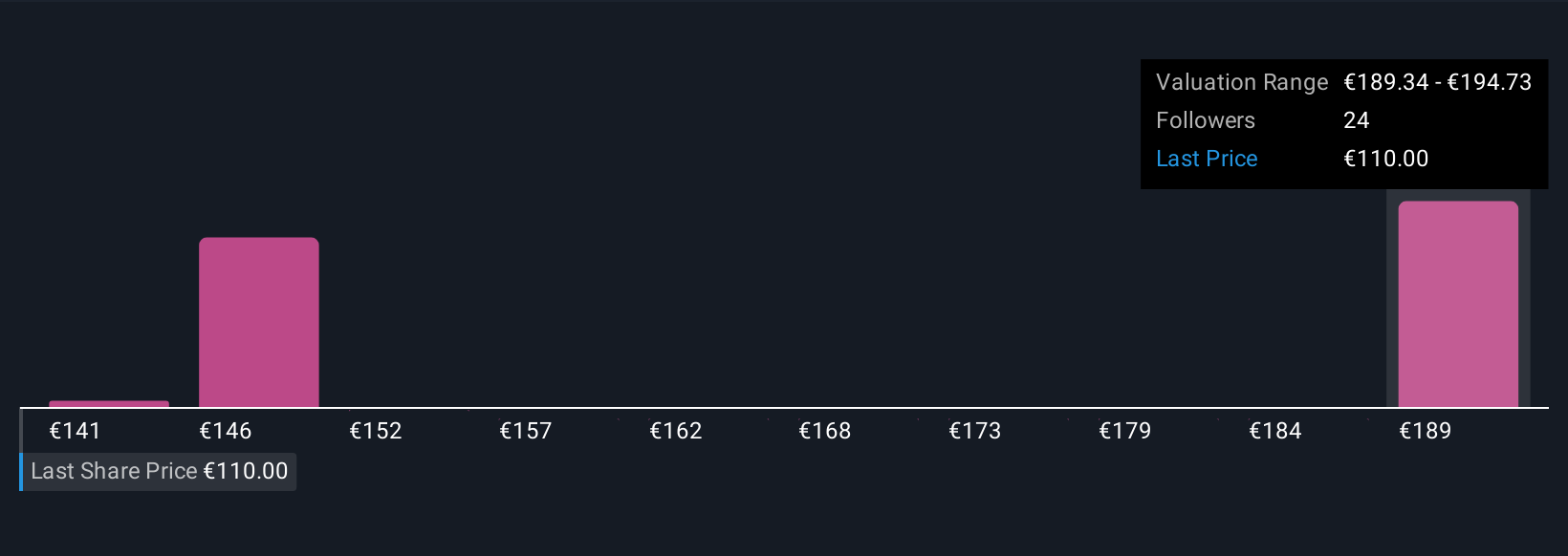

Five community members on Simply Wall St put their fair value estimates for Wolters Kluwer between €140.82 and €197.20. While recurring SaaS revenues are growing, the continued decline in print may still weigh on overall results, so it’s worth seeing how these different viewpoints compare.

Explore 5 other fair value estimates on Wolters Kluwer - why the stock might be worth just €140.82!

Build Your Own Wolters Kluwer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wolters Kluwer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wolters Kluwer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wolters Kluwer's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolters Kluwer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:WKL

Wolters Kluwer

Provides professional information, software solutions, and services in the Netherlands, rest of Europe, the United States, Canada, the Asia Pacific, Africa, and internationally.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives