- Netherlands

- /

- Electrical

- /

- ENXTAM:SIFG

Here's Why Shareholders Should Examine Sif Holding N.V.'s (AMS:SIFG) CEO Compensation Package More Closely

Key Insights

- Sif Holding's Annual General Meeting to take place on 9th of May

- CEO Fred van Beers' total compensation includes salary of €445.5k

- Total compensation is similar to the industry average

- Sif Holding's three-year loss to shareholders was 8.4% while its EPS was down 29% over the past three years

Sif Holding N.V. (AMS:SIFG) has not performed well recently and CEO Fred van Beers will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 9th of May. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Sif Holding

How Does Total Compensation For Fred van Beers Compare With Other Companies In The Industry?

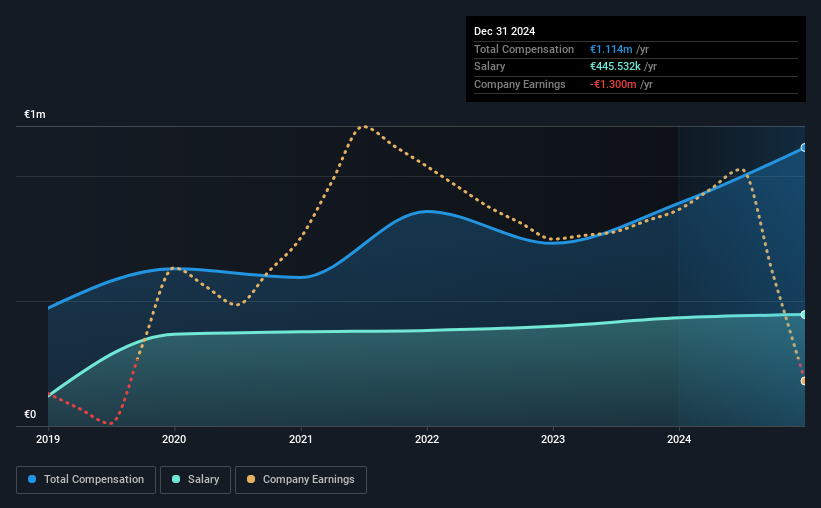

According to our data, Sif Holding N.V. has a market capitalization of €278m, and paid its CEO total annual compensation worth €1.1m over the year to December 2024. Notably, that's an increase of 25% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at €446k.

In comparison with other companies in the the Netherlands Electrical industry with market capitalizations ranging from €177m to €709m, the reported median CEO total compensation was €917k. From this we gather that Fred van Beers is paid around the median for CEOs in the industry. Furthermore, Fred van Beers directly owns €469k worth of shares in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €446k | €433k | 40% |

| Other | €668k | €458k | 60% |

| Total Compensation | €1.1m | €891k | 100% |

Talking in terms of the broader industry, salary and other compensation roughly make up 50% each, of the total compensation. In Sif Holding's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Sif Holding N.V.'s Growth Numbers

Sif Holding N.V. has reduced its earnings per share by 29% a year over the last three years. It saw its revenue drop 5.6% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Sif Holding N.V. Been A Good Investment?

Given the total shareholder loss of 8.4% over three years, many shareholders in Sif Holding N.V. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Sif Holding that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:SIFG

Sif Holding

Manufactures and sells foundation piles for offshore wind farms and metal structures in the Netherlands, the United Kingdom, the United States, Norway, South Korea, Spain, France, Poland, Belgium, Germany, rest of the European Union, and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives