- Netherlands

- /

- Construction

- /

- ENXTAM:HEIJM

Discover 3 Top Dividend Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

As global markets experience mixed returns and economic indicators paint a varied picture, the Netherlands market remains a focal point for investors seeking stability and growth. In this environment, dividend stocks on Euronext Amsterdam offer an attractive option for those looking to benefit from steady income streams. When evaluating dividend stocks, it's crucial to consider their historical performance, payout ratios, and the overall health of the companies—factors that are particularly relevant given the current economic landscape.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.42% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.89% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.99% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.27% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.29% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.75% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acomo N.V., with a market cap of €504.69 million, engages in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry across the Netherlands, Europe, North America, and internationally.

Operations: Acomo N.V. generates revenue from various segments including Tea (€124.04 million), Edible Seeds (€246.52 million), Food Solutions (€23.47 million), Spices and Nuts (€445.76 million), and Organic Ingredients (€429.28 million).

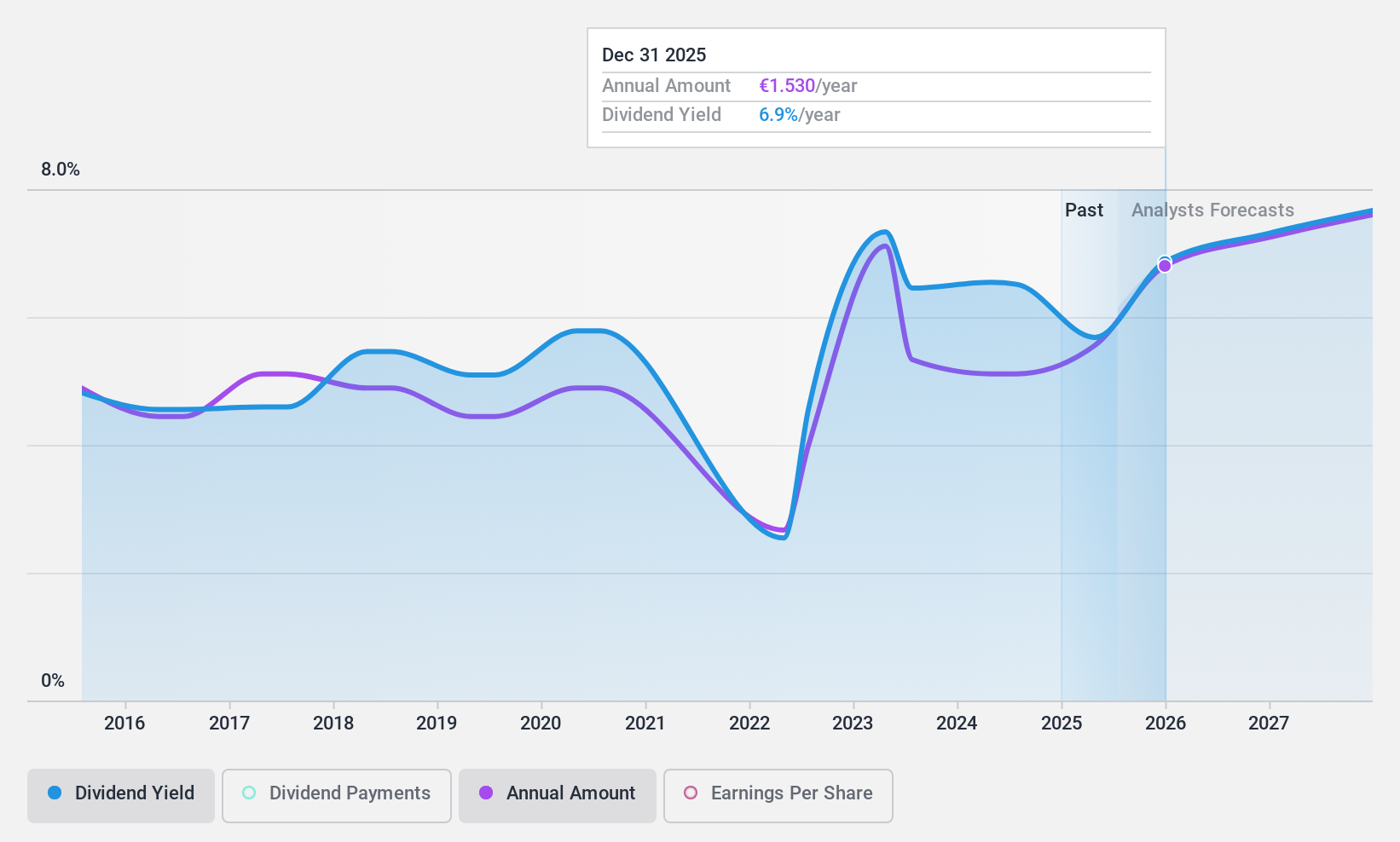

Dividend Yield: 6.7%

Acomo's dividend yield is attractive, ranking in the top 25% of Dutch dividend payers, but its sustainability is questionable with a high payout ratio of 95.7%. Recent earnings showed a slight increase in sales to €668.2 million, though net income and EPS declined. Despite reasonable cash flow coverage (51%), the dividends have been volatile and unreliable over the past decade. Additionally, Acomo has a significant debt level which could impact future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Acomo.

- Our expertly prepared valuation report Acomo implies its share price may be too high.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €697.47 million.

Operations: Koninklijke Heijmans N.V. generates revenue of €871.03 million from its Connecting segment and €1.83 billion from Segment Adjustments.

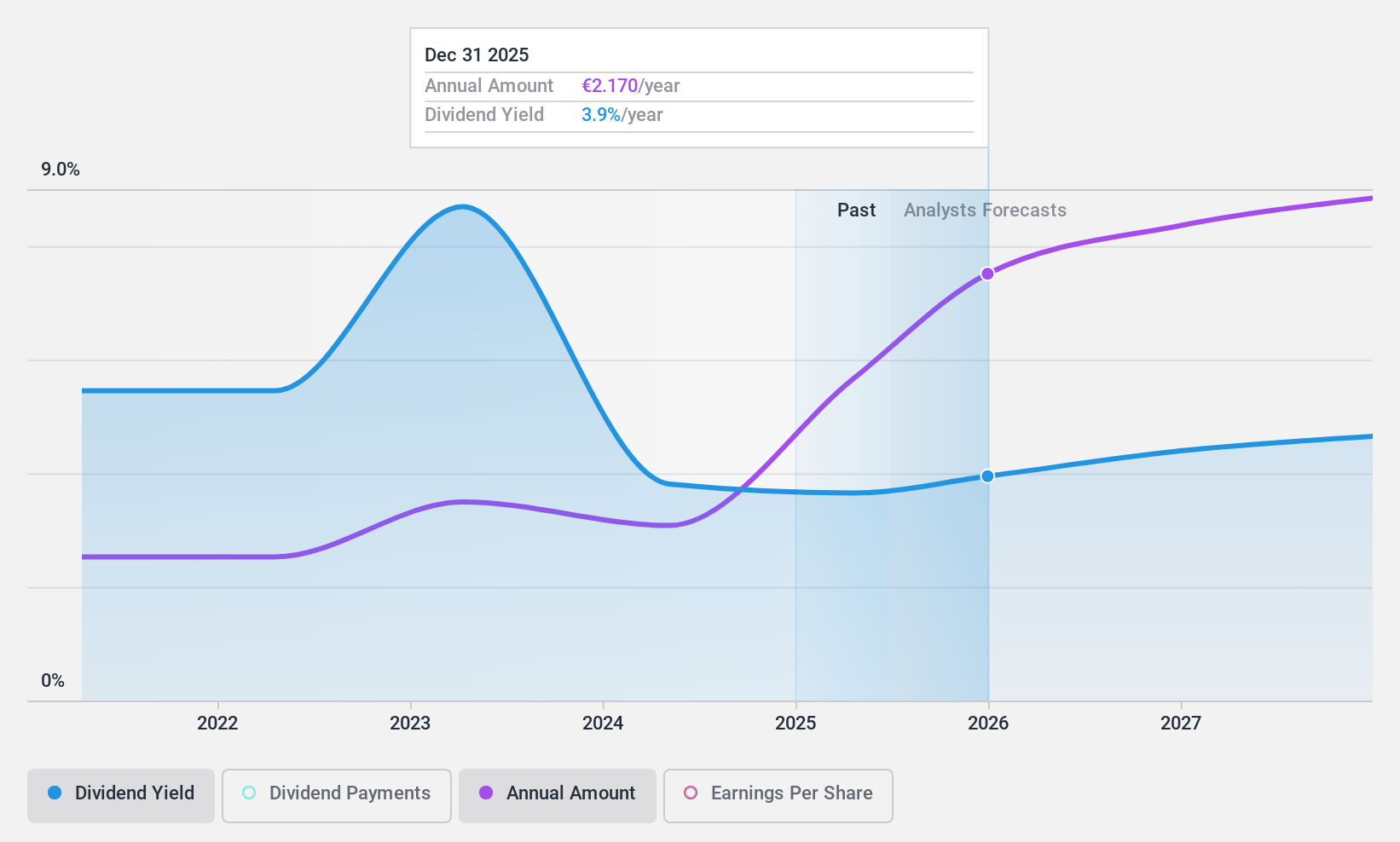

Dividend Yield: 3.4%

Koninklijke Heijmans has shown strong earnings growth, with net income doubling to €37 million for H1 2024. Despite a volatile dividend history, the company’s current payout ratios are sustainable, with dividends well covered by both earnings (30%) and cash flows (20.7%). However, its dividend yield of 3.42% is below the top tier in the Dutch market. The stock trades at a discount to its estimated fair value but has experienced high share price volatility recently.

- Delve into the full analysis dividend report here for a deeper understanding of Koninklijke Heijmans.

- Insights from our recent valuation report point to the potential undervaluation of Koninklijke Heijmans shares in the market.

Randstad (ENXTAM:RAND)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. offers work and human resources (HR) services, with a market capitalization of approximately €7.59 billion.

Operations: Randstad N.V. generates revenue through various solutions in the field of work and HR services, contributing to its overall market presence.

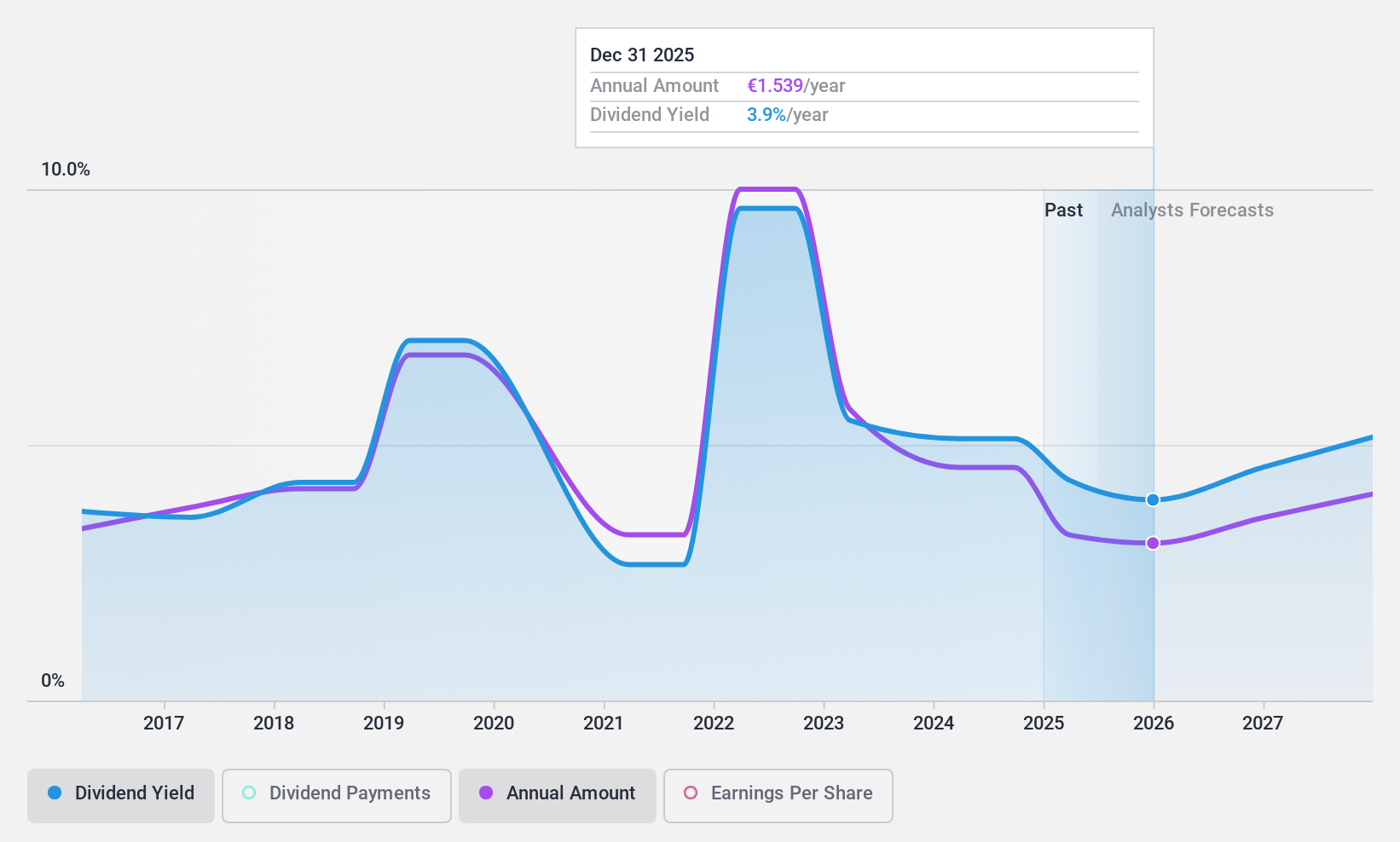

Dividend Yield: 5.3%

Randstad N.V. has demonstrated a mixed performance for dividend investors. The company’s recent buyback program, completed on July 22, 2024, repurchased 7.98 million shares for €399.95 million, potentially enhancing shareholder value. However, Q2 earnings showed a decline with net income at €78 million compared to €137 million last year. Despite this, dividends are covered by both earnings (81.3% payout ratio) and cash flows (51.5% cash payout ratio), though the dividend history has been volatile over the past decade.

- Dive into the specifics of Randstad here with our thorough dividend report.

- Our expertly prepared valuation report Randstad implies its share price may be lower than expected.

Next Steps

- Discover the full array of 6 Top Euronext Amsterdam Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Heijmans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIJM

Koninklijke Heijmans

Engages in the property development, construction, and infrastructure businesses in the Netherlands and internationally.

Flawless balance sheet with solid track record and pays a dividend.