- Netherlands

- /

- Construction

- /

- ENXTAM:BAMNB

Assessing BAM (ENXTAM:BAMNB) Valuation After Euronext 150 Index Inclusion Spurs Fresh Investor Attention

Reviewed by Simply Wall St

Koninklijke BAM Groep (ENXTAM:BAMNB) was just added to the Euronext 150 Index, a move that tends to draw fresh interest from investors and index-tracking funds. Such inclusion often leads to higher trading activity and visibility.

See our latest analysis for Koninklijke BAM Groep.

After joining the Euronext 150, BAM's momentum has cooled a bit with a 30-day share price return of -9.97 percent. Its year-to-date share price is still up nearly 70 percent. What stands out most is the company's strong long-term performance, highlighted by an impressive 88.4 percent total shareholder return over the last year and a staggering 528 percent over five years. This demonstrates real staying power amid recent swings.

If this kind of sustained growth has you wondering what other stocks are making waves, it’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares still below analyst price targets but sharply higher this year, the key question is whether BAM remains undervalued or if the market is already factoring in all of its future potential. Is there still a buying opportunity?

Most Popular Narrative: 14.6% Undervalued

The consensus narrative sets Koninklijke BAM Groep’s fair value at €8.83 per share, noticeably above the last close of €7.54. This gap has investors questioning what supports such upward potential in the face of market volatility.

The current valuation may embed overly optimistic expectations for continued robust infrastructure investment across BAM's core European markets. Any delays, political uncertainties, or cuts to government infrastructure or energy transition budgets could materially reduce order intake and future revenue growth. There is a risk that persistent increases in regulatory and ESG-related compliance costs, combined with stricter sustainability targets for construction, could outpace BAM's ability to improve efficiency or pass on costs. This could pressure long-term net margins and dilute the EBITDA margin improvements currently seen.

Want to see what financial forecasts justify the gap? This narrative’s price target leans on an ambitious mix of profit margin expansion and bold revenue growth angles. Uncover the specific assumptions and future PE projections the analysts are banking on—are they realistic or too good to be true?

Result: Fair Value of €8.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust infrastructure demand and successful delivery of sustainable projects could quickly challenge the idea that BAM is at risk of slowing growth.

Find out about the key risks to this Koninklijke BAM Groep narrative.

Another View: What Do Market Multiples Say?

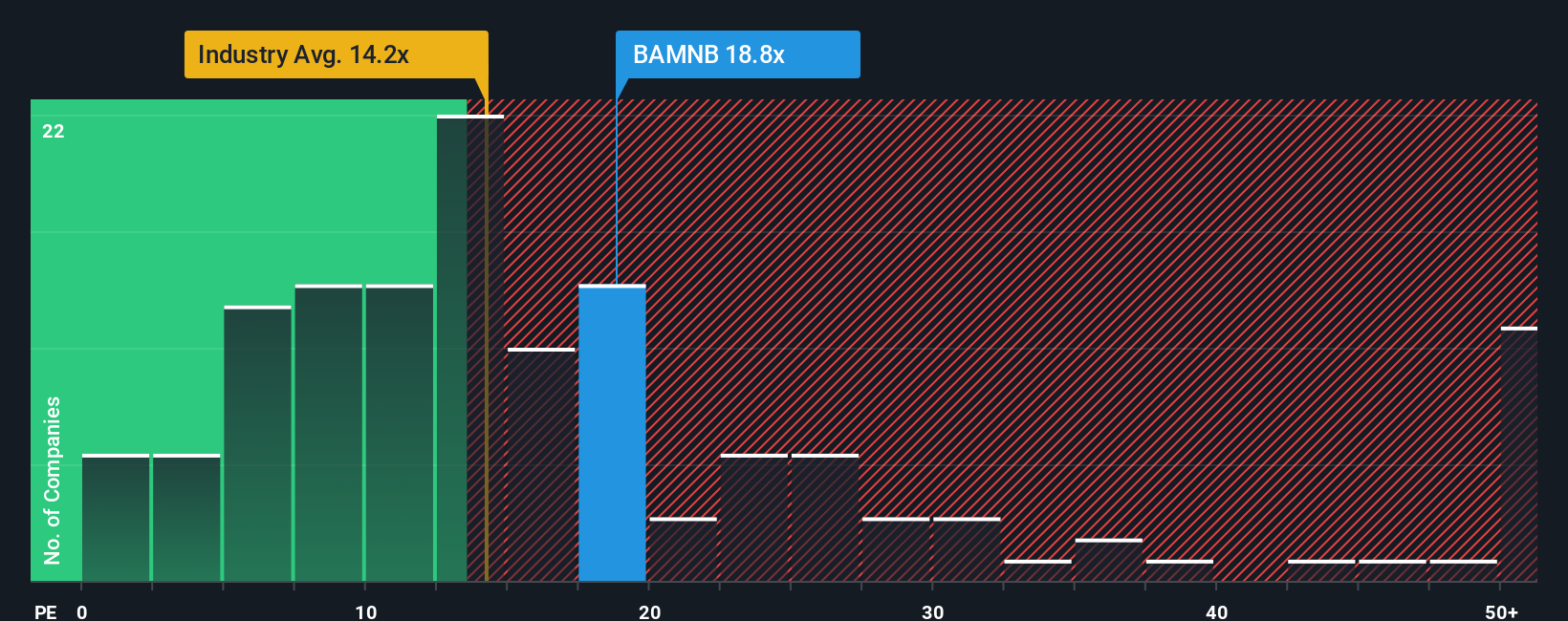

Looking at how BAM is valued compared to competitors, the current price-to-earnings ratio stands at 18.2x. This is notably higher than both the European Construction sector average of 13.7x and the peer group average of 16.1x. The market’s fair ratio, at 16.4x, also trails BAM’s current level. This premium suggests investors may be pricing in substantial future growth. At these levels, however, any slip in performance could hit the share price hard. Is the confidence justified, or does this reveal extra risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Koninklijke BAM Groep Narrative

If the prevailing narratives do not align with your perspective, dive into the numbers and shape your own view in just a few minutes. Do it your way

A great starting point for your Koninklijke BAM Groep research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make sure you seize every opportunity the market offers by checking out unique lists of stocks tailored to different strategies. The best investment might be waiting just beyond your current watchlist. Expand your scope now before the next big move escapes you.

- Boost your portfolio with steady cash flow and see which companies top the charts for reliable returns in these 15 dividend stocks with yields > 3%.

- Catch the momentum behind AI innovation by reviewing these 26 AI penny stocks pushing the boundaries of automation and smart technologies.

- Uncover names trading below their actual worth and get ahead with these 872 undervalued stocks based on cash flows poised for a potential rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke BAM Groep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BAMNB

Koninklijke BAM Groep

Provides products and services in the construction and property, civil engineering, and public private partnerships (PPP) sectors worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives