- Malaysia

- /

- Transportation

- /

- KLSE:EPICON

These 4 Measures Indicate That Epicon Berhad (KLSE:EPICON) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Epicon Berhad (KLSE:EPICON) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Epicon Berhad

What Is Epicon Berhad's Debt?

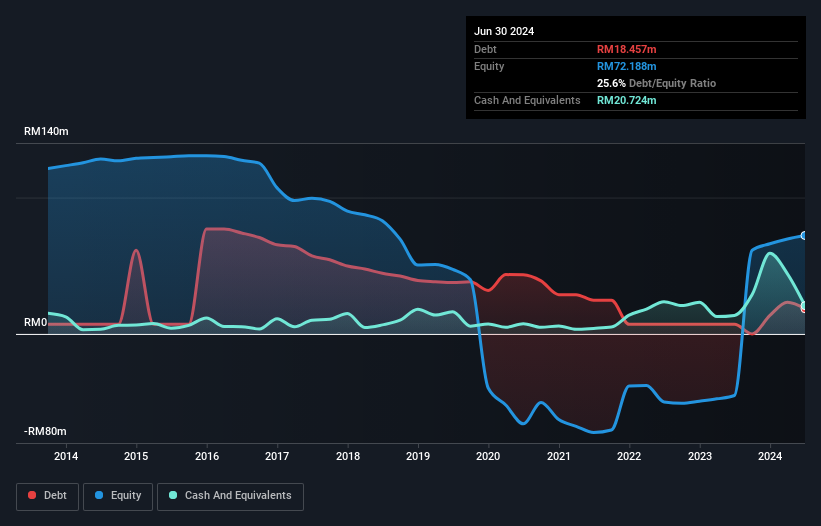

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Epicon Berhad had RM18.5m of debt, an increase on RM7.00m, over one year. But it also has RM20.7m in cash to offset that, meaning it has RM2.27m net cash.

How Strong Is Epicon Berhad's Balance Sheet?

The latest balance sheet data shows that Epicon Berhad had liabilities of RM84.5m due within a year, and liabilities of RM2.83m falling due after that. Offsetting these obligations, it had cash of RM20.7m as well as receivables valued at RM125.0m due within 12 months. So it can boast RM58.4m more liquid assets than total liabilities.

This luscious liquidity implies that Epicon Berhad's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that Epicon Berhad has more cash than debt is arguably a good indication that it can manage its debt safely.

But the bad news is that Epicon Berhad has seen its EBIT plunge 14% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But it is Epicon Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Epicon Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Epicon Berhad saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Epicon Berhad has net cash of RM2.27m, as well as more liquid assets than liabilities. So we don't have any problem with Epicon Berhad's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Epicon Berhad that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Epicon Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EPICON

Epicon Berhad

An investment holding company, engages in the operation of public transportation services in Malaysia.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives