Stock Analysis

More Unpleasant Surprises Could Be In Store For Imaspro Corporation Berhad's (KLSE:IMASPRO) Shares After Tumbling 28%

Imaspro Corporation Berhad (KLSE:IMASPRO) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

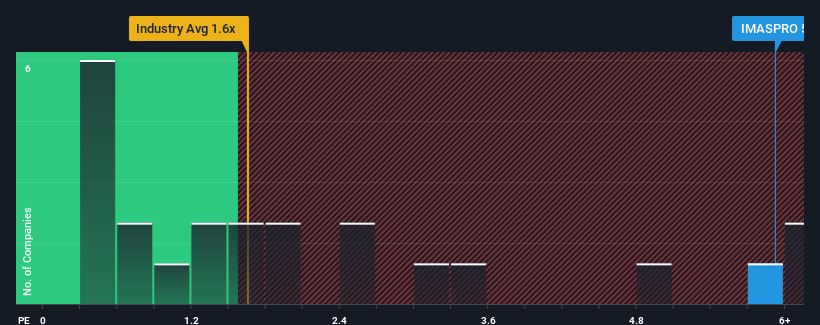

Even after such a large drop in price, you could still be forgiven for thinking Imaspro Corporation Berhad is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.9x, considering almost half the companies in Malaysia's Chemicals industry have P/S ratios below 1.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Imaspro Corporation Berhad

How Has Imaspro Corporation Berhad Performed Recently?

As an illustration, revenue has deteriorated at Imaspro Corporation Berhad over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Imaspro Corporation Berhad will help you shine a light on its historical performance.How Is Imaspro Corporation Berhad's Revenue Growth Trending?

Imaspro Corporation Berhad's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 32%. This means it has also seen a slide in revenue over the longer-term as revenue is down 14% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 0.6% shows it's an unpleasant look.

In light of this, it's alarming that Imaspro Corporation Berhad's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

A significant share price dive has done very little to deflate Imaspro Corporation Berhad's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Imaspro Corporation Berhad currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You always need to take note of risks, for example - Imaspro Corporation Berhad has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Imaspro Corporation Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:IMASPRO

Imaspro Corporation Berhad

Imaspro Corporation Berhad, an investment holding company, engages in the manufacture and distribution of agrochemicals, public health, and environmental science products in Malaysia, Indonesia, Russia, the Philippines, Australia, Cambodia, China, Lebanon, Singapore, Taiwan, New Zealand, and Vietnam.

Flawless balance sheet with solid track record and pays a dividend.