- Malaysia

- /

- Energy Services

- /

- KLSE:WASCO

A Look At Wah Seong Corporation Berhad's (KLSE:WASEONG) Share Price Returns

It is doubtless a positive to see that the Wah Seong Corporation Berhad (KLSE:WASEONG) share price has gained some 63% in the last three months. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 50%. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

See our latest analysis for Wah Seong Corporation Berhad

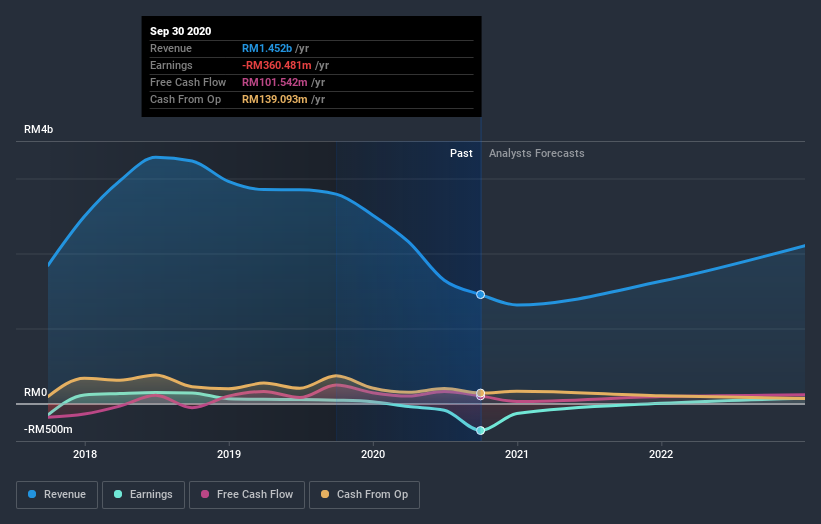

Given that Wah Seong Corporation Berhad didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Wah Seong Corporation Berhad saw its revenue shrink by 11% per year. That is not a good result. The share price decline of 15% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Wah Seong Corporation Berhad stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 8.2% in the last year, Wah Seong Corporation Berhad shareholders lost 45% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Wah Seong Corporation Berhad has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Wah Seong Corporation Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wasco Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:WASCO

Flawless balance sheet and undervalued.

Market Insights

Community Narratives