- Malaysia

- /

- Consumer Durables

- /

- KLSE:NIHSIN

Is Ni Hsin Group Berhad (KLSE:NIHSIN) Weighed On By Its Debt Load?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Ni Hsin Group Berhad (KLSE:NIHSIN) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Ni Hsin Group Berhad

How Much Debt Does Ni Hsin Group Berhad Carry?

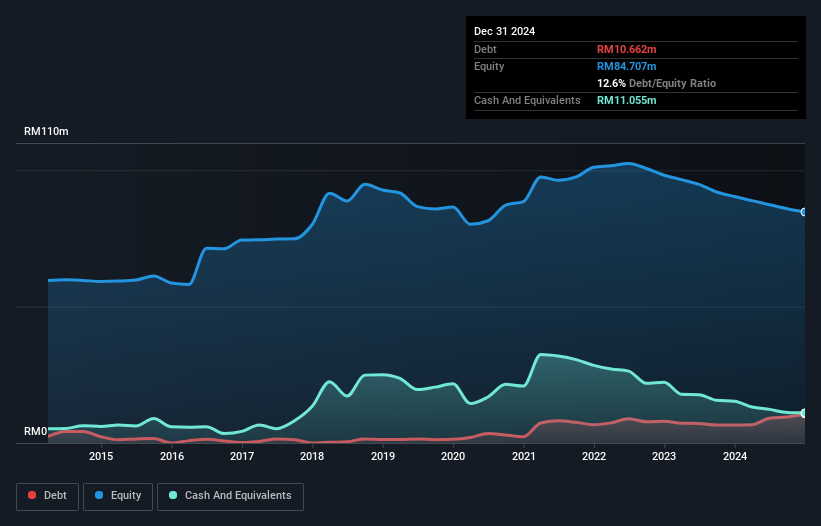

As you can see below, at the end of December 2024, Ni Hsin Group Berhad had RM10.7m of debt, up from RM6.63m a year ago. Click the image for more detail. However, its balance sheet shows it holds RM11.1m in cash, so it actually has RM393.0k net cash.

A Look At Ni Hsin Group Berhad's Liabilities

According to the last reported balance sheet, Ni Hsin Group Berhad had liabilities of RM9.62m due within 12 months, and liabilities of RM15.7m due beyond 12 months. Offsetting this, it had RM11.1m in cash and RM6.22m in receivables that were due within 12 months. So its liabilities total RM8.08m more than the combination of its cash and short-term receivables.

Since publicly traded Ni Hsin Group Berhad shares are worth a total of RM49.7m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Ni Hsin Group Berhad boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is Ni Hsin Group Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Ni Hsin Group Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 21%, to RM35m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Ni Hsin Group Berhad?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Ni Hsin Group Berhad had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of RM8.9m and booked a RM5.7m accounting loss. However, it has net cash of RM393.0k, so it has a bit of time before it will need more capital. Ni Hsin Group Berhad's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Ni Hsin Group Berhad (of which 1 shouldn't be ignored!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Ni Hsin Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NIHSIN

Ni Hsin Group Berhad

An investment holding company, designs, manufactures, and sells stainless steel kitchenware and cookware products in Malaysia, Japan, the United States, Europe, Canada, and the Asia Pacific.

Adequate balance sheet with low risk.

Market Insights

Community Narratives