Stock Analysis

- Malaysia

- /

- Commercial Services

- /

- KLSE:NGGB

Nextgreen Global Berhad's (KLSE:NGGB) 19% CAGR outpaced the company's earnings growth over the same five-year period

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Nextgreen Global Berhad (KLSE:NGGB) which saw its share price drive 139% higher over five years. In more good news, the share price has risen 13% in thirty days.

Since the stock has added RM105m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Nextgreen Global Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

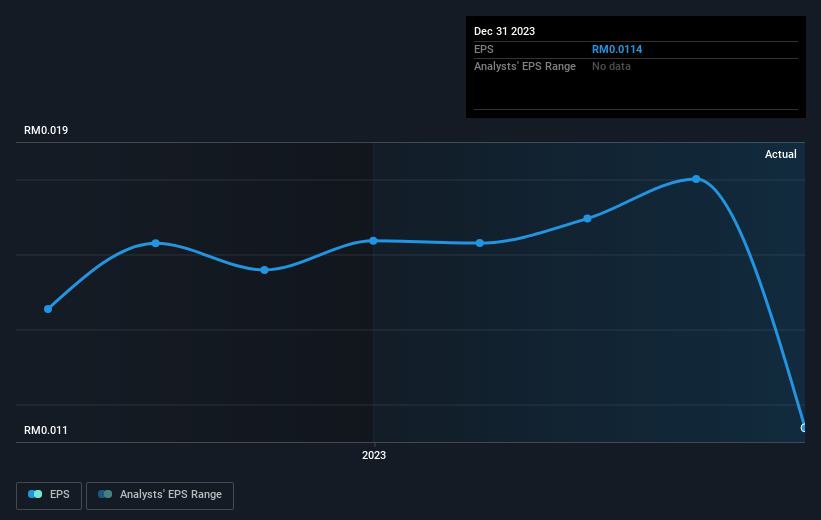

Over half a decade, Nextgreen Global Berhad managed to grow its earnings per share at 26% a year. The EPS growth is more impressive than the yearly share price gain of 19% over the same period. So one could conclude that the broader market has become more cautious towards the stock. Of course, with a P/E ratio of 108.30, the market remains optimistic.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Nextgreen Global Berhad shareholders gained a total return of 11% during the year. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 19% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Nextgreen Global Berhad .

We will like Nextgreen Global Berhad better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Nextgreen Global Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NGGB

Nextgreen Global Berhad

Nextgreen Global Berhad, an investment holding company, engages in printing and publishing business in Malaysia, Nigeria, France, Ghana, and Pakistan.

Adequate balance sheet with questionable track record.