- Malaysia

- /

- Construction

- /

- KLSE:VINVEST

Here's Why Vivocom Intl Holdings Berhad (KLSE:VIVOCOM) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Vivocom Intl Holdings Berhad (KLSE:VIVOCOM) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Vivocom Intl Holdings Berhad

What Is Vivocom Intl Holdings Berhad's Net Debt?

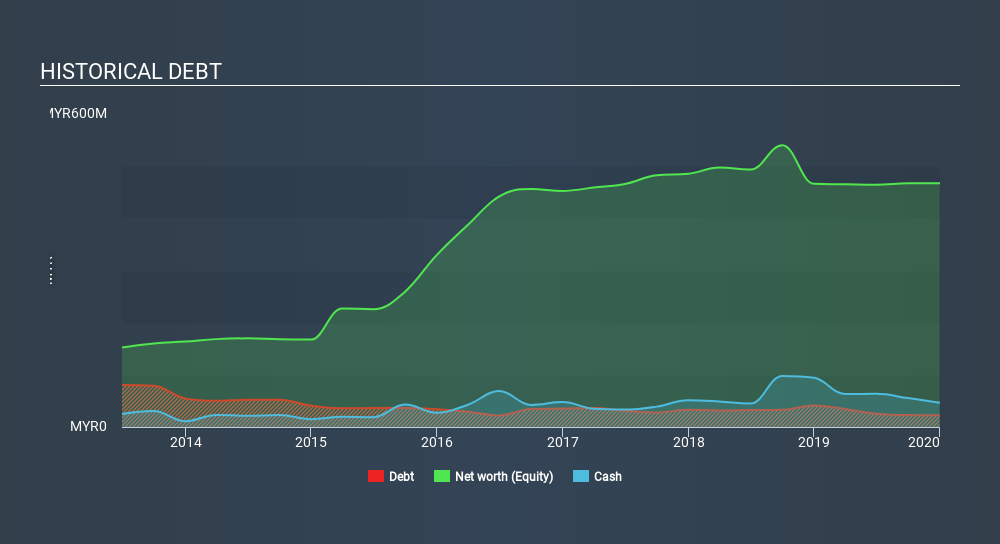

As you can see below, Vivocom Intl Holdings Berhad had RM22.7m of debt at December 2019, down from RM41.1m a year prior. But it also has RM46.6m in cash to offset that, meaning it has RM23.9m net cash.

How Strong Is Vivocom Intl Holdings Berhad's Balance Sheet?

We can see from the most recent balance sheet that Vivocom Intl Holdings Berhad had liabilities of RM40.8m falling due within a year, and liabilities of RM18.3m due beyond that. Offsetting this, it had RM46.6m in cash and RM283.5m in receivables that were due within 12 months. So it actually has RM271.0m more liquid assets than total liabilities.

This excess liquidity is a great indication that Vivocom Intl Holdings Berhad's balance sheet is just as strong as racists are weak. On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Succinctly put, Vivocom Intl Holdings Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

Notably, Vivocom Intl Holdings Berhad made a loss at the EBIT level, last year, but improved that to positive EBIT of RM3.8m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Vivocom Intl Holdings Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Vivocom Intl Holdings Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, Vivocom Intl Holdings Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case Vivocom Intl Holdings Berhad has RM23.9m in net cash and a strong balance sheet. So we are not troubled with Vivocom Intl Holdings Berhad's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Vivocom Intl Holdings Berhad (1 is significant) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:VINVEST

Vinvest Capital Holdings Berhad

An investment holding company, provides construction, property development, aluminium design and fabrication, and telecommunication engineering services in Malaysia.

Adequate balance sheet slight.