Stock Analysis

- Malaysia

- /

- Electrical

- /

- KLSE:SUCCESS

Investors Holding Back On Success Transformer Corporation Berhad (KLSE:SUCCESS)

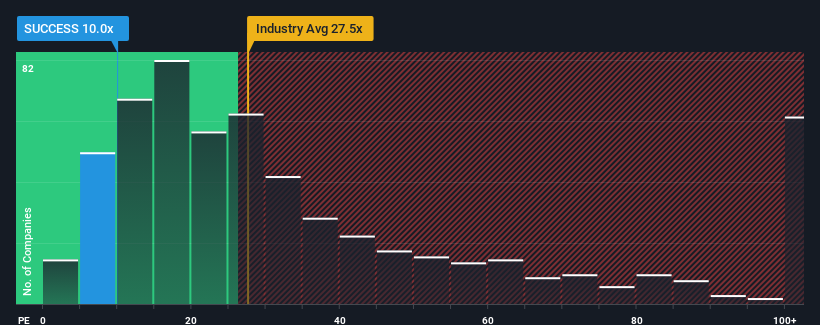

When close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 17x, you may consider Success Transformer Corporation Berhad (KLSE:SUCCESS) as an attractive investment with its 10x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Earnings have risen at a steady rate over the last year for Success Transformer Corporation Berhad, which is generally not a bad outcome. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

View our latest analysis for Success Transformer Corporation Berhad

Is There Any Growth For Success Transformer Corporation Berhad?

There's an inherent assumption that a company should underperform the market for P/E ratios like Success Transformer Corporation Berhad's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 3.2%. This was backed up an excellent period prior to see EPS up by 108% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 17% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Success Transformer Corporation Berhad is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Success Transformer Corporation Berhad's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Success Transformer Corporation Berhad currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

You always need to take note of risks, for example - Success Transformer Corporation Berhad has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Success Transformer Corporation Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Success Transformer Corporation Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SUCCESS

Success Transformer Corporation Berhad

Success Transformer Corporation Berhad, an investment holding company, engages in the design, manufacture, marketing, and distribution of electrical apparatus and industrial lighting products in Malaysia, the People’s Republic of China, and internationally.

Flawless balance sheet with acceptable track record.