SFP Tech Holdings Berhad's (KLSE:SFPTECH) Stock Retreats 27% But Earnings Haven't Escaped The Attention Of Investors

SFP Tech Holdings Berhad (KLSE:SFPTECH) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

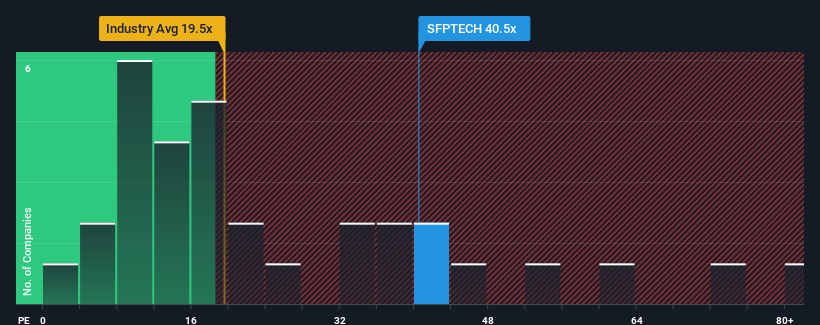

Even after such a large drop in price, SFP Tech Holdings Berhad's price-to-earnings (or "P/E") ratio of 40.5x might still make it look like a strong sell right now compared to the market in Malaysia, where around half of the companies have P/E ratios below 15x and even P/E's below 10x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, SFP Tech Holdings Berhad has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for SFP Tech Holdings Berhad

Is There Enough Growth For SFP Tech Holdings Berhad?

There's an inherent assumption that a company should far outperform the market for P/E ratios like SFP Tech Holdings Berhad's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 6.5% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 99% overall drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 28% per year during the coming three years according to the dual analysts following the company. With the market only predicted to deliver 12% per year, the company is positioned for a stronger earnings result.

With this information, we can see why SFP Tech Holdings Berhad is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, SFP Tech Holdings Berhad's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that SFP Tech Holdings Berhad maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for SFP Tech Holdings Berhad you should know about.

Of course, you might also be able to find a better stock than SFP Tech Holdings Berhad. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SFPTECH

SFP Tech Holdings Berhad

An investment holding company, designs, develops, and manufactures factory and automated equipment solutions in Malaysia, the United States, South Korea, Singapore, Hong Kong, the People’s Republic of China, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives