Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that MGB Berhad (KLSE:MGB) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for MGB Berhad

How Much Debt Does MGB Berhad Carry?

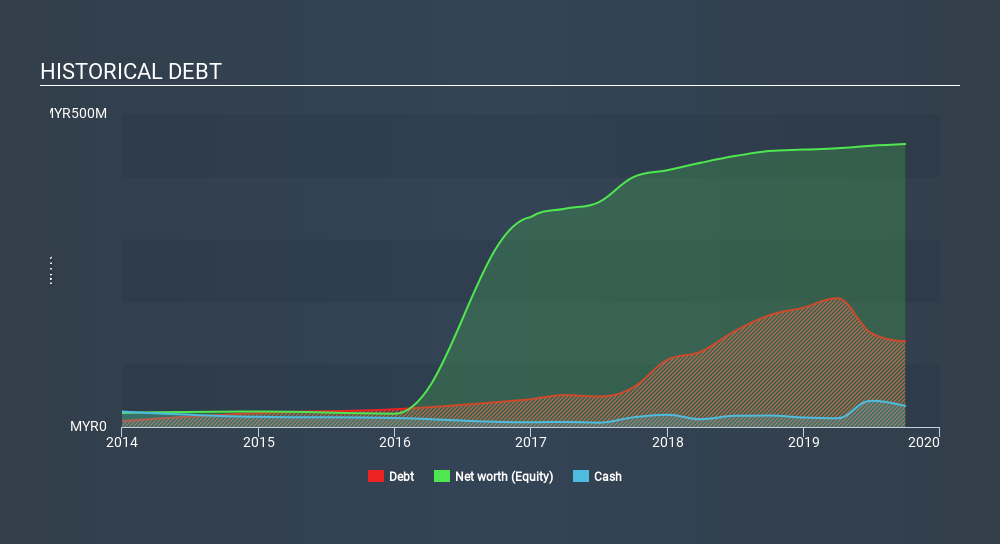

As you can see below, at the end of September 2019, MGB Berhad had RM136.9m of debt, up from RM178 a year ago. Click the image for more detail. However, it does have RM33.8m in cash offsetting this, leading to net debt of about RM103.1m.

A Look At MGB Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that MGB Berhad had liabilities of RM451.1m due within 12 months and liabilities of RM79.5m due beyond that. On the other hand, it had cash of RM33.8m and RM480.6m worth of receivables due within a year. So it has liabilities totalling RM16.2m more than its cash and near-term receivables, combined.

Of course, MGB Berhad has a market capitalization of RM326.1m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

MGB Berhad's debt is 2.6 times its EBITDA, and its EBIT cover its interest expense 2.9 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Shareholders should be aware that MGB Berhad's EBIT was down 56% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine MGB Berhad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, MGB Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, MGB Berhad's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its level of total liabilities is a good sign, and makes us more optimistic. Overall, we think it's fair to say that MGB Berhad has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with MGB Berhad , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:MGB

MGB Berhad

An investment holding company, operates as a construction and development company in Malaysia.

Flawless balance sheet and undervalued.