Stock Analysis

- Malaysia

- /

- Construction

- /

- KLSE:BINTAI

Revenues Not Telling The Story For Bintai Kinden Corporation Berhad (KLSE:BINTAI)

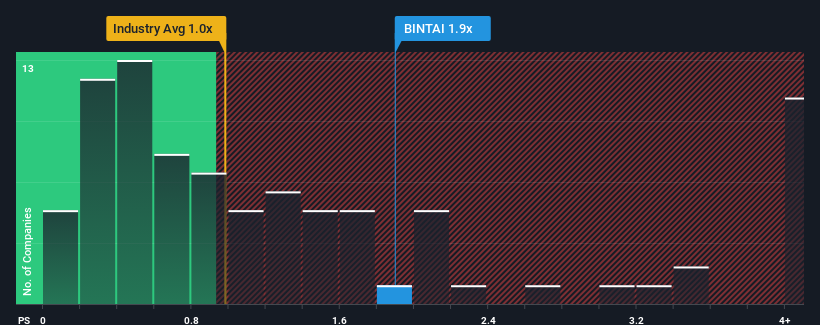

When you see that almost half of the companies in the Construction industry in Malaysia have price-to-sales ratios (or "P/S") below 1x, Bintai Kinden Corporation Berhad (KLSE:BINTAI) looks to be giving off some sell signals with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Bintai Kinden Corporation Berhad

What Does Bintai Kinden Corporation Berhad's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Bintai Kinden Corporation Berhad over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bintai Kinden Corporation Berhad's earnings, revenue and cash flow.How Is Bintai Kinden Corporation Berhad's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Bintai Kinden Corporation Berhad's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 61%. As a result, revenue from three years ago have also fallen 33% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 17% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Bintai Kinden Corporation Berhad's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bintai Kinden Corporation Berhad currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

You should always think about risks. Case in point, we've spotted 4 warning signs for Bintai Kinden Corporation Berhad you should be aware of, and 1 of them is significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Bintai Kinden Corporation Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BINTAI

Bintai Kinden Corporation Berhad

Bintai Kinden Corporation Berhad, an investment holding company, provides specialized mechanical and electrical engineering services in South-East Asia, China, and the Arabian Gulf region.

Mediocre balance sheet with weak fundamentals.