- Italy

- /

- Energy Services

- /

- BIT:SPM

Discover 3 Stocks That May Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

In the midst of a busy week marked by mixed earnings reports and economic data, global markets have seen major indices such as the Nasdaq Composite and S&P MidCap 400 reach record highs before retreating, highlighting ongoing volatility. As investors navigate this complex landscape, identifying stocks that may be trading below their estimated fair value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.27 | 49.9% |

| IMAGICA GROUP (TSE:6879) | ¥476.00 | ¥947.55 | 49.8% |

| Nordic Waterproofing Holding (OM:NWG) | SEK175.60 | SEK349.53 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.63 | US$168.45 | 49.8% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| On the Beach Group (LSE:OTB) | £1.534 | £3.07 | 50% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.45 | CN¥22.90 | 50% |

| KeePer Technical Laboratory (TSE:6036) | ¥3935.00 | ¥7851.33 | 49.9% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.67 | 49.8% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

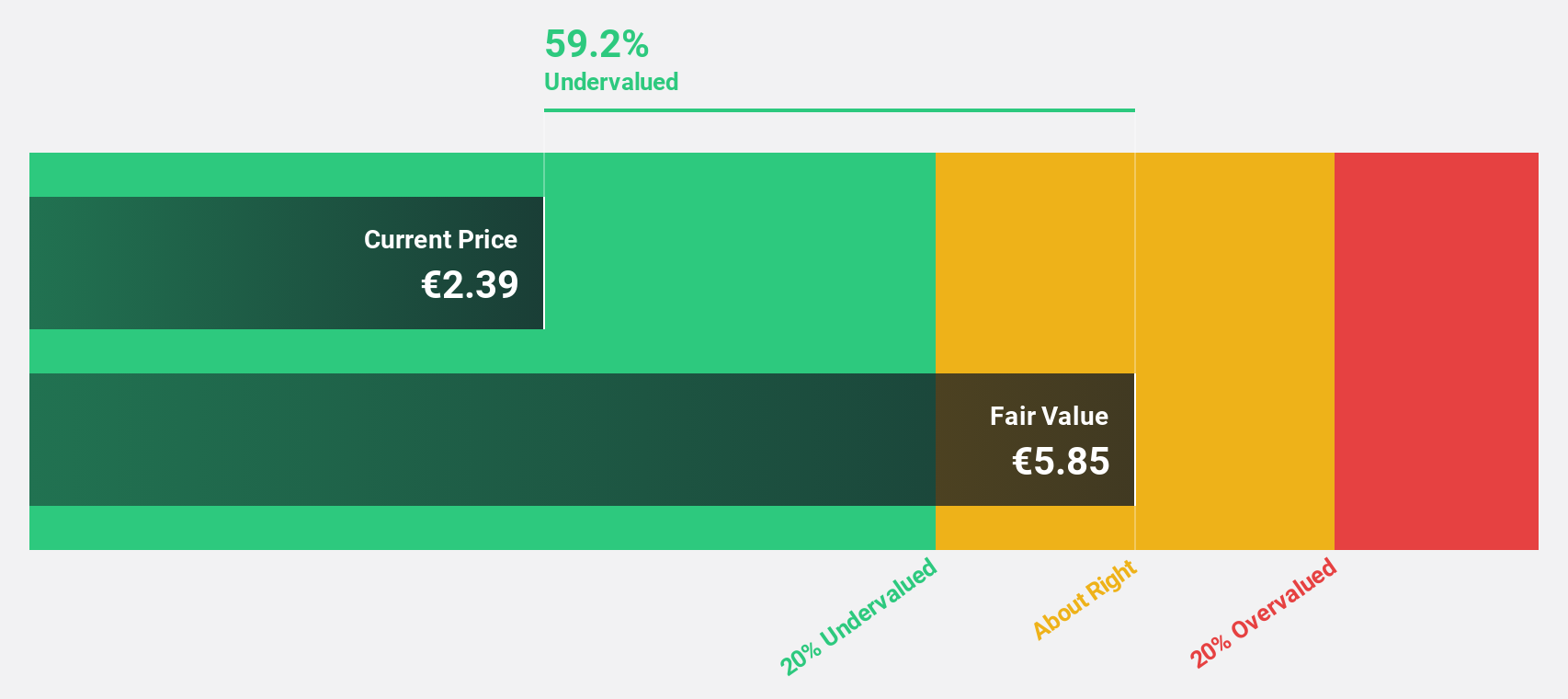

Saipem (BIT:SPM)

Overview: Saipem SpA is a global provider of energy and infrastructure solutions, with a market cap of €4.38 billion.

Operations: The company's revenue segments include Energy Carriers at €5.87 billion, Offshore Drilling at €1.40 billion, and Asset Based Services at €10.86 billion.

Estimated Discount To Fair Value: 49.2%

Saipem is trading at €2.24, significantly below its estimated fair value of €4.41, representing a 49.2% discount. Despite revenue growth forecasts of just 2.3% annually—below the Italian market average—earnings are projected to grow at a robust 25% per year, surpassing market expectations of 7.2%. Analysts anticipate a potential price increase of 34.3%, with Return on Equity expected to reach an impressive 20% in three years.

- In light of our recent growth report, it seems possible that Saipem's financial performance will exceed current levels.

- Click here to discover the nuances of Saipem with our detailed financial health report.

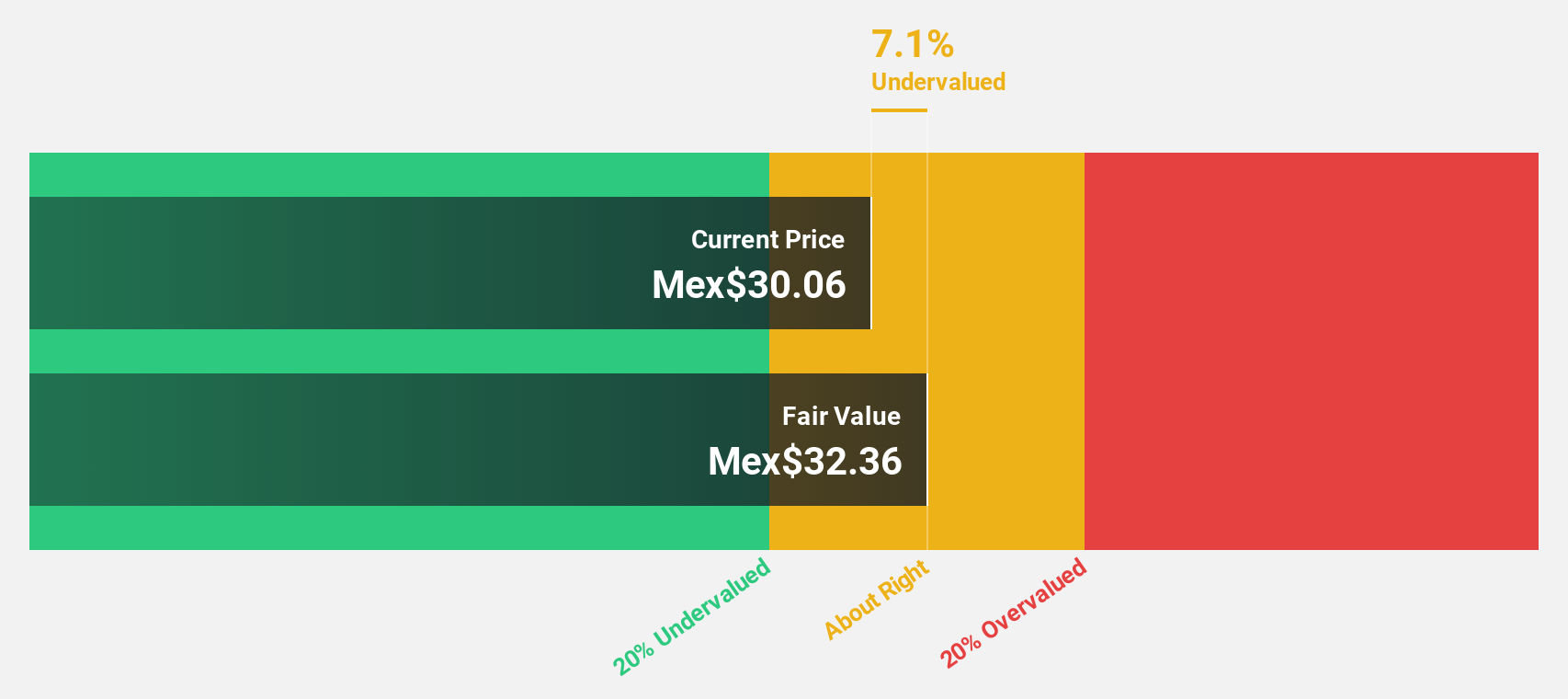

GMéxico Transportes. de (BMV:GMXT *)

Overview: GMéxico Transportes, S.A.B. de C.V. offers logistics and ground transportation solutions in Mexico with a market cap of MX$134.20 billion.

Operations: I'm sorry, but it seems the revenue segment information is missing from the provided text. Could you please provide the relevant details so I can assist you further?

Estimated Discount To Fair Value: 36.9%

GMéxico Transportes is trading at MX$31.62, significantly below its estimated fair value of MX$50.11, indicating a discount of over 20%. Earnings are projected to grow substantially by 22.2% annually, outpacing the Mexican market's growth rate. However, its dividend yield of 6.33% is not well covered by earnings. Recent Q3 results showed increased sales but a decline in net income compared to last year, highlighting potential challenges despite undervaluation based on cash flows.

- Insights from our recent growth report point to a promising forecast for GMéxico Transportes. de's business outlook.

- Take a closer look at GMéxico Transportes. de's balance sheet health here in our report.

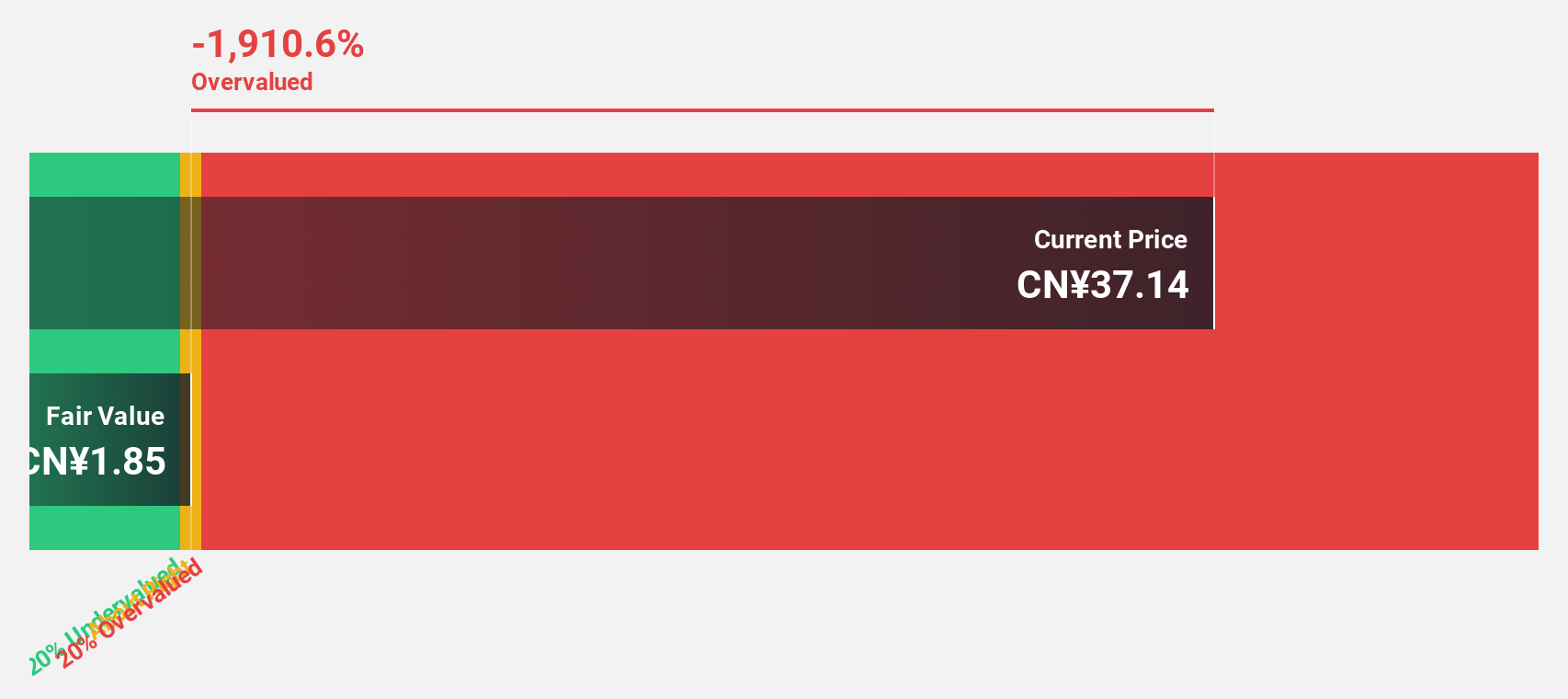

Fujian Torch Electron Technology (SHSE:603678)

Overview: Fujian Torch Electron Technology Co., Ltd. operates in the electronic components industry and has a market cap of CN¥13.32 billion.

Operations: The company's revenue segments are not provided in the text.

Estimated Discount To Fair Value: 37.9%

Fujian Torch Electron Technology is trading at CNY 29.22, considerably below its estimated fair value of CNY 47.08, suggesting it is undervalued by over 20%. Despite recent declines in revenue and net income for the nine months ending September 30, 2024, earnings are expected to grow significantly at an annual rate of 34.5%, surpassing the Chinese market's growth rate. However, future return on equity is projected to be relatively low at 8.8%.

- Upon reviewing our latest growth report, Fujian Torch Electron Technology's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Fujian Torch Electron Technology's balance sheet health report.

Next Steps

- Delve into our full catalog of 963 Undervalued Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SPM

Undervalued with reasonable growth potential.