- Mexico

- /

- Infrastructure

- /

- BMV:ASUR B

3 Global Growth Companies With High Insider Ownership Expecting Up To 64% Earnings Growth

Reviewed by Simply Wall St

In a week marked by heightened concerns over elevated valuations and the impact of a prolonged U.S. government shutdown, global markets have shown signs of strain, with major indices experiencing notable declines. As investors navigate these turbulent times, growth companies with high insider ownership can offer unique insights into potential resilience and strategic positioning amid broader economic challenges.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 12% | 44.9% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

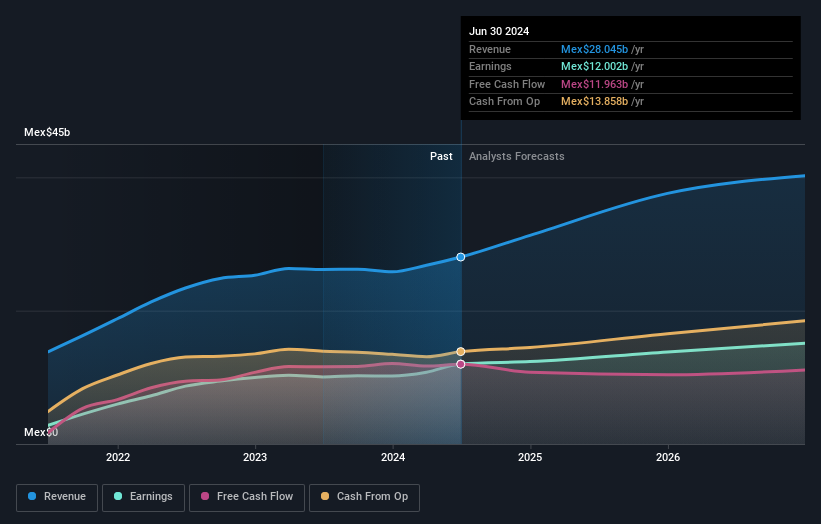

Grupo Aeroportuario del Sureste S. A. B. de C. V (BMV:ASUR B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grupo Aeroportuario del Sureste, S. A. B. de C. V operates airport facilities in Mexico and has a market capitalization of MX$171.10 billion.

Operations: The company's revenue segments include operations in Mexico, with Cancun generating MX$20.37 billion, Merida contributing MX$1.75 billion, Villahermosa at MX$661.60 million, and other Mexican airports adding MX$3.33 billion; along with international operations in San Juan, Puerto Rico at MX$5.39 billion and Colombia at MX$3.79 billion.

Insider Ownership: 29.3%

Earnings Growth Forecast: 13.5% p.a.

Grupo Aeroportuario del Sureste demonstrates potential as a growth company, with revenue forecasted to grow at 8% annually, outpacing the Mexican market. Despite recent declines in net income, its return on equity is expected to be robust at 30.1% in three years. The company trades significantly below estimated fair value, presenting a potential opportunity for investors. However, its high dividend of 14.03% raises sustainability concerns due to inadequate earnings coverage.

- Click here to discover the nuances of Grupo Aeroportuario del Sureste S. A. B. de C. V with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Grupo Aeroportuario del Sureste S. A. B. de C. V shares in the market.

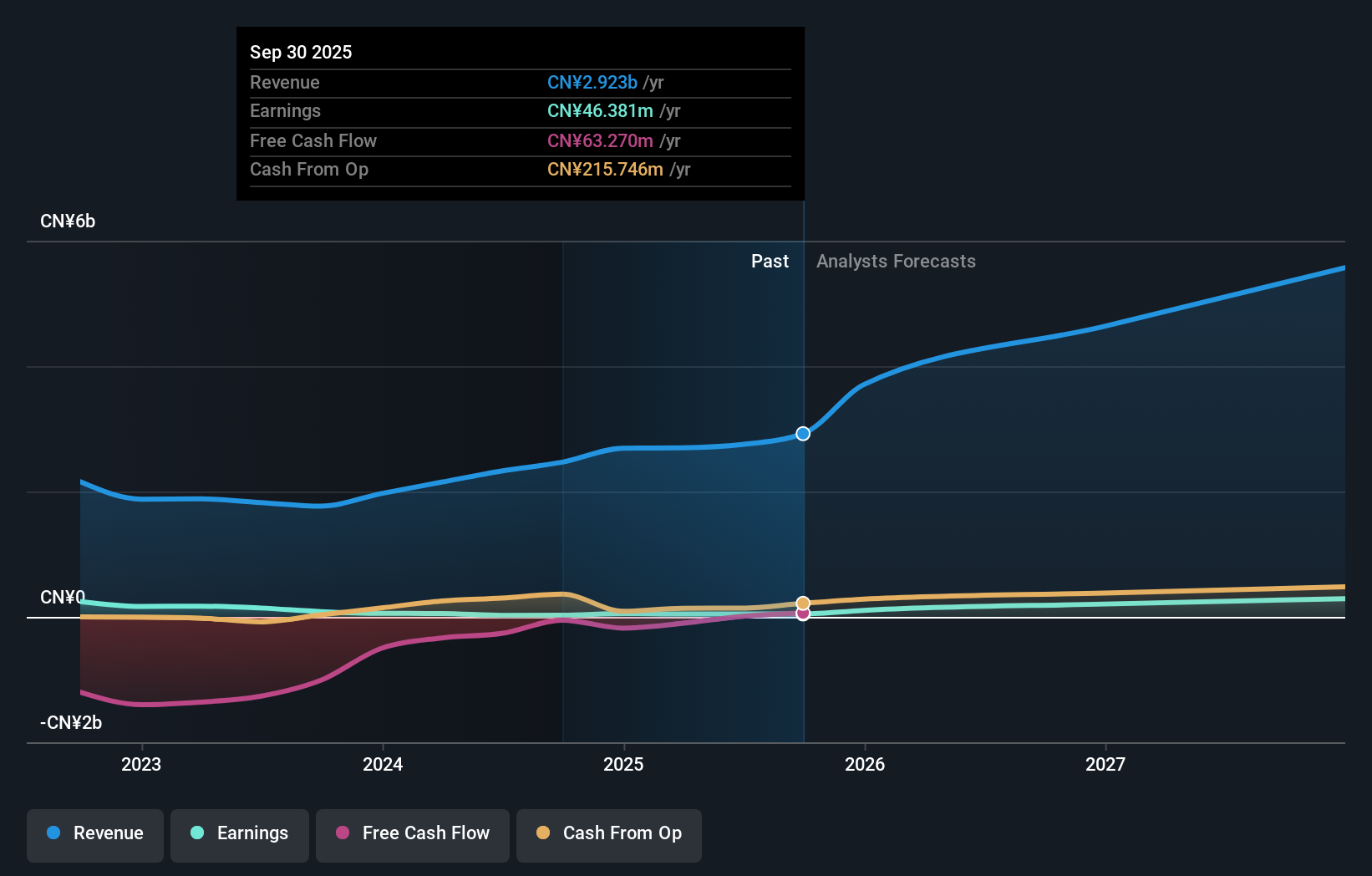

Jiangsu Sidike New Materials Science & Technology (SZSE:300806)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Sidike New Materials Science & Technology Co., Ltd. (SZSE:300806) operates in the advanced materials industry, focusing on the development and production of innovative material solutions, with a market cap of approximately CN¥11.99 billion.

Operations: Jiangsu Sidike New Materials Science & Technology Co., Ltd. generates its revenue through various segments within the advanced materials industry, although specific segment details are not provided in the available text.

Insider Ownership: 38.5%

Earnings Growth Forecast: 64.6% p.a.

Jiangsu Sidike New Materials Science & Technology is positioned for significant growth, with earnings expected to rise 64.6% annually, outpacing the Chinese market. Revenue forecasts also exceed market expectations at 26% per year. However, recent financial results highlight challenges, as net income declined to CNY 45.27 million for the first nine months of 2025 from CNY 53.77 million a year ago. Despite high insider ownership, interest payments are not well covered by earnings and share price volatility remains high.

- Get an in-depth perspective on Jiangsu Sidike New Materials Science & Technology's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Jiangsu Sidike New Materials Science & Technology's current price could be inflated.

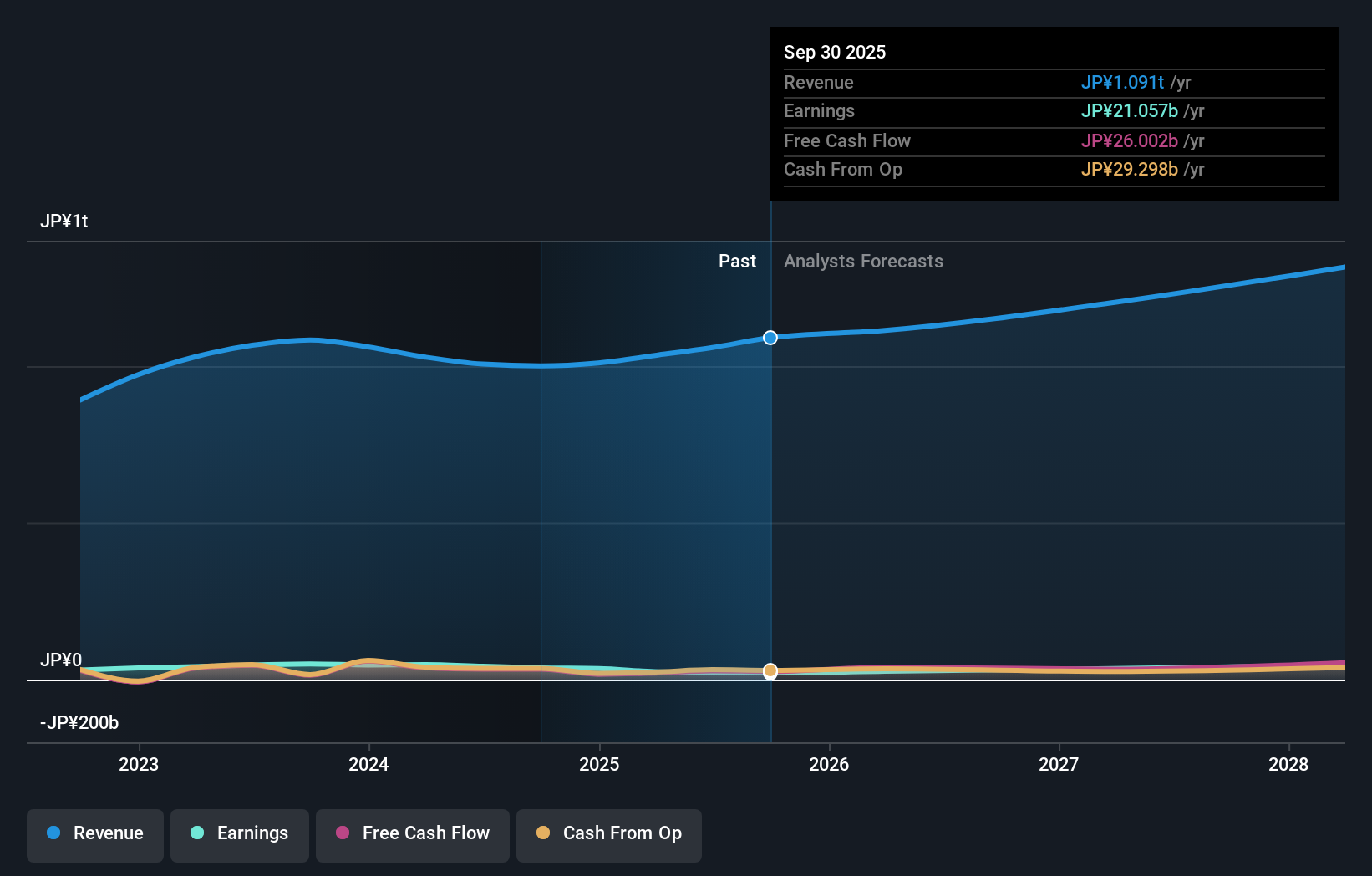

Macnica Holdings (TSE:3132)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Macnica Holdings, Inc. is engaged in the import, sale, and export of electronic components in Japan with a market capitalization of ¥405.34 billion.

Operations: The company's revenue is primarily derived from its Integrated Circuits, Electronic Devices and Other Businesses segment, which generated ¥929.52 billion, and its Cybersecurity And Other IT Solutions Business segment, contributing ¥161.19 billion.

Insider Ownership: 13.5%

Earnings Growth Forecast: 30% p.a.

Macnica Holdings is poised for significant earnings growth, with forecasts indicating a 30% annual increase, surpassing the Japanese market's average. However, revenue growth is expected to be modest at 7.8% annually. The company trades at a substantial discount to its estimated fair value but faces challenges with declining profit margins and an unstable dividend history. Recent board meetings discussed potential mergers among subsidiaries, signaling strategic shifts ahead without recent insider trading activity noted.

- Delve into the full analysis future growth report here for a deeper understanding of Macnica Holdings.

- Upon reviewing our latest valuation report, Macnica Holdings' share price might be too pessimistic.

Make It Happen

- Navigate through the entire inventory of 828 Fast Growing Global Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:ASUR B

Grupo Aeroportuario del Sureste S. A. B. de C. V

Grupo Aeroportuario del Sureste, S. A. B.

Good value with reasonable growth potential.

Market Insights

Community Narratives