- Mexico

- /

- Wireless Telecom

- /

- BMV:AMX L

América Móvil. de (BMV:AMXL) Is Paying Out A Larger Dividend Than Last Year

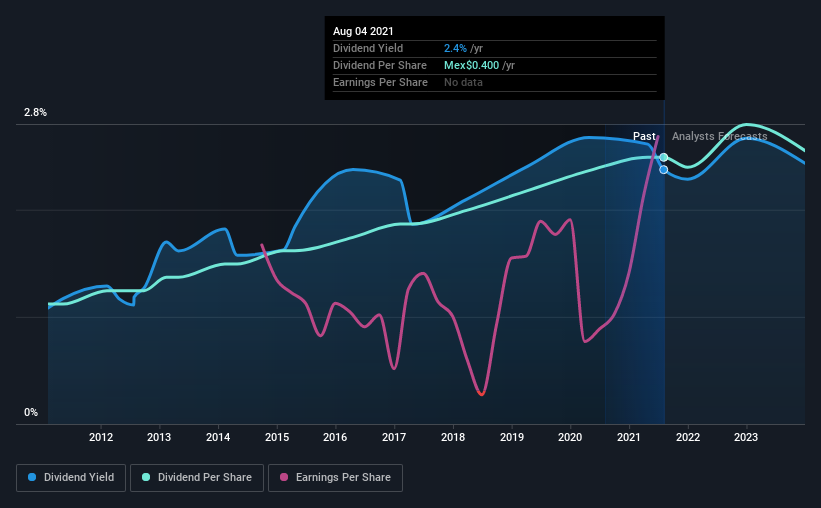

América Móvil, S.A.B. de C.V. (BMV:AMXL) will increase its dividend on the 8th of November to Mex$0.20. This takes the annual payment to 2.4% of the current stock price, which unfortunately is below what the industry is paying.

Check out our latest analysis for América Móvil. de

América Móvil. de's Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, América Móvil. de was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to fall by 9.7%. Assuming the dividend continues along recent trends, we believe the payout ratio could be 31%, which we are pretty comfortable with and we think is feasible on an earnings basis.

América Móvil. de Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from Mex$0.18 in 2011 to the most recent annual payment of Mex$0.40. This implies that the company grew its distributions at a yearly rate of about 8.3% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see América Móvil. de has been growing its earnings per share at 32% a year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

We Really Like América Móvil. de's Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for América Móvil. de that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade América Móvil. de, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:AMX L

América Móvil. de

Provides telecommunications services in Latin America and internationally.

Established dividend payer with proven track record.