- Mexico

- /

- Metals and Mining

- /

- BMV:PE&OLES *

Industrias Peñoles. de's (BMV:PE&OLES) investors will be pleased with their 20% return over the last five years

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Furthermore, you'd generally like to see the share price rise faster than the market. But Industrias Peñoles, S.A.B. de C.V. (BMV:PE&OLES) has fallen short of that second goal, with a share price rise of 17% over five years, which is below the market return. The last year has been disappointing, with the stock price down 1.1% in that time.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Industrias Peñoles. de

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Industrias Peñoles. de's earnings per share are down 15% per year, despite strong share price performance over five years.

Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. Given that EPS is down, but the share price is up, it seems clear the market is focussed on other aspects of the business, at the moment.

On the other hand, Industrias Peñoles. de's revenue is growing nicely, at a compound rate of 7.2% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

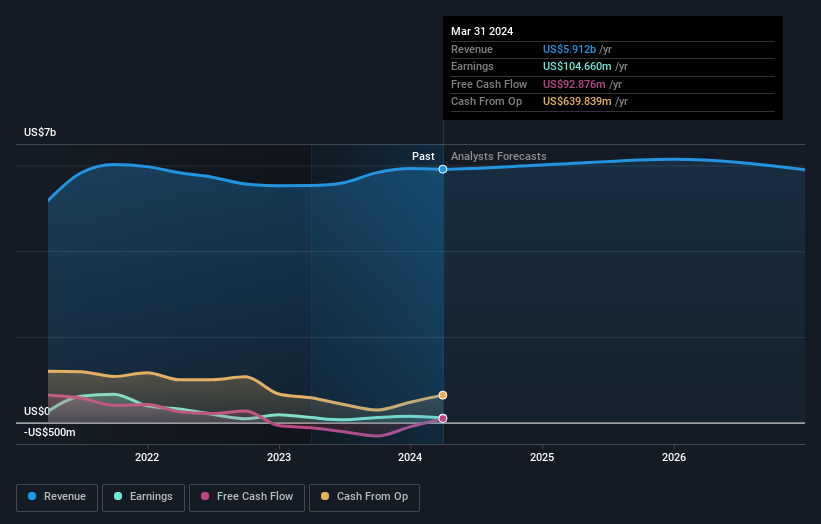

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Industrias Peñoles. de's financial health with this free report on its balance sheet.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Over the last 5 years, Industrias Peñoles. de generated a TSR of 20%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

Industrias Peñoles. de shareholders are down 1.1% for the year, but the market itself is up 6.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Industrias Peñoles. de that you should be aware of.

But note: Industrias Peñoles. de may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Mexican exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:PE&OLES *

Industrias Peñoles. de

Engages in the exploration, extraction, and sale of mineral concentrates and ores in Mexico, Europe, Asia, North America, South America, and internationally.

Adequate balance sheet very low.