- Mexico

- /

- Metals and Mining

- /

- BMV:GMEXICO B

Grupo México, S.A.B. de C.V.'s (BMV:GMEXICOB) Share Price Could Signal Some Risk

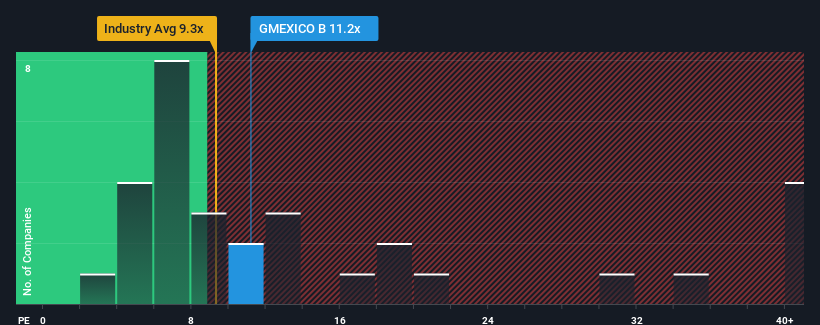

It's not a stretch to say that Grupo México, S.A.B. de C.V.'s (BMV:GMEXICOB) price-to-earnings (or "P/E") ratio of 11.2x right now seems quite "middle-of-the-road" compared to the market in Mexico, where the median P/E ratio is around 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times haven't been advantageous for Grupo México. de as its earnings have been rising slower than most other companies. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Grupo México. de

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Grupo México. de's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a decent 8.4% gain to the company's bottom line. The latest three year period has also seen an excellent 105% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings growth is heading into negative territory, declining 9.7% over the next year. Meanwhile, the broader market is forecast to expand by 10%, which paints a poor picture.

In light of this, it's somewhat alarming that Grupo México. de's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Grupo México. de currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Grupo México. de you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might also be able to find a better stock than Grupo México. de. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:GMEXICO B

Grupo México. de

Engages in copper production, cargo transportation, and infrastructure businesses worldwide.

Flawless balance sheet average dividend payer.