- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A009150

Samsung Electro-Mechanics Co., Ltd. (KRX:009150) Stocks Shoot Up 25% But Its P/E Still Looks Reasonable

Samsung Electro-Mechanics Co., Ltd. (KRX:009150) shares have continued their recent momentum with a 25% gain in the last month alone. The last month tops off a massive increase of 109% in the last year.

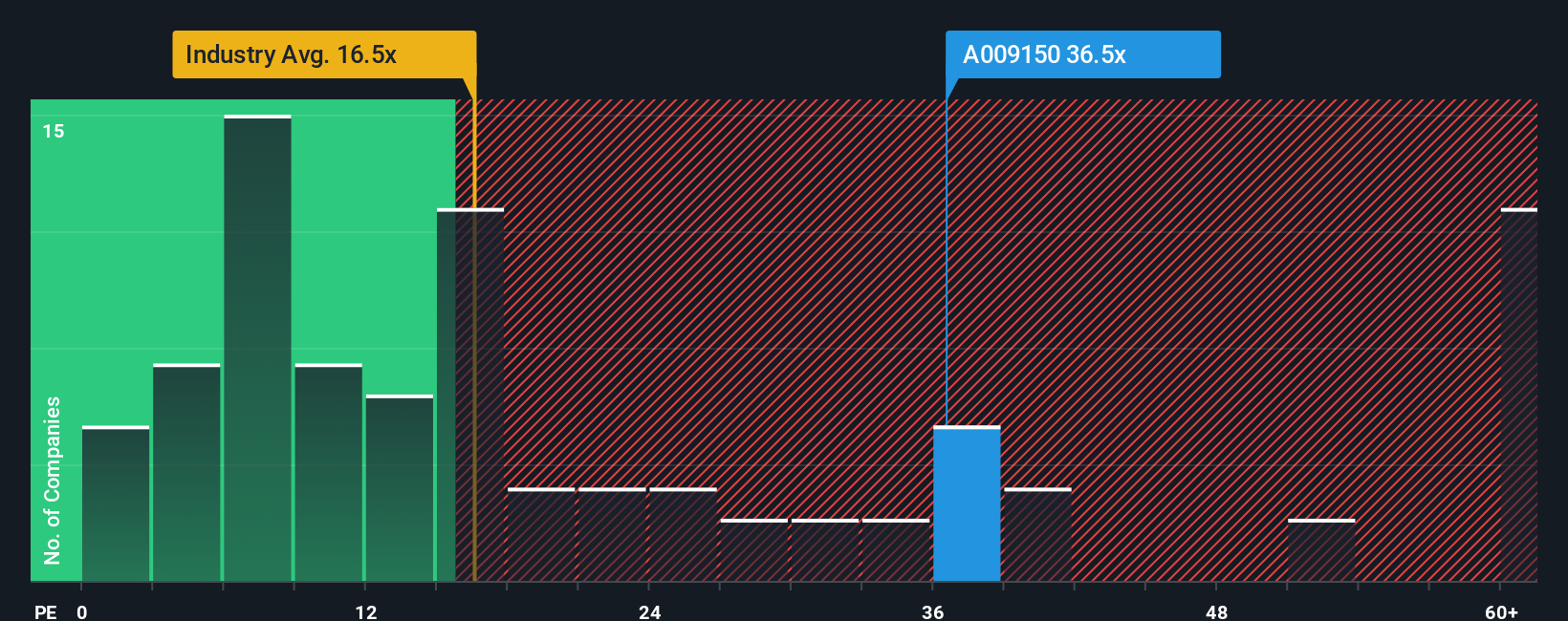

Following the firm bounce in price, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 14x, you may consider Samsung Electro-Mechanics as a stock to avoid entirely with its 36.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Samsung Electro-Mechanics as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Samsung Electro-Mechanics

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Samsung Electro-Mechanics' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. As a result, earnings from three years ago have also fallen 56% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 32% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 21% per annum growth forecast for the broader market.

With this information, we can see why Samsung Electro-Mechanics is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Samsung Electro-Mechanics' P/E

Shares in Samsung Electro-Mechanics have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Samsung Electro-Mechanics maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Samsung Electro-Mechanics with six simple checks.

Of course, you might also be able to find a better stock than Samsung Electro-Mechanics. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009150

Samsung Electro-Mechanics

Manufactures and sells various electronic components in Korea, China, Southeast Asia, Japan, the Americas, and Europe.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives