- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

High Growth Tech Stocks to Watch in South Korea August 2024

Reviewed by Simply Wall St

The South Korean market has climbed 4.1% in the last 7 days, with a gain of 8.2%, and over the past 12 months, it is up by 5.1%, while earnings are expected to grow by 28% per annum over the next few years. In this dynamic environment, identifying high-growth tech stocks that align with these robust market conditions can be crucial for investors looking to capitalize on future opportunities.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ALTEOGEN | 48.67% | 72.95% | ★★★★★★ |

| IMLtd | 20.76% | 106.30% | ★★★★★★ |

| Bioneer | 22.49% | 89.69% | ★★★★★★ |

| NEXON Games | 31.70% | 66.31% | ★★★★★★ |

| Seojin SystemLtd | 34.20% | 58.67% | ★★★★★★ |

| Devsisters | 26.11% | 65.92% | ★★★★★★ |

| AmosenseLtd | 24.29% | 55.45% | ★★★★★★ |

| Park Systems | 22.50% | 37.52% | ★★★★★★ |

| Daejoo Electronic Materials | 42.24% | 48.74% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★☆☆

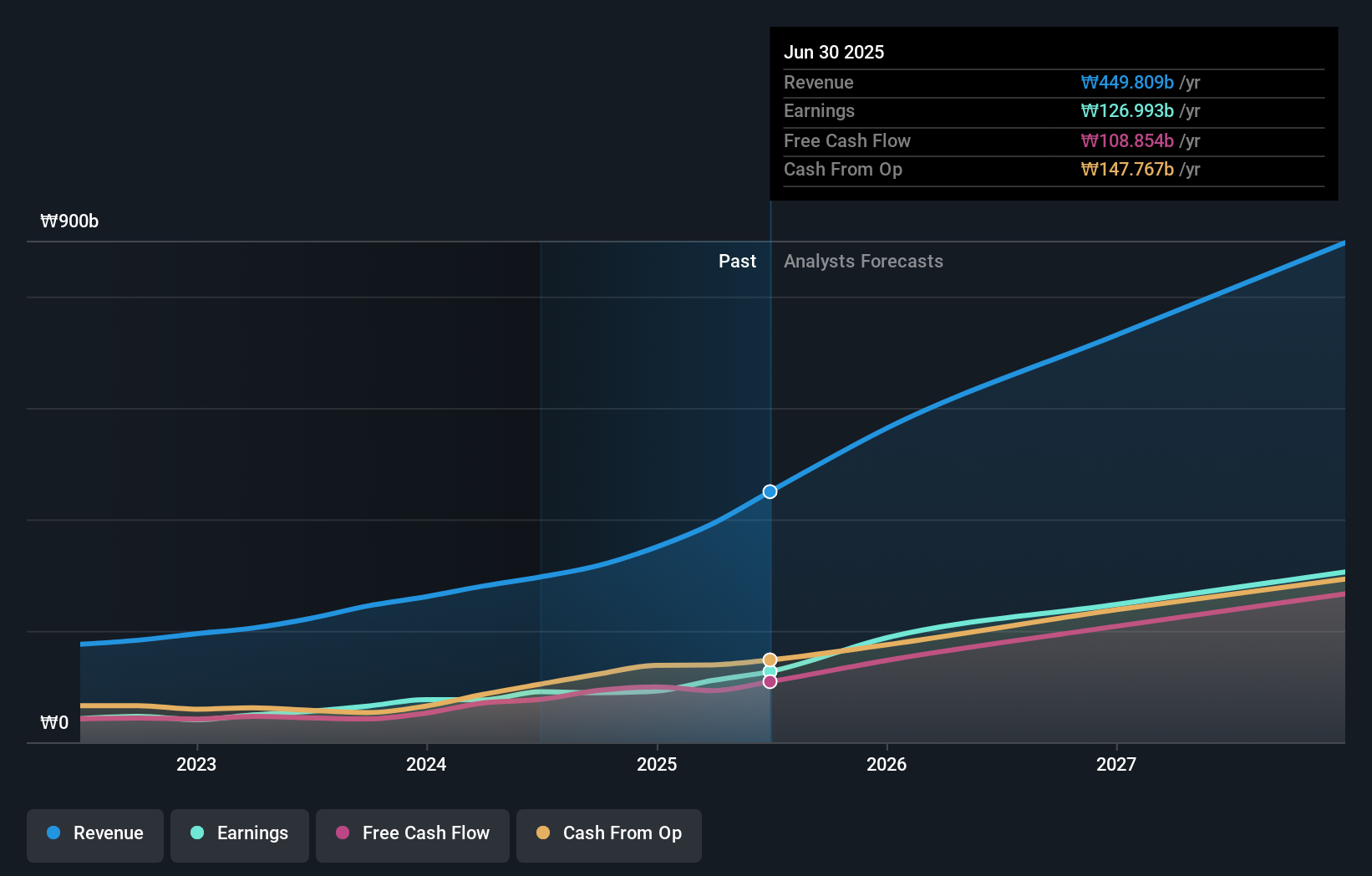

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea, with a market cap of approximately ₩1.94 trillion.

Operations: PharmaResearch Co., Ltd. generates revenue primarily from its pharmaceutical segment, which reported ₩280.29 billion. The company operates mainly in South Korea and focuses on biopharmaceutical products.

PharmaResearch has demonstrated robust earnings growth, with a 55.4% increase over the past year, outpacing the biotech industry average of 41.1%. The company's revenue is forecast to grow at 19.8% per year, surpassing the South Korean market's 10.7%. Notably, R&D expenses have been significant, reflecting a commitment to innovation and development within its sector. With projected annual profit growth of 20.7%, PharmaResearch shows promising potential in South Korea's tech landscape.

- Get an in-depth perspective on PharmaResearch's performance by reading our health report here.

Examine PharmaResearch's past performance report to understand how it has performed in the past.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

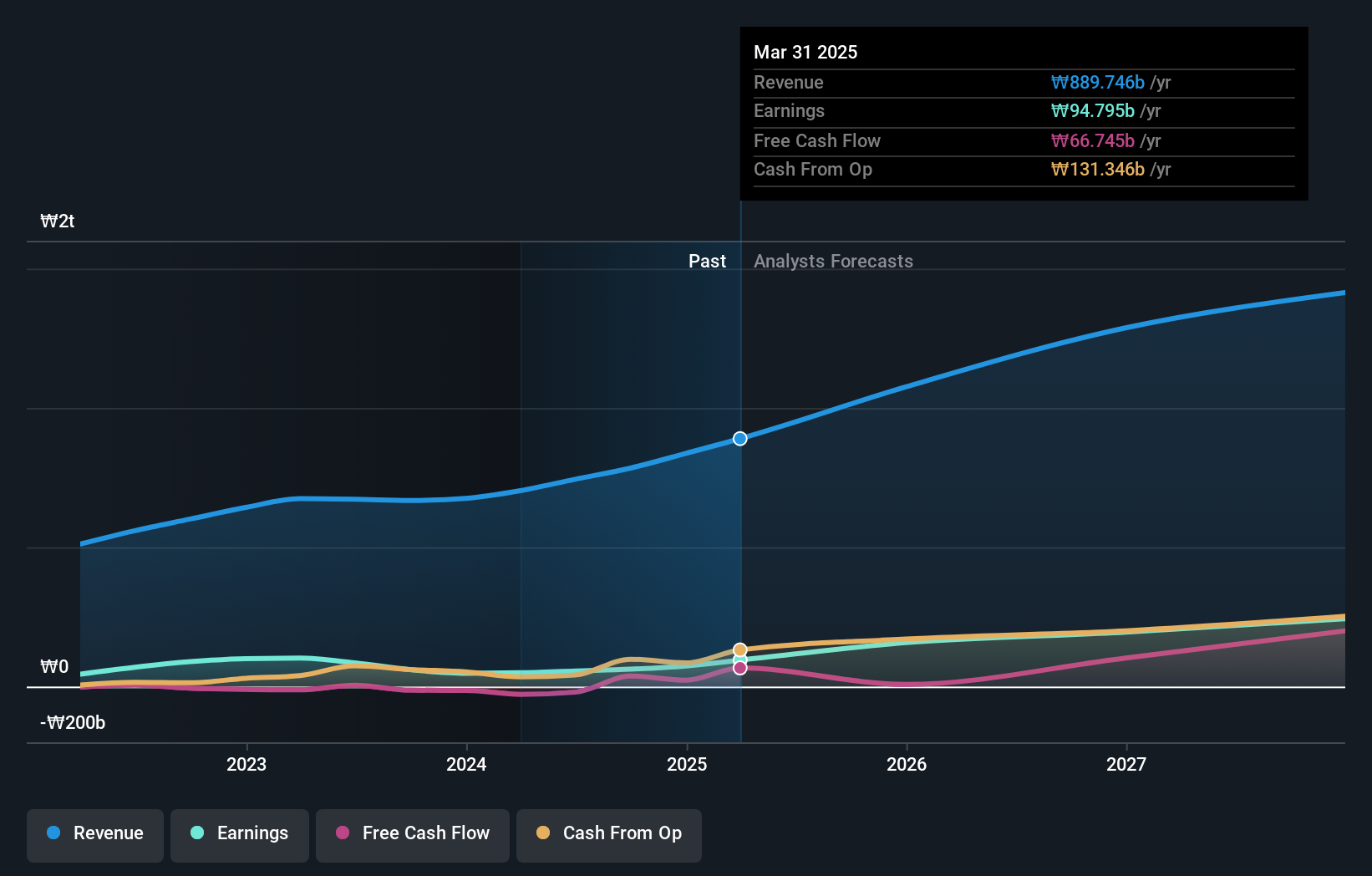

Overview: ISU Petasys Co., Ltd. manufactures and sells printed circuit boards (PCBs) worldwide, with a market cap of ₩2.85 trillion.

Operations: ISU Petasys Co., Ltd. specializes in the global production and sale of printed circuit boards (PCBs). The company operates with a market capitalization of ₩2.85 trillion, focusing on diverse revenue streams within the PCB sector.

ISU Petasys has shown notable performance in the tech sector with an expected revenue growth rate of 19.7% per year, outpacing the South Korean market's average of 10.7%. Despite a challenging past year with a net profit margin drop from 15.1% to 7%, its earnings are forecasted to grow significantly at 43.7% annually over the next three years, indicating strong future potential. The company's commitment to innovation is evident from substantial R&D expenses, which play a crucial role in maintaining its competitive edge in high-growth tech industries.

- Click to explore a detailed breakdown of our findings in ISU Petasys' health report.

Evaluate ISU Petasys' historical performance by accessing our past performance report.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

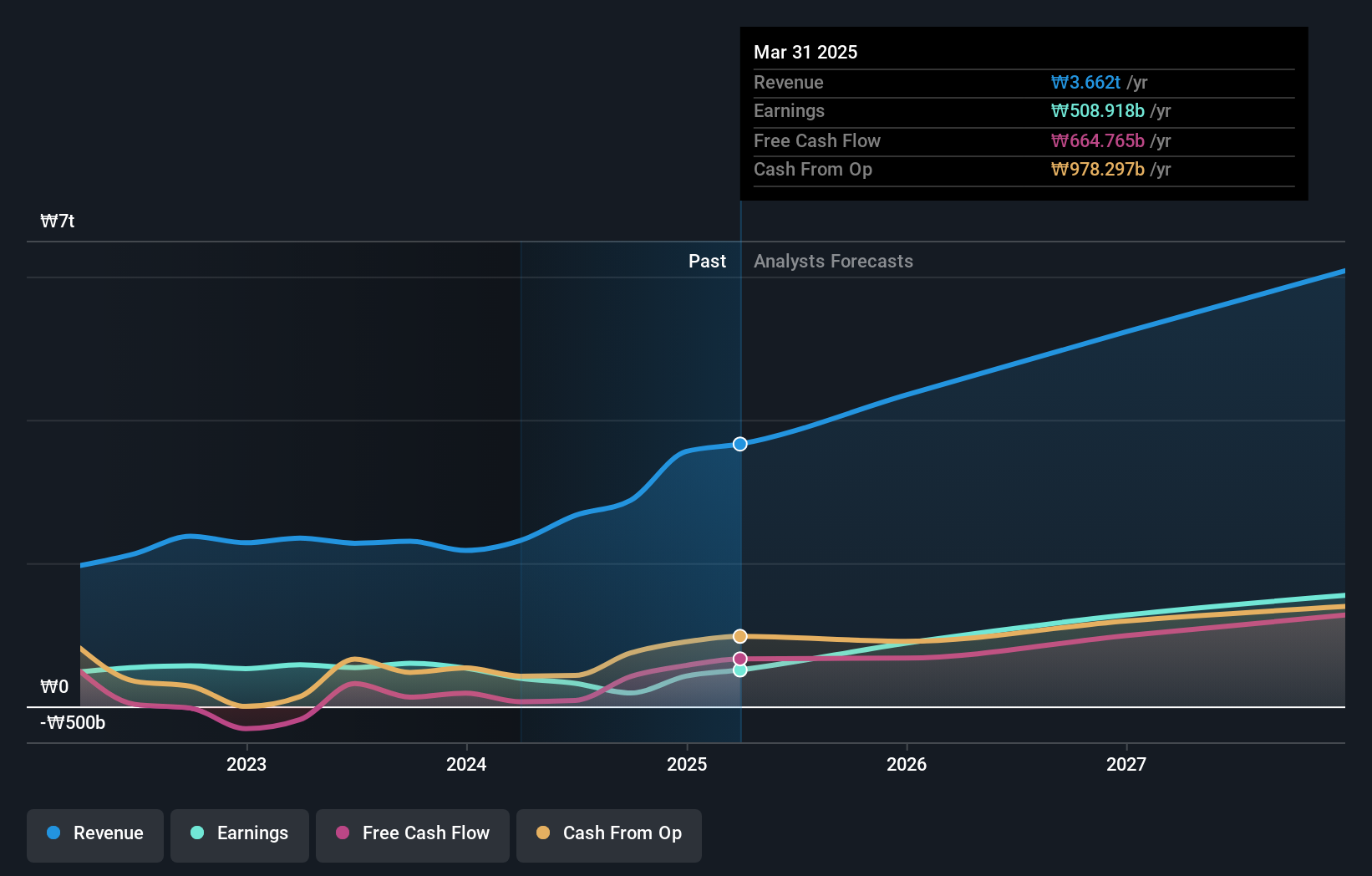

Overview: Celltrion, Inc., along with its subsidiaries, develops and produces protein-based drugs for oncology treatment in South Korea and has a market cap of ₩40.59 trillion.

Operations: Celltrion, Inc. generates revenue primarily from its Bio Medical Supply segment (₩2.43 trillion) and Chemical Drugs segment (₩504.14 billion). The company focuses on developing and producing protein-based drugs for oncology treatment in South Korea.

Celltrion's R&D expenditure, accounting for 21.4% of its revenue, underscores its commitment to innovation in the biotech sector. Recent positive Phase III data for CT-P47 and European Commission approval of Omlyclo® highlight significant advancements in biosimilars, potentially boosting future earnings growth by 52% annually. The company repurchased 436,047 shares worth ₩80.55 billion between April and May 2024, aiming to enhance shareholder value and stabilize stock prices amidst a challenging market environment.

- Click here and access our complete health analysis report to understand the dynamics of Celltrion.

Gain insights into Celltrion's past trends and performance with our Past report.

Where To Now?

- Reveal the 48 hidden gems among our KRX High Growth Tech and AI Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Flawless balance sheet and undervalued.