Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A078600

High Growth Tech Stocks to Watch in South Korea September 2024

Reviewed by Simply Wall St

Consumer sentiment in South Korea was slightly softer in September, with the Composite Consumer Sentiment Index (CCSI) score dipping to 100.0 from 100.8 in August, reflecting a cautious outlook among consumers regarding economic conditions and future household income. In this environment, identifying high-growth tech stocks that can navigate these sentiments and deliver robust performance becomes crucial for investors seeking opportunities in South Korea's dynamic market.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 50 stocks from our KRX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across various global markets, including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia, with a market cap of ₩1.71 billion.

Operations: Daejoo Electronic Materials Co., Ltd. focuses on the development, production, and sale of electrical and electronic components, generating revenue of ₩206.32 million. The company operates in multiple global markets including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

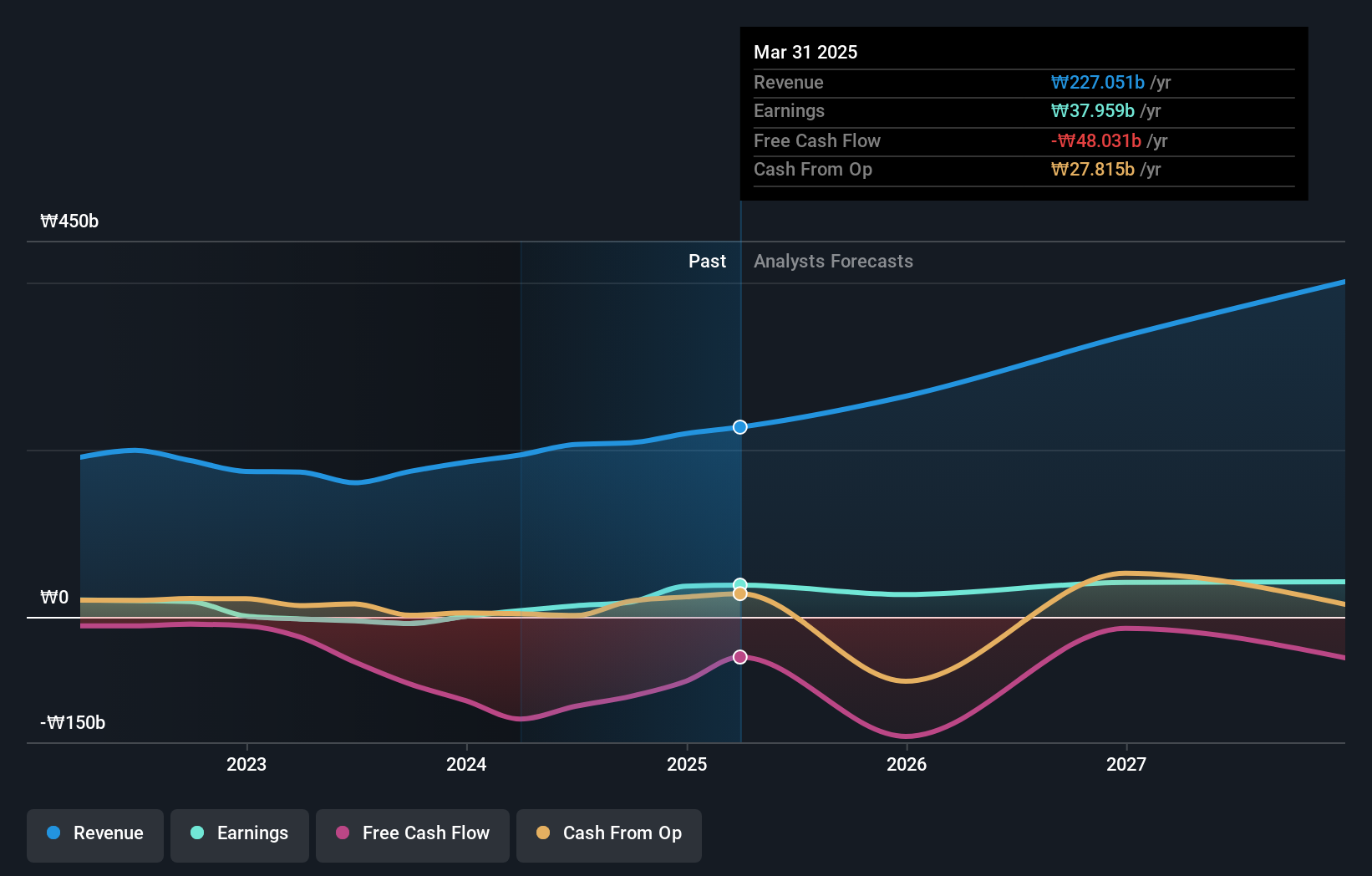

Daejoo Electronic Materials has demonstrated a robust turnaround in its financial performance, with net income soaring to KRW 12.21 billion from a loss just a year prior, reflecting an impressive growth trajectory. This surge is underpinned by significant revenue growth projections of 42.2% annually, outpacing the broader South Korean tech market's average. Despite challenges such as highly volatile share prices and non-cash earnings constituting a large portion of profit, Daejoo's strategic focus on R&D investment—which remains undisclosed but is pivotal in sustaining innovation—positions it favorably within the competitive landscape. Looking forward, the company’s earnings are expected to expand by 48.7% per year, suggesting potential for continued upward momentum in its market segment.

- Click here to discover the nuances of Daejoo Electronic Materials with our detailed analytical health report.

Gain insights into Daejoo Electronic Materials' past trends and performance with our Past report.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JNTC Co., Ltd. specializes in providing connector, hinge, and tempered glass products in South Korea and has a market cap of ₩1.26 billion.

Operations: JNTC Co., Ltd. generates revenue primarily from the manufacturing and sales of mobile parts, amounting to ₩402.99 billion. The company focuses on producing connectors, hinges, and tempered glass products for the South Korean market.

JNTC, a South Korean tech firm, is navigating the competitive landscape with promising financial forecasts. With an expected revenue growth of 18.1% per year, it outpaces the national market average of 10.5%, showcasing its robust market position. Notably, its earnings are projected to surge by 51.9% annually, significantly higher than the broader market's 29.3%. This growth is underpinned by JNTC's commitment to innovation as evidenced by substantial R&D expenditures which are crucial for sustaining its technological edge and competitiveness in a rapidly evolving industry. Despite not being top-tier in high-growth sectors within South Korea, JNTC has demonstrated potential through strategic investments and financial performance that suggest promising future prospects. The company’s focus on expanding its technological capabilities could well position it as a key player in the tech industry moving forward, despite current challenges such as a highly volatile share price and unsecured interest payments which reflect areas needing improvement.

- Delve into the full analysis health report here for a deeper understanding of JNTC.

Assess JNTC's past performance with our detailed historical performance reports.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. engages in music production, publishing, and artist development and management businesses with a market cap of ₩7.20 trillion.

Operations: HYBE generates revenue primarily from its Label segment (₩1.28 trillion) and Solution segment (₩1.24 trillion), with additional income from its Platform segment (₩361.12 billion). The company's diverse operations include music production, publishing, and artist development and management.

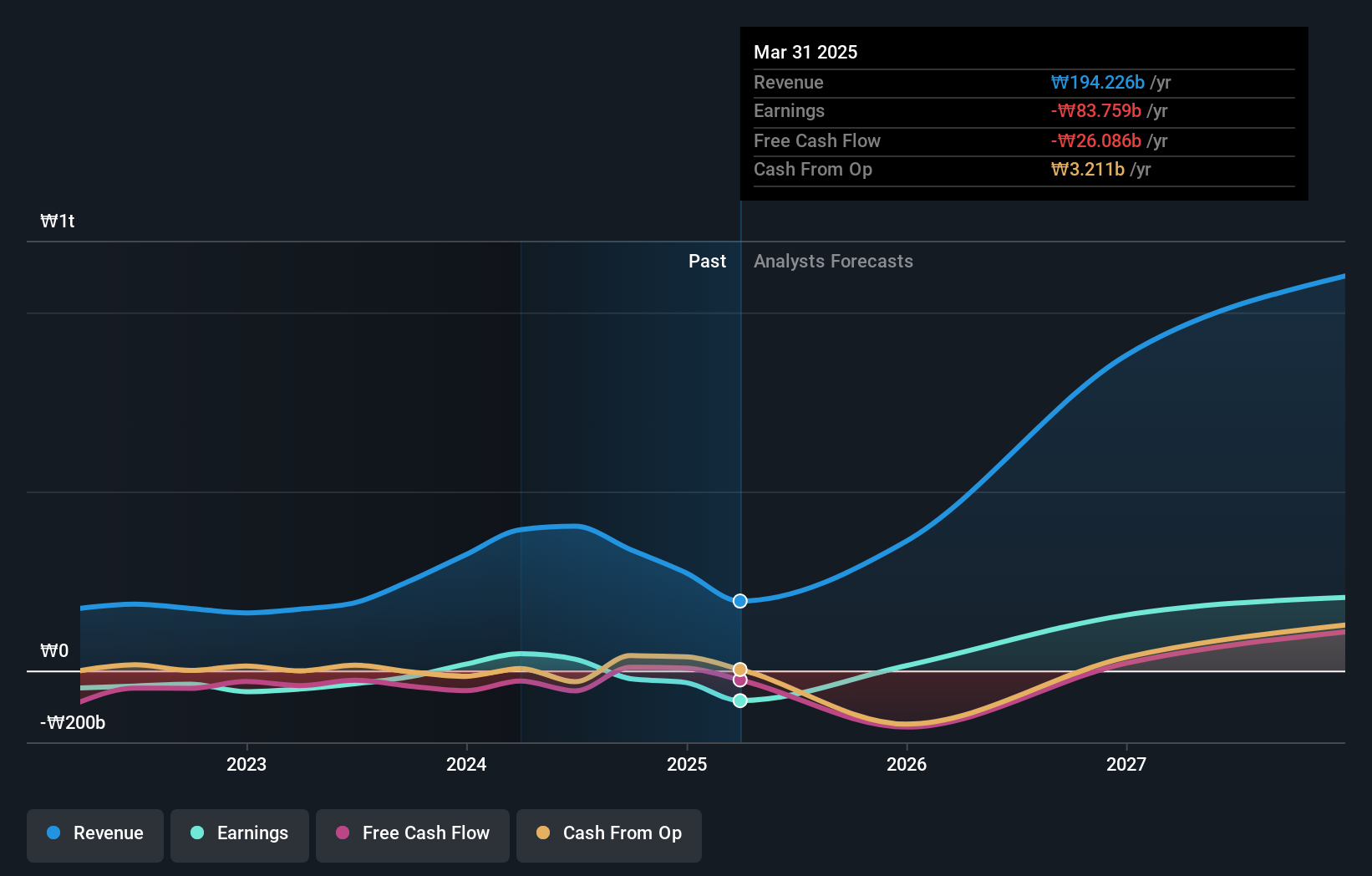

HYBE, a South Korean tech firm, is leveraging its R&D to stay competitive in the high-growth tech sector. With a 14% annual revenue growth and a notable 42.2% forecast in earnings growth per year, it surpasses the broader market's expectations. The company recently repurchased 150,000 shares for KRW 26.09 billion to stabilize its stock price, reflecting confidence in its financial health despite significant one-off losses of ₩189.4B last year impacting earnings. This strategic focus on innovation and shareholder value underscores HYBE's potential amidst challenges like fluctuating net income figures reported in recent quarters.

Turning Ideas Into Actions

- Access the full spectrum of 50 KRX High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078600

Daejoo Electronic Materials

Develops and sells electronic materials in South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.