- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A204270

High Growth Tech Stocks To Explore This November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the small-cap Russell 2000 seeing significant gains, investor optimism is fueled by expectations of growth-friendly policies and tax reforms. In this context of heightened market activity and potential regulatory changes, identifying high-growth tech stocks involves looking for companies that can leverage these favorable conditions to expand their market presence and drive innovation.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JNTC Co., Ltd. operates in South Korea, offering products such as connectors, hinges, and tempered glass, with a market cap of approximately ₩975.87 billion.

Operations: The company generates revenue primarily through the manufacturing and sales of mobile parts, amounting to approximately ₩402.99 billion. Its product offerings include connectors, hinges, and tempered glass.

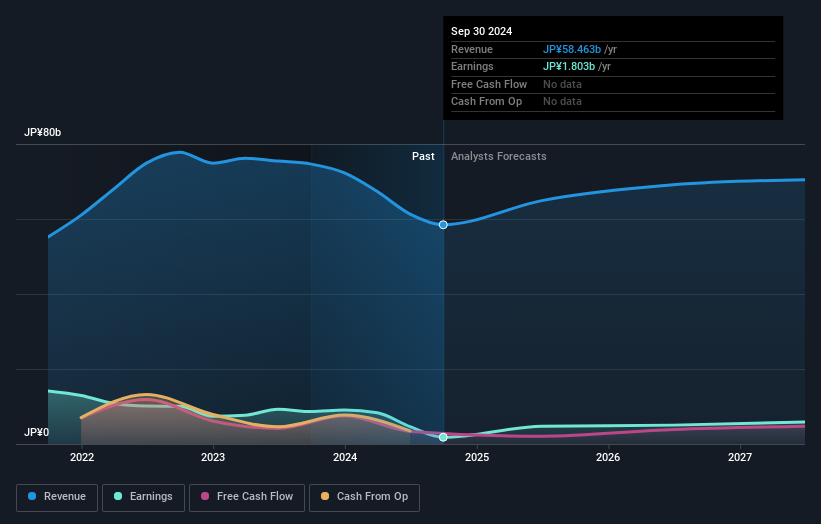

JNTC has demonstrated a robust trajectory with its revenue forecast to surge by 18.1% annually, outpacing the broader KR market's growth of 10.2%. This performance is bolstered by an even more impressive projected annual earnings increase of 51.9%, significantly ahead of the market average at 29.4%. Despite not having positive free cash flow, JNTC's strategic emphasis on R&D could be a pivotal factor in sustaining its competitive edge and fostering innovation within the tech sector. The company’s recent shift towards profitability highlights its potential resilience and adaptability in a dynamic industry landscape, although it grapples with high share price volatility and underwhelming interest coverage ratios.

- Click to explore a detailed breakdown of our findings in JNTC's health report.

Examine JNTC's past performance report to understand how it has performed in the past.

Wanma Technology (SZSE:300698)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wanma Technology Co., Ltd. focuses on the research and development, production, system integration, and sales of communication and medical information equipment with a market capitalization of CN¥5.96 billion.

Operations: The company generates revenue through the development and sale of communication and medical information equipment, leveraging its expertise in system integration.

Wanma Technology has shown resilience despite a challenging financial year, with a revenue increase to CNY 385.48 million from CNY 357.46 million and a slight dip in net income to CNY 31.22 million from CNY 40.39 million, as reported in their latest earnings for the nine months ended September 2024. This performance is underpinned by significant investment in R&D, crucial for maintaining its competitive edge in the tech industry where innovation is key. With expected annual revenue growth at an impressive rate of 37.3%, Wanma outpaces the broader Chinese market's growth rate of 13.9%. However, its earnings trajectory reflects volatility with a forecasted substantial rise of 53.8% per year over the next three years, indicating potential for future profitability amidst current financial pressures.

- Click here to discover the nuances of Wanma Technology with our detailed analytical health report.

Assess Wanma Technology's past performance with our detailed historical performance reports.

GREE (TSE:3632)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GREE, Inc. is a company engaged in Internet entertainment, investment, and incubation businesses both in Japan and internationally, with a market capitalization of ¥69.29 billion.

Operations: GREE, Inc. generates revenue primarily from its Game and Anime Business, which contributes significantly more than other segments such as the Metaverse and Investment Businesses. The company also engages in a DX Business segment, though it is smaller in scale compared to its primary revenue streams.

GREE, Inc. is navigating a transformative phase with robust R&D investments and strategic restructuring to bolster its market position. With an anticipated revenue growth of 4.7% annually, GREE is outpacing the Japanese market's average of 4.2%. The company's earnings are also expected to surge by approximately 24.9% per year, showcasing its potential in a competitive landscape. Recent changes include a transition to GREE Holdings, Inc., reflecting its expanded business objectives post-restructuring, effective January 2025—a move that could redefine its industry footprint and attract new business avenues.

- Unlock comprehensive insights into our analysis of GREE stock in this health report.

Gain insights into GREE's past trends and performance with our Past report.

Turning Ideas Into Actions

- Take a closer look at our High Growth Tech and AI Stocks list of 1280 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A204270

JNTC

Provides connector, hinge, and tempered glass products in South Korea.

Good value with reasonable growth potential.