- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

Exploring 3 High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 1.4%, and its performance has remained flat over the past year, although earnings are forecast to grow by 30% annually. In this environment, identifying high-growth tech stocks that demonstrate strong potential can be crucial for investors looking to capitalize on future gains.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

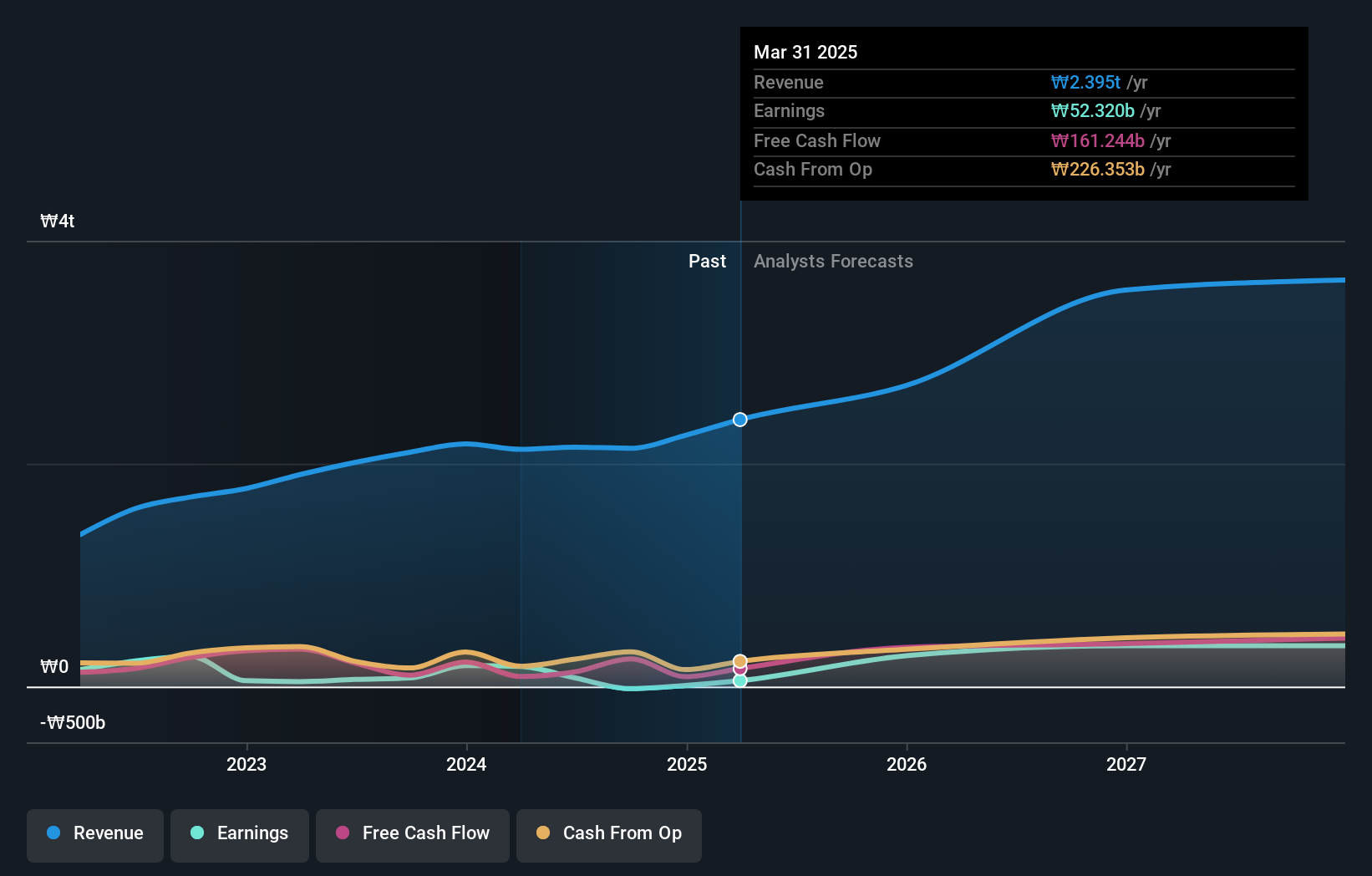

Overview: ALTEOGEN Inc., a biotechnology company, specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩17.85 billion.

Operations: ALTEOGEN Inc. generates revenue primarily from its biotechnology segment, amounting to ₩90.79 billion. The company focuses on long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

With a projected annual revenue growth of 64.2%, ALTEOGEN stands out in South Korea's high-tech sector, particularly following the recent MFDS approval of Tergase®, developed using its proprietary Hybrozyme™ Technology. This approval not only transitions ALTEOGEN into a commercial-stage company but also sets it apart with Tergase®'s over 99% purity and lower immunogenicity compared to traditional animal-derived alternatives. Despite being currently unprofitable with a highly volatile share price, the company's significant R&D investment aligns with its strategic focus on innovative biologics, potentially positioning it for profitability within the next three years as forecasted earnings growth hits 99.5%.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JNTC Co., Ltd. operates in South Korea, offering connector, hinge, and tempered glass products with a market cap of ₩1.26 billion.

Operations: The company focuses on manufacturing and selling mobile parts, generating revenue of ₩402.99 million. Its operations encompass a range of products, including connectors, hinges, and tempered glass.

JNTC, amidst South Korea's vibrant tech landscape, is harnessing a robust 18.1% annual revenue growth rate, outpacing the domestic market's 10.5%. This surge is bolstered by its strategic emphasis on R&D, dedicating substantial resources that equate to an impressive alignment with its future revenue streams. In particular, JNTC has channeled investments into developing cutting-edge software solutions, which now represent a significant portion of their earnings contributions. Despite some volatility in share prices and a competitive sector environment, JNTC's forward-looking R&D expenditure strategy—marked by a notable 51.9% forecast in earnings growth per annum—positions it as a potential key player in shaping next-gen tech innovations in South Korea.

- Unlock comprehensive insights into our analysis of JNTC stock in this health report.

Review our historical performance report to gain insights into JNTC's's past performance.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in the music production, publishing, and artist development and management sectors with a market capitalization of ₩7.09 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily from its Label and Solution segments, contributing ₩1.28 trillion and ₩1.24 trillion respectively, while the Platform segment adds ₩361.12 billion to its earnings.

Amidst a challenging landscape, HYBE has demonstrated resilience with a strategic focus on innovation and market adaptation. The company's commitment to R&D is evident as it allocated significant resources, aligning closely with its futuristic revenue models. This investment strategy is underscored by an anticipated 42.2% annual earnings growth, outstripping the domestic tech sector's average. Moreover, recent share repurchase initiatives for stock price stabilization reflect HYBE’s proactive approach in shareholder value enhancement, completing a buyback of 150,000 shares for KRW 26.09 billion in September 2024. These maneuvers not only bolster confidence but also signal robust internal forecasts and operational strength moving forward.

- Navigate through the intricacies of HYBE with our comprehensive health report here.

Gain insights into HYBE's historical performance by reviewing our past performance report.

Taking Advantage

- Click through to start exploring the rest of the 45 KRX High Growth Tech and AI Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with excellent balance sheet.