- South Korea

- /

- Communications

- /

- KOSDAQ:A178320

Three Growth Companies With High Insider Ownership And At Least 15% Revenue Growth

Reviewed by Simply Wall St

Amidst a backdrop of moderating inflation and record highs in major U.S. indices, global markets are presenting varied opportunities for investors. In this context, growth companies with high insider ownership can be particularly compelling, as they often signal confidence from those who know the company best—its leaders—especially when these firms also demonstrate robust revenue growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

| Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

| Nordic Halibut (OB:NOHAL) | 29.9% | 90.7% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 67.2% |

| Vow (OB:VOW) | 31.8% | 99.4% |

| UTI (KOSDAQ:A179900) | 34.2% | 111.6% |

| EHang Holdings (NasdaqGM:EH) | 33% | 97.1% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.1% | 92.9% |

Here's a peek at a few of the choices from the screener.

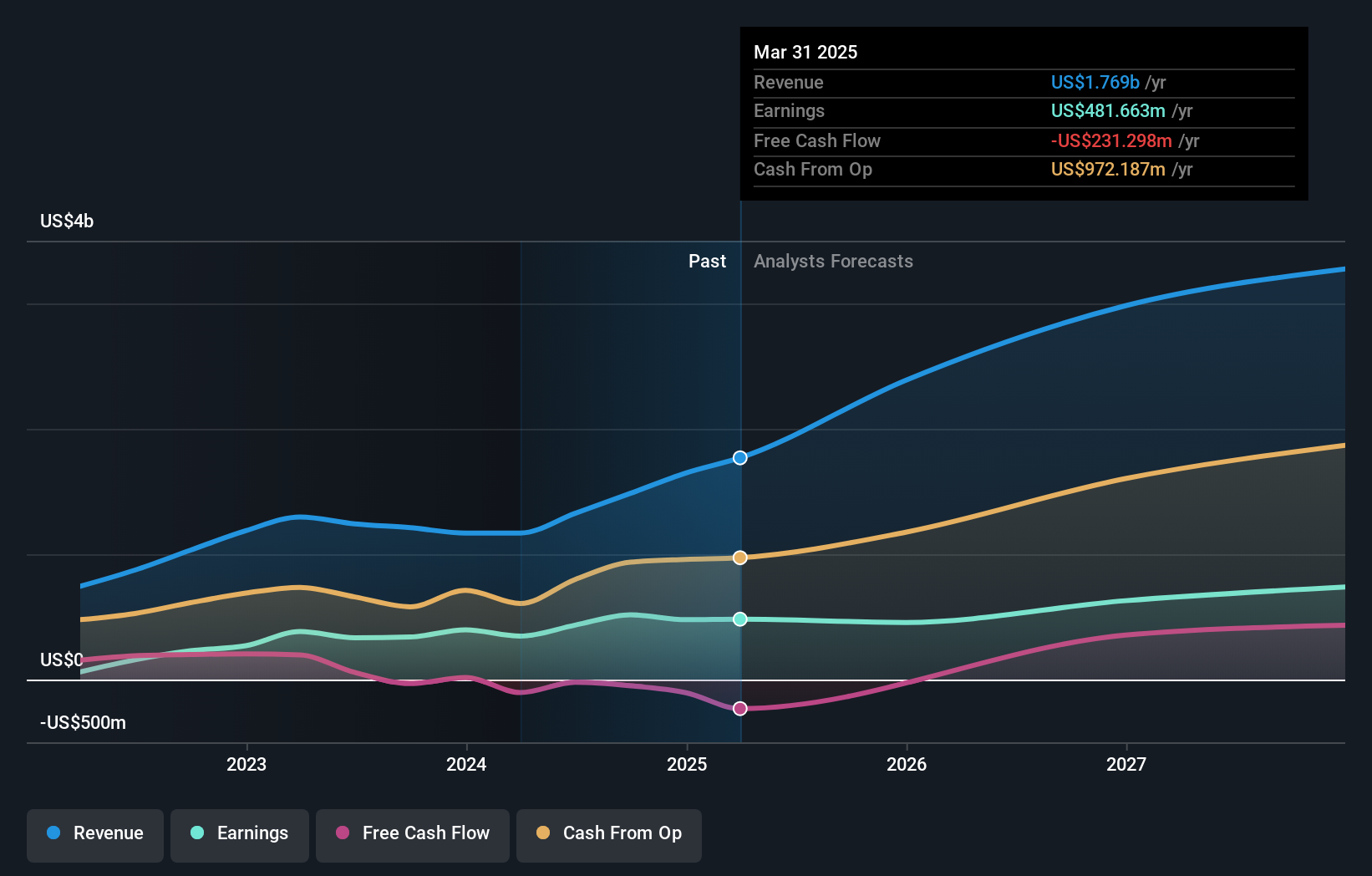

Vista Energy. de (BMV:VISTA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vista Energy, S.A.B. de C.V. operates in the oil and gas exploration and production sector across Latin America, with a market capitalization of approximately MX$77.06 billion.

Operations: The company generates revenue primarily from the exploration and production of crude oil, natural gas, and LPG, totaling $1.17 billion.

Insider Ownership: 12.3%

Revenue Growth Forecast: 18.5% p.a.

Vista Energy, with significant insider ownership, is trading at 39.9% below its estimated fair value, reflecting potential undervaluation. Despite a volatile share price recently, the company's earnings are expected to grow by 28.5% annually, outpacing the MX market average of 11.2%. However, shareholder dilution occurred over the past year. Recently, Vista initiated a US$50 million share buyback program following shareholder approval, underscoring management's confidence in the company’s value and future prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Vista Energy. de.

- Insights from our recent valuation report point to the potential overvaluation of Vista Energy. de shares in the market.

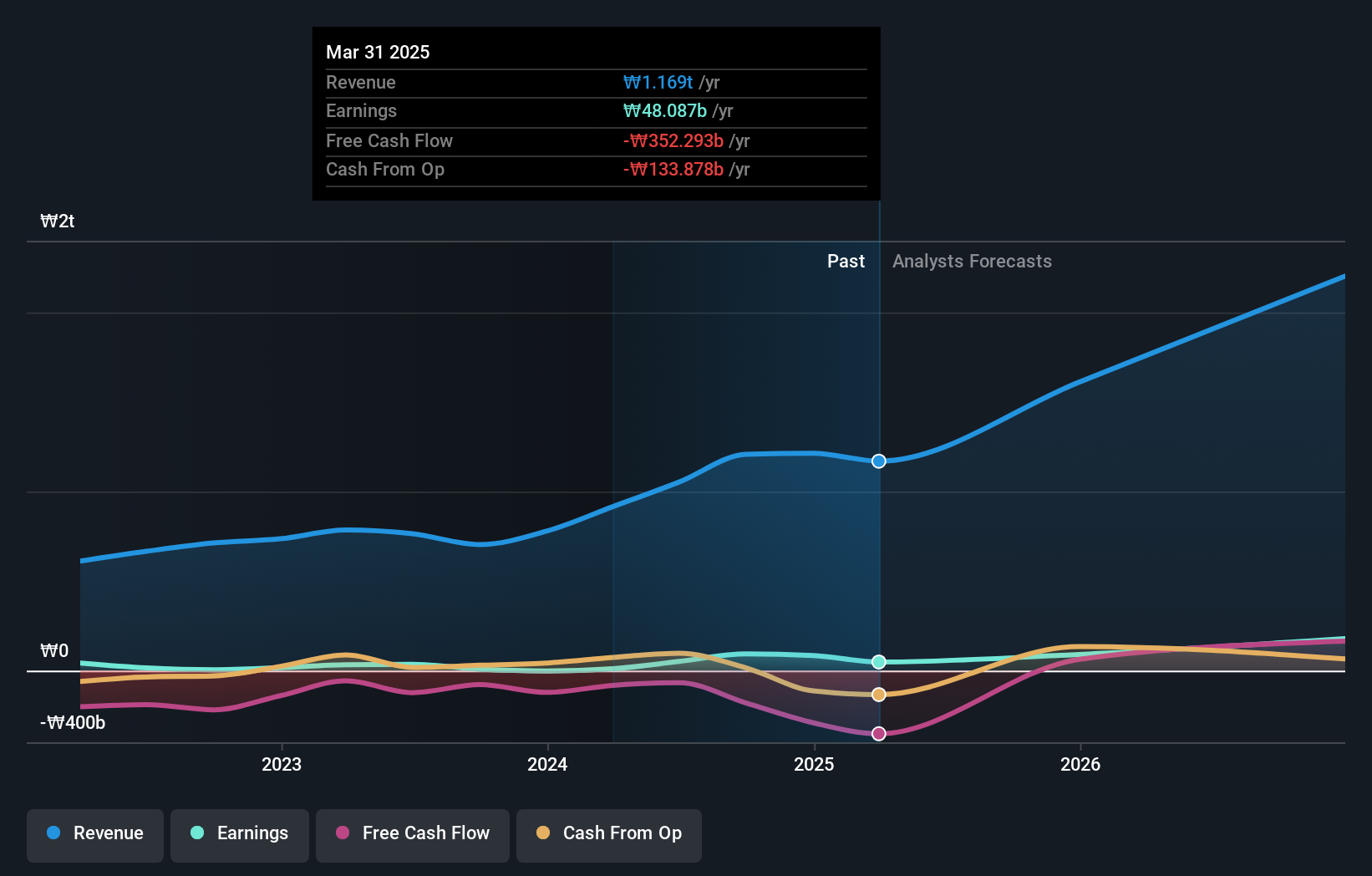

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd specializes in manufacturing telecom equipment, repeaters, mechanical products, and LED equipment, with a market capitalization of approximately ₩1.21 billion.

Operations: The company's revenue is primarily derived from its EMS, semiconductor, and mechanical products segments, generating ₩0.85 billion, ₩0.16 billion, and ₩0.25 billion respectively.

Insider Ownership: 30.9%

Revenue Growth Forecast: 30.8% p.a.

Seojin System Ltd is expected to outpace the Korean market with a revenue growth forecast of 30.8% annually, significantly higher than the market's 9.5%. The company is projected to turn profitable within three years, with an anticipated high return on equity of 25.6%. However, its ability to cover interest payments with earnings is weak, and shareholder dilution has occurred over the past year, raising concerns despite strong growth prospects.

- Dive into the specifics of Seojin SystemLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Seojin SystemLtd implies its share price may be too high.

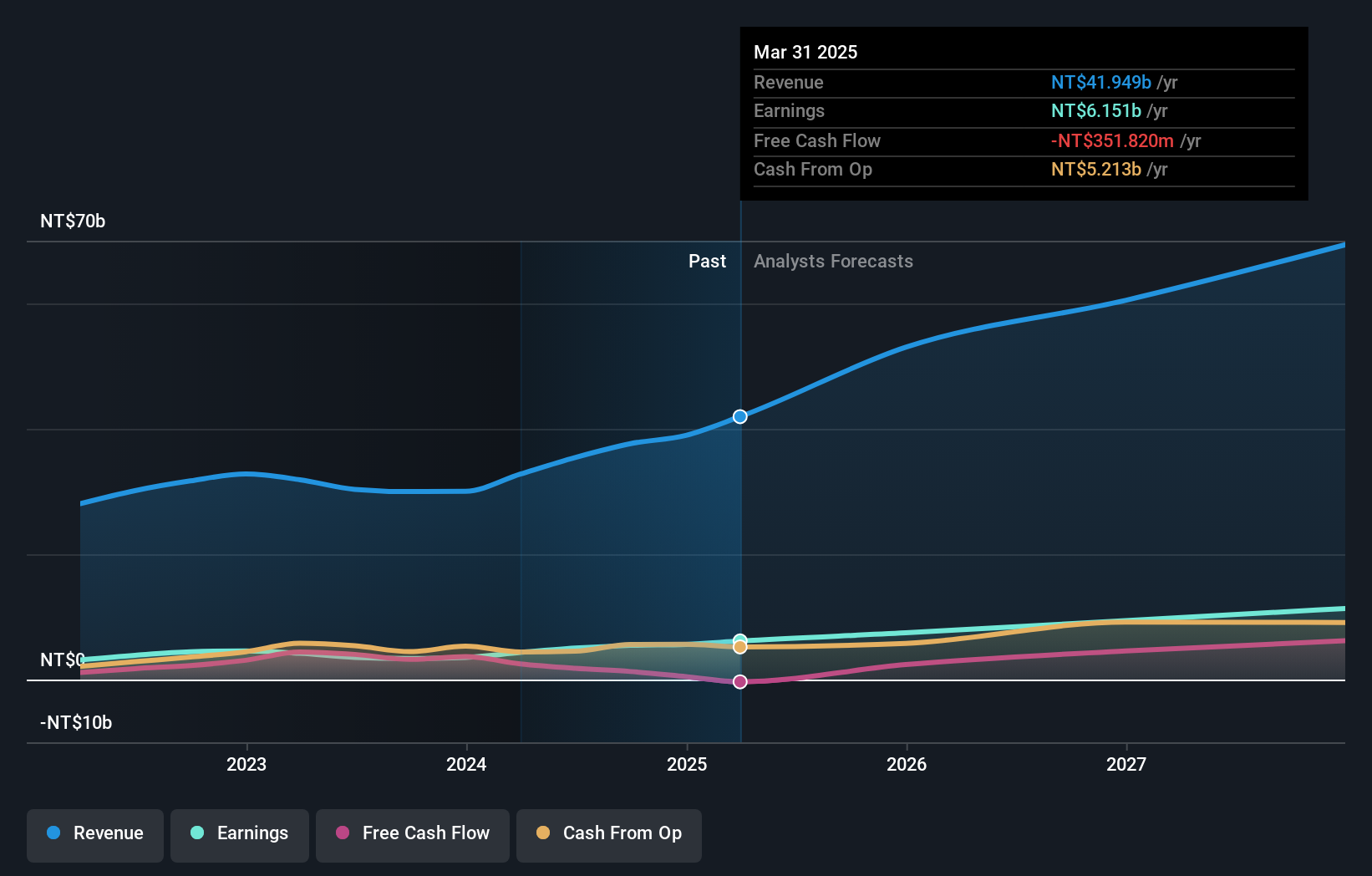

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gold Circuit Electronics Ltd., based in Taiwan, specializes in the manufacturing, processing, and trading of multilayer printed circuit boards, with a market capitalization of approximately NT$100.50 billion.

Operations: The company primarily generates revenue from the manufacture, processing, and trade of multilayer printed circuit boards.

Insider Ownership: 37.1%

Revenue Growth Forecast: 15.9% p.a.

Gold Circuit Electronics Ltd. has demonstrated robust financial performance, with a significant increase in sales and net income as of the first quarter of 2024. The company's revenue and earnings growth are expected to surpass the Taiwan market average, with forecasts indicating a yearly revenue increase of 15.9% and earnings growth of 23.5%. Despite this positive outlook, the stock is currently trading below analyst price targets and exhibits high share price volatility, which could concern potential investors looking for stability.

- Click here and access our complete growth analysis report to understand the dynamics of Gold Circuit Electronics.

- The analysis detailed in our Gold Circuit Electronics valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Reveal the 1503 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A178320

Seojin SystemLtd

Provides telecom equipment, repeaters, mechanical products, and LED and other equipment.

Exceptional growth potential and good value.